Continuous audit utilizes real-time data analysis and automated tools to monitor financial transactions and controls consistently throughout the fiscal period. Compliance audit focuses on verifying adherence to regulatory standards and internal policies at specific points in time, ensuring organizational accountability and legal conformity. Explore how these audit methodologies can enhance your organization's financial integrity and risk management.

Why it is important

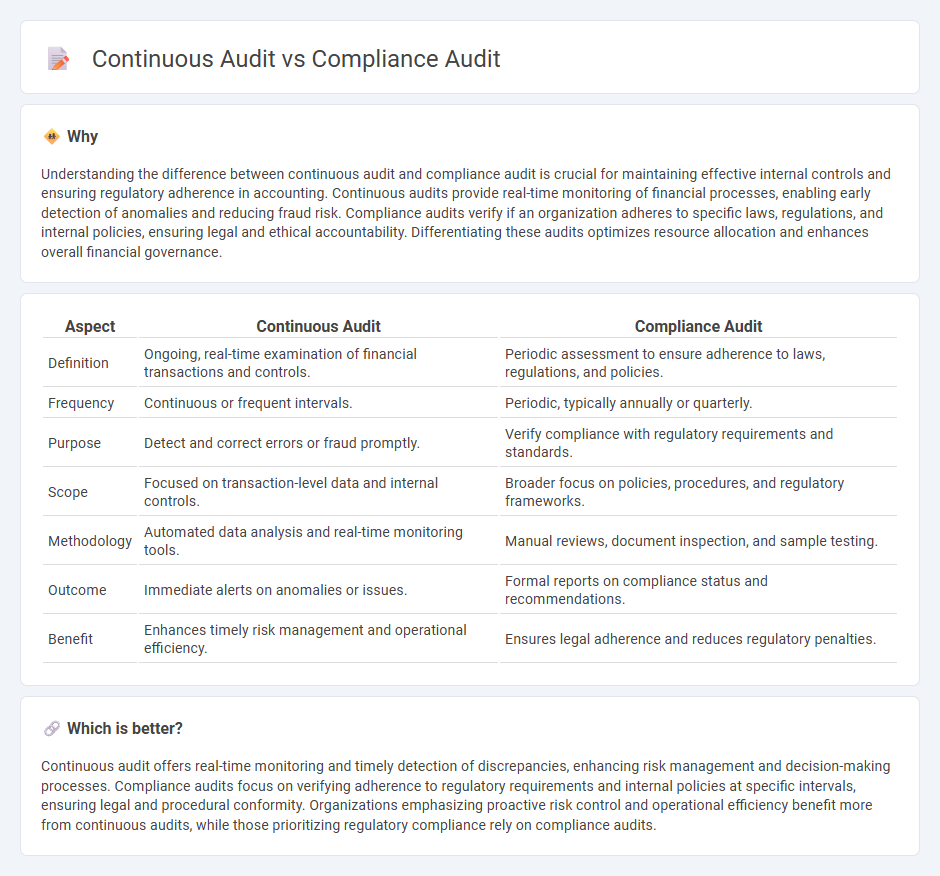

Understanding the difference between continuous audit and compliance audit is crucial for maintaining effective internal controls and ensuring regulatory adherence in accounting. Continuous audits provide real-time monitoring of financial processes, enabling early detection of anomalies and reducing fraud risk. Compliance audits verify if an organization adheres to specific laws, regulations, and internal policies, ensuring legal and ethical accountability. Differentiating these audits optimizes resource allocation and enhances overall financial governance.

Comparison Table

| Aspect | Continuous Audit | Compliance Audit |

|---|---|---|

| Definition | Ongoing, real-time examination of financial transactions and controls. | Periodic assessment to ensure adherence to laws, regulations, and policies. |

| Frequency | Continuous or frequent intervals. | Periodic, typically annually or quarterly. |

| Purpose | Detect and correct errors or fraud promptly. | Verify compliance with regulatory requirements and standards. |

| Scope | Focused on transaction-level data and internal controls. | Broader focus on policies, procedures, and regulatory frameworks. |

| Methodology | Automated data analysis and real-time monitoring tools. | Manual reviews, document inspection, and sample testing. |

| Outcome | Immediate alerts on anomalies or issues. | Formal reports on compliance status and recommendations. |

| Benefit | Enhances timely risk management and operational efficiency. | Ensures legal adherence and reduces regulatory penalties. |

Which is better?

Continuous audit offers real-time monitoring and timely detection of discrepancies, enhancing risk management and decision-making processes. Compliance audits focus on verifying adherence to regulatory requirements and internal policies at specific intervals, ensuring legal and procedural conformity. Organizations emphasizing proactive risk control and operational efficiency benefit more from continuous audits, while those prioritizing regulatory compliance rely on compliance audits.

Connection

Continuous audit and compliance audit are connected through their focus on ensuring ongoing adherence to regulatory requirements and internal controls within an organization. Continuous audit employs real-time data analysis and automated tools to monitor financial transactions and processes, enabling early detection of compliance issues. Compliance audit leverages these insights to systematically evaluate conformity with laws, standards, and policies, thereby enhancing overall risk management and governance.

Key Terms

Regulatory Requirements

Compliance audits evaluate adherence to regulatory requirements at specific points in time, ensuring organizations meet standards like GDPR, HIPAA, or SOX. Continuous audits use automated tools and real-time data monitoring to provide ongoing assurance that regulatory controls remain effective and operational. Discover the benefits of integrating continuous auditing to enhance regulatory compliance and risk management.

Real-time Monitoring

Compliance audits evaluate an organization's adherence to regulatory requirements at specific points in time, often producing snapshot assessments of compliance status. Continuous audits leverage real-time monitoring technologies, enabling ongoing evaluation and immediate detection of compliance deviations through automated data analysis. Explore how real-time monitoring in continuous audits transforms regulatory oversight and operational risk management.

Internal Controls

A compliance audit evaluates whether internal controls adhere to regulatory requirements at a specific point in time, identifying gaps and risks linked to non-compliance. Continuous audit employs real-time monitoring and automated data analysis to assess the effectiveness of internal controls on an ongoing basis, enabling prompt detection and remediation of control weaknesses. Explore deeper insights into optimizing internal controls through compliance and continuous audits for enhanced organizational governance.

Source and External Links

What is Compliance Audit: A Comprehensive Guide | MetricStream - A compliance audit is a formal review process to determine if an organization follows regulatory guidelines and internal policies, helping to mitigate risks and improve operational efficiency through steps like planning, execution, reporting, and follow-up.

What is compliance audit? | Definition from TechTarget - It is a comprehensive review of an organization's adherence to regulations, involving internal or external audits that produce reports to confirm compliance with laws such as Sarbanes-Oxley, HIPAA, or PCI-DSS.

Compliance Audit: Definition, Types, and What to Expect - AuditBoard - Compliance audits are formal evaluations by independent auditors assessing organizational adherence to frameworks or regulations, resulting in reports that provide reasonable assurance of compliance through document review and interviews.

dowidth.com

dowidth.com