Embedded finance reconciliation involves integrating financial transactions directly within platforms, allowing seamless tracking of payments, loans, and insurance activities, enhancing real-time accuracy. Credit card reconciliation focuses on comparing credit card statements with accounting records to identify discrepancies, manage fraud risk, and ensure accurate expense categorization. Explore more to understand the distinct processes and benefits of embedded finance versus credit card reconciliation.

Why it is important

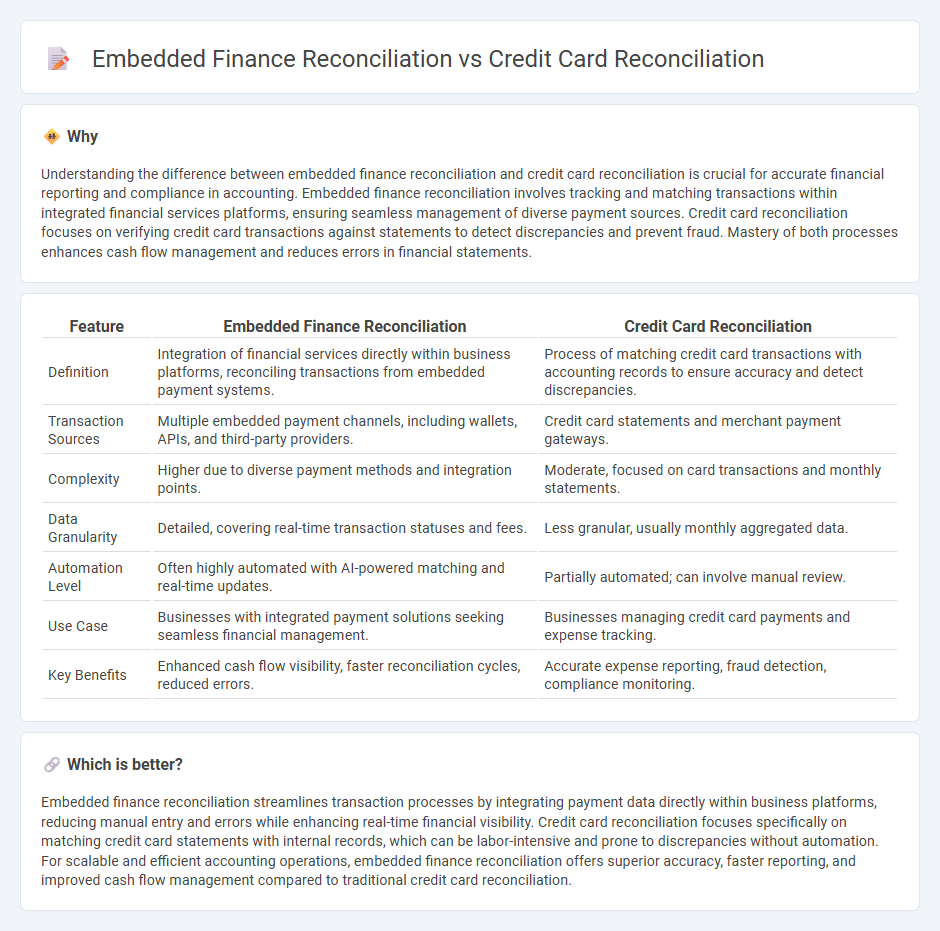

Understanding the difference between embedded finance reconciliation and credit card reconciliation is crucial for accurate financial reporting and compliance in accounting. Embedded finance reconciliation involves tracking and matching transactions within integrated financial services platforms, ensuring seamless management of diverse payment sources. Credit card reconciliation focuses on verifying credit card transactions against statements to detect discrepancies and prevent fraud. Mastery of both processes enhances cash flow management and reduces errors in financial statements.

Comparison Table

| Feature | Embedded Finance Reconciliation | Credit Card Reconciliation |

|---|---|---|

| Definition | Integration of financial services directly within business platforms, reconciling transactions from embedded payment systems. | Process of matching credit card transactions with accounting records to ensure accuracy and detect discrepancies. |

| Transaction Sources | Multiple embedded payment channels, including wallets, APIs, and third-party providers. | Credit card statements and merchant payment gateways. |

| Complexity | Higher due to diverse payment methods and integration points. | Moderate, focused on card transactions and monthly statements. |

| Data Granularity | Detailed, covering real-time transaction statuses and fees. | Less granular, usually monthly aggregated data. |

| Automation Level | Often highly automated with AI-powered matching and real-time updates. | Partially automated; can involve manual review. |

| Use Case | Businesses with integrated payment solutions seeking seamless financial management. | Businesses managing credit card payments and expense tracking. |

| Key Benefits | Enhanced cash flow visibility, faster reconciliation cycles, reduced errors. | Accurate expense reporting, fraud detection, compliance monitoring. |

Which is better?

Embedded finance reconciliation streamlines transaction processes by integrating payment data directly within business platforms, reducing manual entry and errors while enhancing real-time financial visibility. Credit card reconciliation focuses specifically on matching credit card statements with internal records, which can be labor-intensive and prone to discrepancies without automation. For scalable and efficient accounting operations, embedded finance reconciliation offers superior accuracy, faster reporting, and improved cash flow management compared to traditional credit card reconciliation.

Connection

Embedded finance reconciliation streamlines transaction tracking by integrating financial services directly within business platforms, enabling real-time synchronization of payment data. Credit card reconciliation involves matching credit card statements with internal records to identify discrepancies and ensure accurate financial reporting. Together, these processes enhance accounting accuracy by automating data integration and simplifying the verification of credit card transactions within embedded financial systems.

Key Terms

Transaction Matching

Credit card reconciliation involves matching card transactions with merchant statements to identify discrepancies, ensure accurate payments, and detect fraud, often utilizing transaction IDs, timestamps, and amounts as key data points. Embedded finance reconciliation integrates these processes within non-financial platforms, enabling seamless transaction matching across various services such as lending, payments, and insurance, benefiting from real-time data synchronization and automated workflows. Discover how transaction matching enhances accuracy and efficiency in both credit card and embedded finance reconciliation by exploring our comprehensive insights.

Settlement Reports

Credit card reconciliation involves matching transaction data from credit card statements with internal sales records to ensure accuracy and identify discrepancies, focusing heavily on Settlement Reports for transaction validation. Embedded finance reconciliation integrates financial services within non-financial platforms, requiring detailed Settlement Reports that consolidate multi-channel payments and fees for comprehensive financial tracking. Explore more to understand the nuanced roles of Settlement Reports in both reconciliation processes.

Platform Integration

Credit card reconciliation involves matching transactions processed through credit card networks with accounting records to ensure accuracy and detect discrepancies, relying heavily on traditional platform integration with payment gateways and financial institutions. Embedded finance reconciliation integrates banking and payment services directly within non-financial platforms, requiring seamless API-driven connectivity to synchronize transaction data across diverse systems in real time. Explore further to understand how platform integration impacts efficiency and accuracy in these reconciliation processes.

Source and External Links

How to Do a Credit Card Reconciliation - An 8-step guide including gathering statements and receipts, checking opening balances, comparing transactions, and recording adjustments for legitimate discrepancies to reconcile credit cards accurately.

Complete Guide to Credit Card Reconciliation - A detailed process emphasizing collecting all documents, digitizing data, cross-checking transactions against ledgers, identifying errors, and ensuring outstanding items are accounted for to maintain accurate records.

Complete Guide to Credit Card Reconciliation in 2025 - Explains how to set up an automated system to track expenses, gather documentation, and reconcile discrepancies including duplicate charges and unauthorized transactions, focusing on corporate credit card reconciliation.

dowidth.com

dowidth.com