Triple-entry accounting enhances transparency by using blockchain technology to create a shared, immutable ledger that records transactions with a cryptographic third entry, unlike traditional double-entry systems. Accrual accounting recognizes revenues and expenses when they are incurred, providing a more accurate financial picture by matching income and related costs within the same period. Explore how these accounting methods can optimize financial accuracy and reliability for your business.

Why it is important

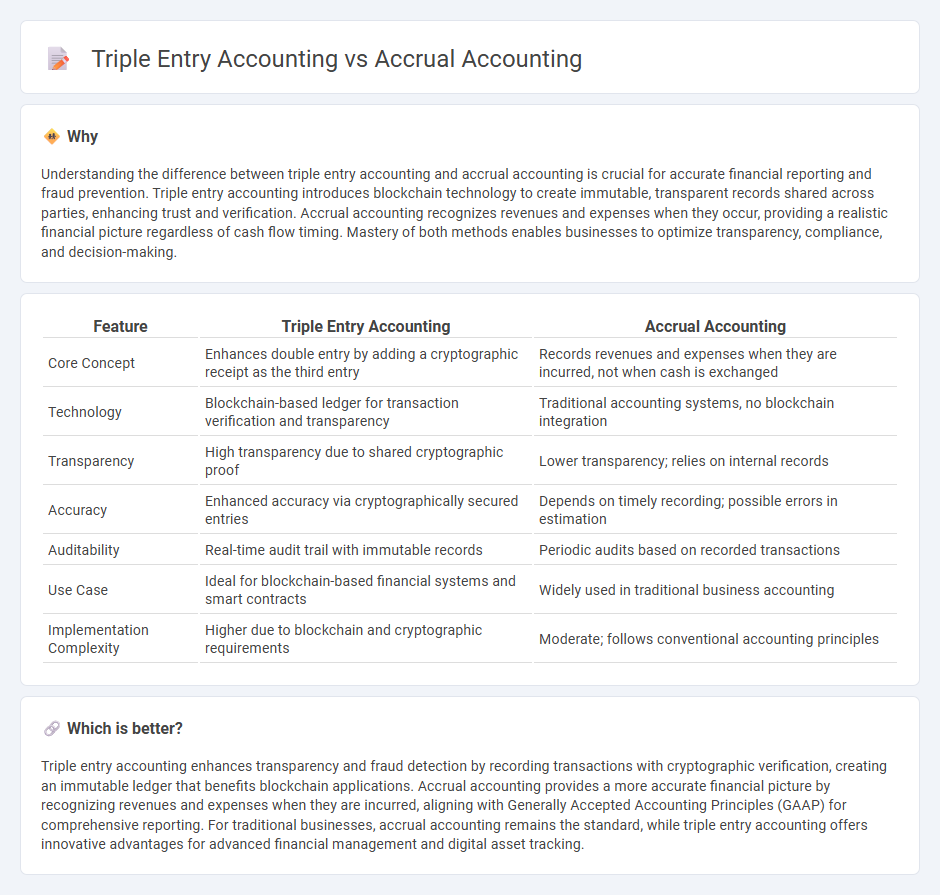

Understanding the difference between triple entry accounting and accrual accounting is crucial for accurate financial reporting and fraud prevention. Triple entry accounting introduces blockchain technology to create immutable, transparent records shared across parties, enhancing trust and verification. Accrual accounting recognizes revenues and expenses when they occur, providing a realistic financial picture regardless of cash flow timing. Mastery of both methods enables businesses to optimize transparency, compliance, and decision-making.

Comparison Table

| Feature | Triple Entry Accounting | Accrual Accounting |

|---|---|---|

| Core Concept | Enhances double entry by adding a cryptographic receipt as the third entry | Records revenues and expenses when they are incurred, not when cash is exchanged |

| Technology | Blockchain-based ledger for transaction verification and transparency | Traditional accounting systems, no blockchain integration |

| Transparency | High transparency due to shared cryptographic proof | Lower transparency; relies on internal records |

| Accuracy | Enhanced accuracy via cryptographically secured entries | Depends on timely recording; possible errors in estimation |

| Auditability | Real-time audit trail with immutable records | Periodic audits based on recorded transactions |

| Use Case | Ideal for blockchain-based financial systems and smart contracts | Widely used in traditional business accounting |

| Implementation Complexity | Higher due to blockchain and cryptographic requirements | Moderate; follows conventional accounting principles |

Which is better?

Triple entry accounting enhances transparency and fraud detection by recording transactions with cryptographic verification, creating an immutable ledger that benefits blockchain applications. Accrual accounting provides a more accurate financial picture by recognizing revenues and expenses when they are incurred, aligning with Generally Accepted Accounting Principles (GAAP) for comprehensive reporting. For traditional businesses, accrual accounting remains the standard, while triple entry accounting offers innovative advantages for advanced financial management and digital asset tracking.

Connection

Triple entry accounting enhances traditional accrual accounting by introducing cryptographic verification, ensuring each financial transaction is recorded with a third, tamper-proof entry alongside debits and credits. This integration improves transparency and accuracy in accrual-based financial statements by providing an immutable audit trail. As a result, businesses benefit from more reliable and secure recording of revenues and expenses over reporting periods.

Key Terms

Revenue Recognition

Accrual accounting recognizes revenue when earned, matching income to the period it relates to, while triple entry accounting enhances this process by creating an immutable digital record using blockchain technology to ensure transparency and reduce fraud. This method embeds cryptographic verification in revenue recognition, enabling real-time auditing and greater trust in financial statements. Discover how triple entry accounting revolutionizes revenue recognition by improving accuracy and accountability.

Double-entry Bookkeeping

Double-entry bookkeeping forms the foundation of both accrual accounting and triple-entry accounting, ensuring every financial transaction affects at least two accounts, preserving the accounting equation. Accrual accounting recognizes revenues and expenses when they are earned or incurred, providing a more accurate financial picture, whereas triple-entry accounting introduces a cryptographic third entry to improve transparency and reduce fraud. Discover how integrating triple-entry methods can transform traditional bookkeeping practices and enhance financial trust.

Blockchain Ledger

Accrual accounting records financial transactions when they are incurred, regardless of cash flow, providing an accurate picture of liabilities and revenues, while triple entry accounting leverages blockchain technology to create a decentralized and immutable ledger that enhances transparency and fraud resistance. Blockchain-based triple entry accounting allows simultaneous recording of transactions by multiple parties, ensuring data consistency and real-time verification within distributed networks. Discover how integrating blockchain transforms traditional accounting frameworks into secure, automated, and trustless systems.

Source and External Links

Accrual-Based Accounting Explained - Accrual basis accounting recognizes revenue and expenses when they are generated, not when money changes hands, providing a more accurate financial picture of a company.

Accrual Accounting - Guide - Accrual accounting involves recording earned revenues and incurred expenses regardless of cash transactions, aligning with the matching principle.

What Is Accrual Accounting? - Accrual accounting is a method that recognizes revenue and expenses in the period they are earned or incurred, not necessarily when cash is received or paid.

dowidth.com

dowidth.com