Digital asset taxation involves the valuation, tracking, and reporting of cryptocurrencies and other digital currencies, requiring adherence to evolving regulations and specific IRS guidelines on virtual property. Real estate taxation focuses on property valuation, mortgage interest deductions, and capital gains treatment under well-established tax codes. Explore how these distinct frameworks impact financial reporting and compliance strategies.

Why it is important

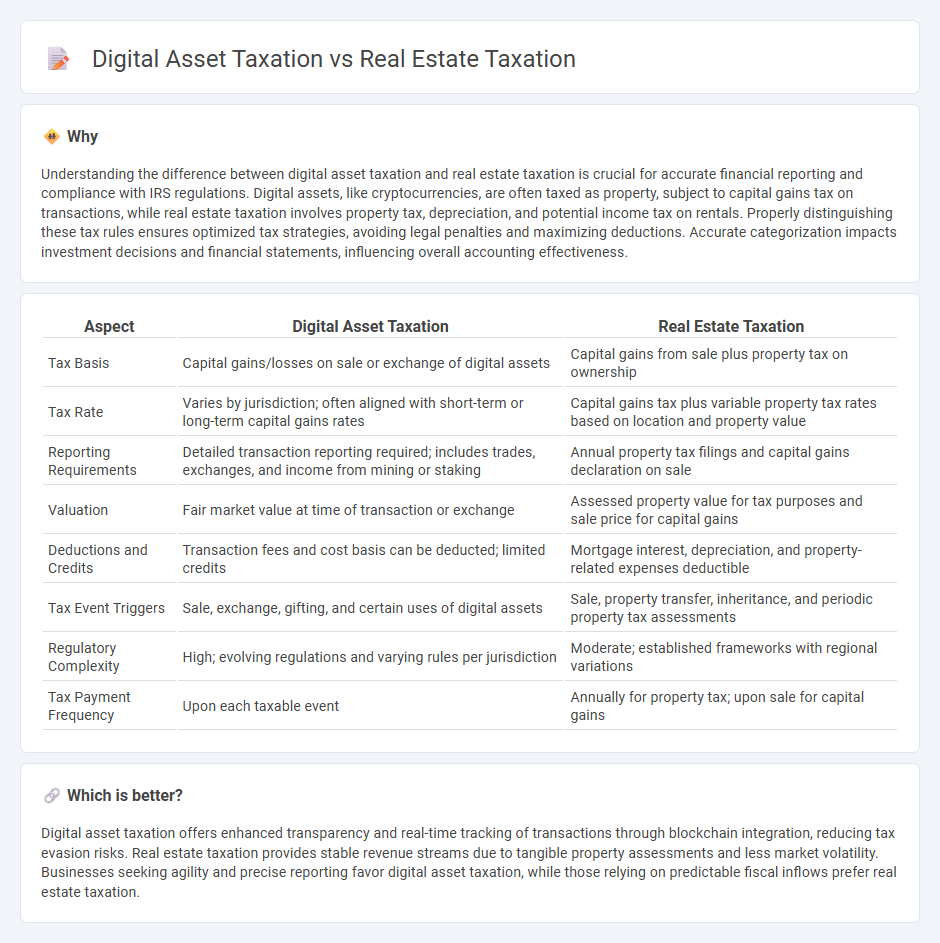

Understanding the difference between digital asset taxation and real estate taxation is crucial for accurate financial reporting and compliance with IRS regulations. Digital assets, like cryptocurrencies, are often taxed as property, subject to capital gains tax on transactions, while real estate taxation involves property tax, depreciation, and potential income tax on rentals. Properly distinguishing these tax rules ensures optimized tax strategies, avoiding legal penalties and maximizing deductions. Accurate categorization impacts investment decisions and financial statements, influencing overall accounting effectiveness.

Comparison Table

| Aspect | Digital Asset Taxation | Real Estate Taxation |

|---|---|---|

| Tax Basis | Capital gains/losses on sale or exchange of digital assets | Capital gains from sale plus property tax on ownership |

| Tax Rate | Varies by jurisdiction; often aligned with short-term or long-term capital gains rates | Capital gains tax plus variable property tax rates based on location and property value |

| Reporting Requirements | Detailed transaction reporting required; includes trades, exchanges, and income from mining or staking | Annual property tax filings and capital gains declaration on sale |

| Valuation | Fair market value at time of transaction or exchange | Assessed property value for tax purposes and sale price for capital gains |

| Deductions and Credits | Transaction fees and cost basis can be deducted; limited credits | Mortgage interest, depreciation, and property-related expenses deductible |

| Tax Event Triggers | Sale, exchange, gifting, and certain uses of digital assets | Sale, property transfer, inheritance, and periodic property tax assessments |

| Regulatory Complexity | High; evolving regulations and varying rules per jurisdiction | Moderate; established frameworks with regional variations |

| Tax Payment Frequency | Upon each taxable event | Annually for property tax; upon sale for capital gains |

Which is better?

Digital asset taxation offers enhanced transparency and real-time tracking of transactions through blockchain integration, reducing tax evasion risks. Real estate taxation provides stable revenue streams due to tangible property assessments and less market volatility. Businesses seeking agility and precise reporting favor digital asset taxation, while those relying on predictable fiscal inflows prefer real estate taxation.

Connection

Digital asset taxation and real estate taxation intersect through the treatment of property as taxable assets subject to valuation, capital gains, and reporting requirements. Both involve complex regulatory frameworks that require accurate record-keeping and assessment of transaction values to determine tax liabilities. Recent regulatory developments emphasize transparency and compliance to prevent tax evasion in both digital and physical property markets.

Key Terms

Property Tax (Real Estate)

Property tax on real estate is typically assessed based on the property's assessed value and local tax rates, serving as a key revenue source for municipalities. Unlike digital assets, which may face capital gains or transaction taxes, property tax is an ongoing levy paid annually or semi-annually. Explore the detailed distinctions and implications of property tax versus digital asset taxation to better understand your fiscal responsibilities.

Capital Gains Tax (Digital Assets)

Capital gains tax on digital assets, such as cryptocurrencies and NFTs, is calculated based on the difference between the purchase price and the sale price, similar to real estate but often complicated by frequent transactions and valuation challenges. Real estate capital gains tax typically applies after a property is sold, considering factors like holding period, improvements, and primary residence exemptions, which are less common in digital asset taxation. Explore more to understand specific tax rates, reporting requirements, and potential deductions for digital asset investors.

Depreciation (Real Estate)

Depreciation in real estate taxation allows property owners to deduct the cost of tangible assets over their useful life, reducing taxable income annually. Digital assets, however, lack a standardized depreciation framework since they are often classified as intangible, leading to different tax treatment focused on capital gains rather than amortization. Explore the nuances between these taxation methods to optimize your investment strategy.

Source and External Links

Real Property Tax - General - This webpage provides information on Ohio's real estate taxation, including how tax values are assessed and adjusted to maintain stable tax rates.

Understanding Ohio Property Taxes - This episode discusses the calculation of property taxes in Ohio, including the role of millage rates and the distribution of tax revenue.

Real Estate Taxes - Franklin County Treasurer - Offers details on how real estate taxes are assessed and collected in Franklin County, Ohio, including payment options and tax uses.

dowidth.com

dowidth.com