Embedded finance accounting integrates financial services directly into non-financial platforms, streamlining transaction processing and real-time financial reporting. API-based accounting relies on application programming interfaces to connect disparate financial systems, enabling seamless data exchange and automation of bookkeeping tasks. Explore the distinctions and benefits of each approach to optimize your accounting strategy.

Why it is important

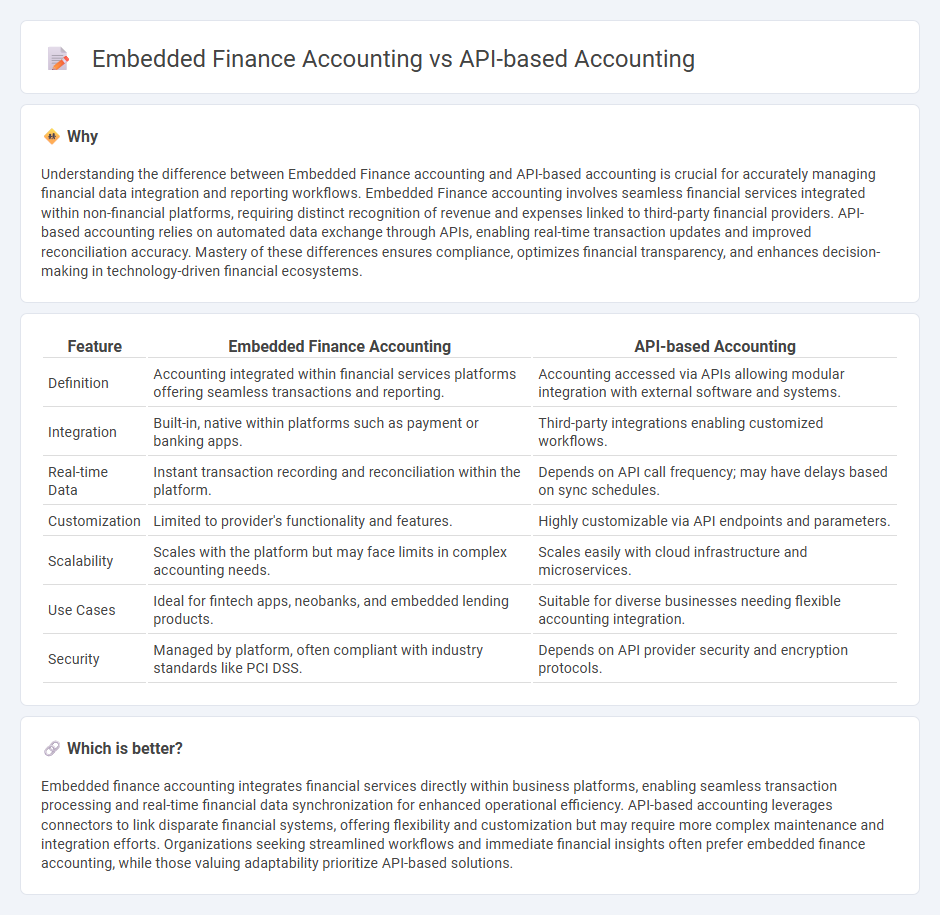

Understanding the difference between Embedded Finance accounting and API-based accounting is crucial for accurately managing financial data integration and reporting workflows. Embedded Finance accounting involves seamless financial services integrated within non-financial platforms, requiring distinct recognition of revenue and expenses linked to third-party financial providers. API-based accounting relies on automated data exchange through APIs, enabling real-time transaction updates and improved reconciliation accuracy. Mastery of these differences ensures compliance, optimizes financial transparency, and enhances decision-making in technology-driven financial ecosystems.

Comparison Table

| Feature | Embedded Finance Accounting | API-based Accounting |

|---|---|---|

| Definition | Accounting integrated within financial services platforms offering seamless transactions and reporting. | Accounting accessed via APIs allowing modular integration with external software and systems. |

| Integration | Built-in, native within platforms such as payment or banking apps. | Third-party integrations enabling customized workflows. |

| Real-time Data | Instant transaction recording and reconciliation within the platform. | Depends on API call frequency; may have delays based on sync schedules. |

| Customization | Limited to provider's functionality and features. | Highly customizable via API endpoints and parameters. |

| Scalability | Scales with the platform but may face limits in complex accounting needs. | Scales easily with cloud infrastructure and microservices. |

| Use Cases | Ideal for fintech apps, neobanks, and embedded lending products. | Suitable for diverse businesses needing flexible accounting integration. |

| Security | Managed by platform, often compliant with industry standards like PCI DSS. | Depends on API provider security and encryption protocols. |

Which is better?

Embedded finance accounting integrates financial services directly within business platforms, enabling seamless transaction processing and real-time financial data synchronization for enhanced operational efficiency. API-based accounting leverages connectors to link disparate financial systems, offering flexibility and customization but may require more complex maintenance and integration efforts. Organizations seeking streamlined workflows and immediate financial insights often prefer embedded finance accounting, while those valuing adaptability prioritize API-based solutions.

Connection

Embedded finance accounting integrates financial services directly into non-financial platforms, streamlining transaction recording and reconciliation within those systems. API-based accounting enables seamless data exchange between different software applications, enhancing real-time financial reporting and automation. Together, these technologies create a unified ecosystem that improves accuracy, efficiency, and transparency in accounting processes.

Key Terms

Data Integration

API-based accounting enables seamless data integration by connecting disparate financial systems through standardized interfaces, facilitating real-time transaction updates and automated reporting. Embedded finance accounting integrates financial services directly within non-financial platforms, ensuring unified data flow across customer touchpoints and enhanced accuracy in financial records. Discover more about how these approaches optimize data integration for streamlined accounting processes.

Real-time Processing

API-based accounting enables real-time transaction syncing by integrating various financial systems via standardized interfaces, enhancing accuracy and reducing manual reconciliation. Embedded finance accounting incorporates financial services directly into non-financial platforms, offering seamless real-time processing within customer workflows and accelerating decision-making. Explore how these approaches transform financial operations with real-time capabilities and choose the best fit for your business needs.

Revenue Recognition

API-based accounting streamlines revenue recognition by automating data exchange between financial platforms, ensuring real-time accuracy and compliance with standards like ASC 606. Embedded finance accounting integrates financial services directly within non-financial applications, enhancing seamless customer experiences while managing complex revenue streams from multiple embedded sources. Explore our in-depth analysis to understand which approach optimizes your revenue recognition processes.

Source and External Links

Guide to accounting APIs and integrations - Merge.dev - This guide explains key use cases for accounting APIs, including financial forecasting, tracking receivables/payables, payments, creditworthiness evaluation, and tax preparation, showing how APIs enable seamless integration and automation in accounting workflows.

What Is an Accounting API, and Why Is It Important? - Bill.com - Accounting APIs enable communication between accounting software and other financial systems, supporting real-time anomaly detection, AI-driven forecasting, cloud-based connectivity, and evolving toward greater standardization and regulatory compliance.

Your Guide to Accounting APIs - AvidXchange - Accounting APIs streamline finance processes by automating routine tasks, improving data accuracy, integrating systems, and enabling AI-based analytics, with recommendations to collaborate with IT and ensure security and compliance during implementation.

dowidth.com

dowidth.com