Predictive close leverages advanced analytics and real-time data to estimate financial outcomes before the actual year-end close, enabling proactive decision-making and operational adjustments. Year-end close is the traditional accounting process that finalizes all financial statements and ensures compliance with regulatory standards after the fiscal period ends. Explore the differences and benefits of Predictive close versus Year-end close to optimize your organization's financial management.

Why it is important

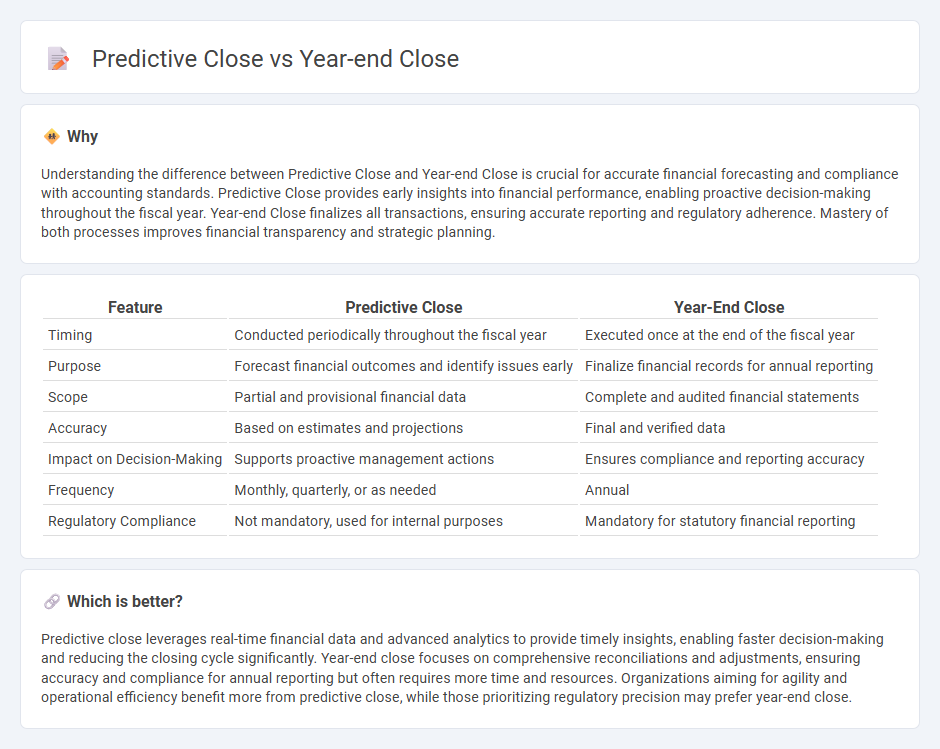

Understanding the difference between Predictive Close and Year-end Close is crucial for accurate financial forecasting and compliance with accounting standards. Predictive Close provides early insights into financial performance, enabling proactive decision-making throughout the fiscal year. Year-end Close finalizes all transactions, ensuring accurate reporting and regulatory adherence. Mastery of both processes improves financial transparency and strategic planning.

Comparison Table

| Feature | Predictive Close | Year-End Close |

|---|---|---|

| Timing | Conducted periodically throughout the fiscal year | Executed once at the end of the fiscal year |

| Purpose | Forecast financial outcomes and identify issues early | Finalize financial records for annual reporting |

| Scope | Partial and provisional financial data | Complete and audited financial statements |

| Accuracy | Based on estimates and projections | Final and verified data |

| Impact on Decision-Making | Supports proactive management actions | Ensures compliance and reporting accuracy |

| Frequency | Monthly, quarterly, or as needed | Annual |

| Regulatory Compliance | Not mandatory, used for internal purposes | Mandatory for statutory financial reporting |

Which is better?

Predictive close leverages real-time financial data and advanced analytics to provide timely insights, enabling faster decision-making and reducing the closing cycle significantly. Year-end close focuses on comprehensive reconciliations and adjustments, ensuring accuracy and compliance for annual reporting but often requires more time and resources. Organizations aiming for agility and operational efficiency benefit more from predictive close, while those prioritizing regulatory precision may prefer year-end close.

Connection

Predictive close and year-end close are interconnected processes in accounting that streamline financial reporting and enhance accuracy. Predictive close leverages data analytics and real-time insights to forecast financial outcomes, enabling organizations to identify discrepancies and make adjustments before the year-end close. This proactive approach reduces errors, accelerates the year-end closing timeline, and ensures compliance with accounting standards such as GAAP or IFRS.

Key Terms

Financial Statements

Year-end close involves finalizing all accounting activities to produce accurate financial statements reflecting the company's fiscal position, ensuring compliance with regulatory standards and audit readiness. Predictive close leverages real-time data and advanced analytics to forecast financial outcomes, enabling proactive decision-making and enhanced cash flow management. Explore how integrating predictive close methods can transform your financial reporting strategy.

Accruals

Year-end close processes heavily rely on accurate accrual accounting to ensure that all expenses and revenues are recorded in the correct fiscal period, thereby providing a true financial position. Predictive close leverages advanced analytics and automation to estimate accruals in real-time, enabling faster and more accurate financial closing cycles. Explore how integrating predictive accruals can transform your financial close strategy and enhance reporting accuracy.

Forecasting

Year-end close typically emphasizes finalizing financial statements and reconciling accounts to ensure accuracy for stakeholders and regulatory compliance. Predictive close leverages advanced forecasting models and real-time data analytics to anticipate future financial outcomes, enabling proactive decision-making throughout the fiscal year. Explore how integrating predictive close techniques can transform your forecasting accuracy and overall financial strategy.

Source and External Links

Year-end accounting checklist (2024) - The year-end accounting close involves reviewing and reconciling all financial transactions from the fiscal year to spot discrepancies, make necessary adjustments, and prepare accurate financial statements for tax and budgeting purposes.

Year End Close Process Explained (Step by Step) - The year-end close is a comprehensive, annual accounting process that includes reviewing and reconciling ledgers, inventory valuation, adjusting entries, and preparing annual financial statements, distinct from the more frequent month-end close.

Year-End Closing Process - Financials - Year-end close is a set of activities performed to comply with regulatory requirements, involving closing accounts by transferring balances and ensuring debits and credits balance over the fiscal year.

dowidth.com

dowidth.com