Dynamic discounting allows buyers to optimize cash flow by paying suppliers early in exchange for discounts, improving working capital efficiency and supplier relationships. Supply chain finance leverages third-party financing to extend payment terms while ensuring suppliers receive timely payments, enhancing liquidity across the supply chain. Explore how integrating these financing strategies can drive operational and financial benefits for your business.

Why it is important

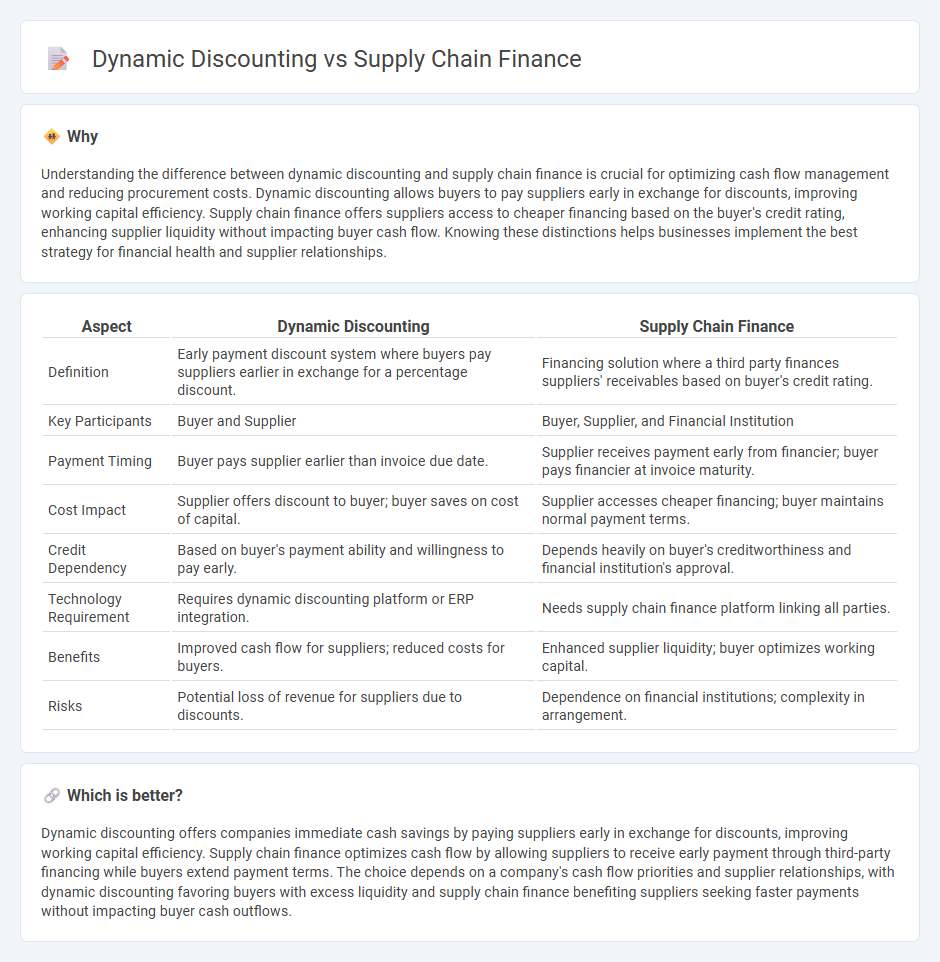

Understanding the difference between dynamic discounting and supply chain finance is crucial for optimizing cash flow management and reducing procurement costs. Dynamic discounting allows buyers to pay suppliers early in exchange for discounts, improving working capital efficiency. Supply chain finance offers suppliers access to cheaper financing based on the buyer's credit rating, enhancing supplier liquidity without impacting buyer cash flow. Knowing these distinctions helps businesses implement the best strategy for financial health and supplier relationships.

Comparison Table

| Aspect | Dynamic Discounting | Supply Chain Finance |

|---|---|---|

| Definition | Early payment discount system where buyers pay suppliers earlier in exchange for a percentage discount. | Financing solution where a third party finances suppliers' receivables based on buyer's credit rating. |

| Key Participants | Buyer and Supplier | Buyer, Supplier, and Financial Institution |

| Payment Timing | Buyer pays supplier earlier than invoice due date. | Supplier receives payment early from financier; buyer pays financier at invoice maturity. |

| Cost Impact | Supplier offers discount to buyer; buyer saves on cost of capital. | Supplier accesses cheaper financing; buyer maintains normal payment terms. |

| Credit Dependency | Based on buyer's payment ability and willingness to pay early. | Depends heavily on buyer's creditworthiness and financial institution's approval. |

| Technology Requirement | Requires dynamic discounting platform or ERP integration. | Needs supply chain finance platform linking all parties. |

| Benefits | Improved cash flow for suppliers; reduced costs for buyers. | Enhanced supplier liquidity; buyer optimizes working capital. |

| Risks | Potential loss of revenue for suppliers due to discounts. | Dependence on financial institutions; complexity in arrangement. |

Which is better?

Dynamic discounting offers companies immediate cash savings by paying suppliers early in exchange for discounts, improving working capital efficiency. Supply chain finance optimizes cash flow by allowing suppliers to receive early payment through third-party financing while buyers extend payment terms. The choice depends on a company's cash flow priorities and supplier relationships, with dynamic discounting favoring buyers with excess liquidity and supply chain finance benefiting suppliers seeking faster payments without impacting buyer cash outflows.

Connection

Dynamic discounting and supply chain finance are connected through their focus on optimizing cash flow and working capital management by facilitating early payments from buyers to suppliers in exchange for discounts. Dynamic discounting allows buyers to leverage excess liquidity to secure discounts on invoices, while supply chain finance involves third-party financing solutions that improve supplier access to affordable capital. Both strategies enhance financial efficiency within the supply chain by reducing payment cycles and strengthening supplier relationships.

Key Terms

**Supply Chain Finance:**

Supply Chain Finance (SCF) leverages financial technology to optimize cash flow between buyers and suppliers by providing early payment options through third-party financiers, enhancing liquidity and strengthening supplier relationships. Unlike Dynamic Discounting, which relies on buyer-funded early payments with variable discounts, SCF utilizes external funding sources, reducing the buyer's capital constraints and improving working capital efficiency. Explore the benefits and implementation strategies of Supply Chain Finance to enhance your supply chain's financial performance.

Reverse Factoring

Reverse factoring, a key form of supply chain finance, allows suppliers to receive early payments through a third party, improving their cash flow while buyers extend payment terms. Dynamic discounting, in contrast, enables buyers to pay suppliers early in exchange for flexible discounts based on the payment date. Explore the strategic differences and benefits of reverse factoring within supply chain finance to optimize working capital management.

Accounts Payable

Supply chain finance and dynamic discounting both optimize accounts payable but differ in approach; supply chain finance leverages third-party financing to extend payment terms and improve supplier cash flow, while dynamic discounting enables buyers to offer early payments in exchange for discounts based on invoice aging. Dynamic discounting provides more control to the buyer by directly managing payment timing and discounts without involving external financiers, making it ideal for companies with strong cash positions. Explore how these solutions transform accounts payable workflows and enhance working capital efficiency.

Source and External Links

What is supply chain finance? | British Business Bank - Supply chain finance, or reverse factoring, helps companies optimize cash flow by allowing suppliers to get paid early by a finance company while buyers pay the funder later at invoice maturity, with costs based on the buyer's credit rating benefiting both parties.

What is Supply Chain Finance? - PrimeRevenue - Supply chain finance allows suppliers to sell approved invoices to a funder before payment due dates, enabling early payment at lower financing costs based on the buyer's credit risk, thus improving cash flow for suppliers and extending payment terms for buyers.

Supply Chain Finance | Mizuho Bank - Supply chain finance is a platform-based service that improves working capital by extending buyers' payment terms while allowing suppliers to receive early discounted payments, benefiting both through cash flow optimization, reduced risk, and stronger buyer-supplier relationships.

dowidth.com

dowidth.com