On-demand accruals represent expenses recognized immediately when incurred, ensuring precise matching of costs with revenues, while accounts payable track outstanding bills owed to suppliers based on received invoices. Efficient management of these two components enhances cash flow accuracy and financial statement reliability. Explore deeper insights into optimizing accrual and payable processes to improve your accounting strategy.

Why it is important

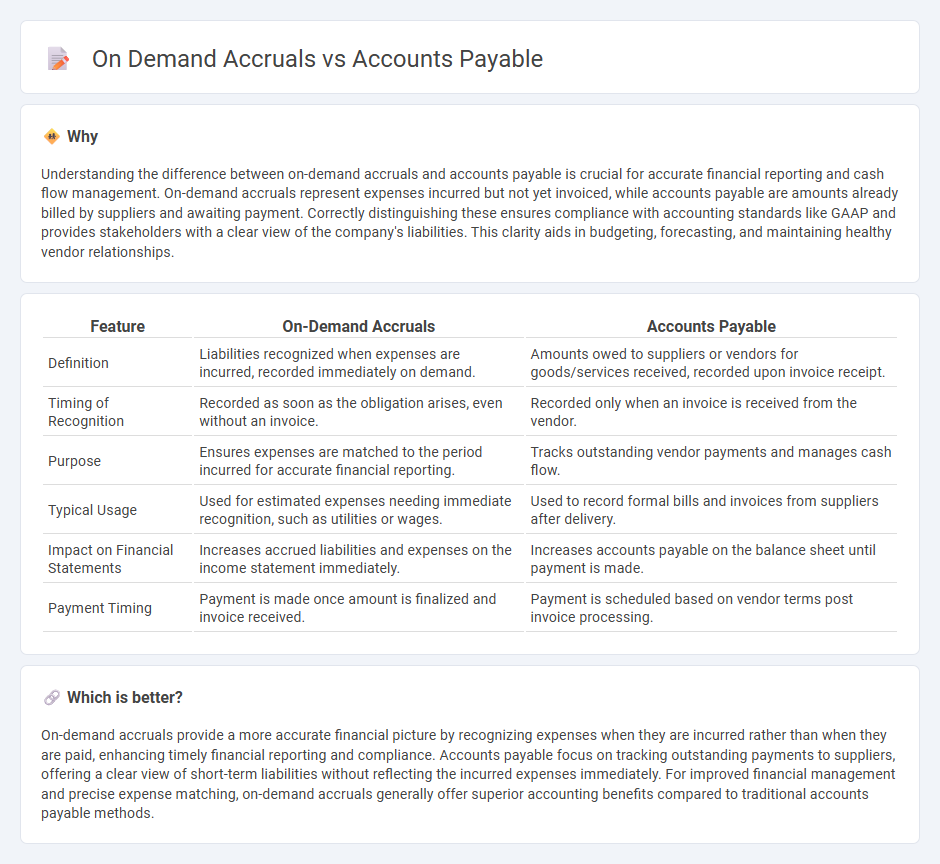

Understanding the difference between on-demand accruals and accounts payable is crucial for accurate financial reporting and cash flow management. On-demand accruals represent expenses incurred but not yet invoiced, while accounts payable are amounts already billed by suppliers and awaiting payment. Correctly distinguishing these ensures compliance with accounting standards like GAAP and provides stakeholders with a clear view of the company's liabilities. This clarity aids in budgeting, forecasting, and maintaining healthy vendor relationships.

Comparison Table

| Feature | On-Demand Accruals | Accounts Payable |

|---|---|---|

| Definition | Liabilities recognized when expenses are incurred, recorded immediately on demand. | Amounts owed to suppliers or vendors for goods/services received, recorded upon invoice receipt. |

| Timing of Recognition | Recorded as soon as the obligation arises, even without an invoice. | Recorded only when an invoice is received from the vendor. |

| Purpose | Ensures expenses are matched to the period incurred for accurate financial reporting. | Tracks outstanding vendor payments and manages cash flow. |

| Typical Usage | Used for estimated expenses needing immediate recognition, such as utilities or wages. | Used to record formal bills and invoices from suppliers after delivery. |

| Impact on Financial Statements | Increases accrued liabilities and expenses on the income statement immediately. | Increases accounts payable on the balance sheet until payment is made. |

| Payment Timing | Payment is made once amount is finalized and invoice received. | Payment is scheduled based on vendor terms post invoice processing. |

Which is better?

On-demand accruals provide a more accurate financial picture by recognizing expenses when they are incurred rather than when they are paid, enhancing timely financial reporting and compliance. Accounts payable focus on tracking outstanding payments to suppliers, offering a clear view of short-term liabilities without reflecting the incurred expenses immediately. For improved financial management and precise expense matching, on-demand accruals generally offer superior accounting benefits compared to traditional accounts payable methods.

Connection

On-demand accruals and accounts payable are interconnected through the recognition and recording of expenses that a company incurs before receiving the corresponding invoice. On-demand accruals estimate and capture these liabilities in the accounting period when the expense occurs, ensuring accurate financial reporting. Accounts payable subsequently represent the actual amounts owed to suppliers and vendors, reflecting the conversion of accrued liabilities into formal obligations.

Key Terms

Liability

Accounts payable represents short-term liabilities arising from outstanding invoices for goods or services received, typically due within a standard credit period. On-demand accruals refer to liabilities recognized for expenses incurred but not yet billed, often involving uncertain payment timing and amounts. Explore detailed distinctions and implications of these liabilities for enhanced financial clarity.

Accrual basis

Accounts payable represents liabilities for goods or services received but not yet paid, recorded under the accrual basis to match expenses with incurred obligations. On demand accruals involve recognizing expenses as they arise without immediate invoices, ensuring financial statements reflect accurate liability timing. Explore further to understand their impact on accrual accounting accuracy.

Payment terms

Accounts payable represents outstanding invoices from suppliers payable within agreed payment terms, typically 30 to 90 days, while on demand accruals are liabilities recognized for expenses incurred but paid immediately when requested. Payment terms in accounts payable affect cash flow management and vendor relationships, whereas on demand accruals provide a more flexible mechanism for settling obligations without fixed terms. Discover more to optimize financial operations and improve payment strategies.

Source and External Links

Accounts Payable | Wex - Accounts payable refers to short-term debt owed by a company to its suppliers for goods and services received on credit.

What is Accounts Payable - This resource defines accounts payable as the money owed to suppliers for goods and services purchased on credit and outlines the process involved.

Accounts Payable - Wikipedia - Accounts payable represents the money a business owes its suppliers, listed as a liability on the company's balance sheet.

dowidth.com

dowidth.com