Fractional CFO services provide strategic financial leadership, offering expertise in budgeting, forecasting, and cash flow management to drive business growth. Tax preparation focuses on accurately filing tax returns and ensuring compliance with regulations to minimize liabilities. Discover how choosing between these services can optimize your financial success.

Why it is important

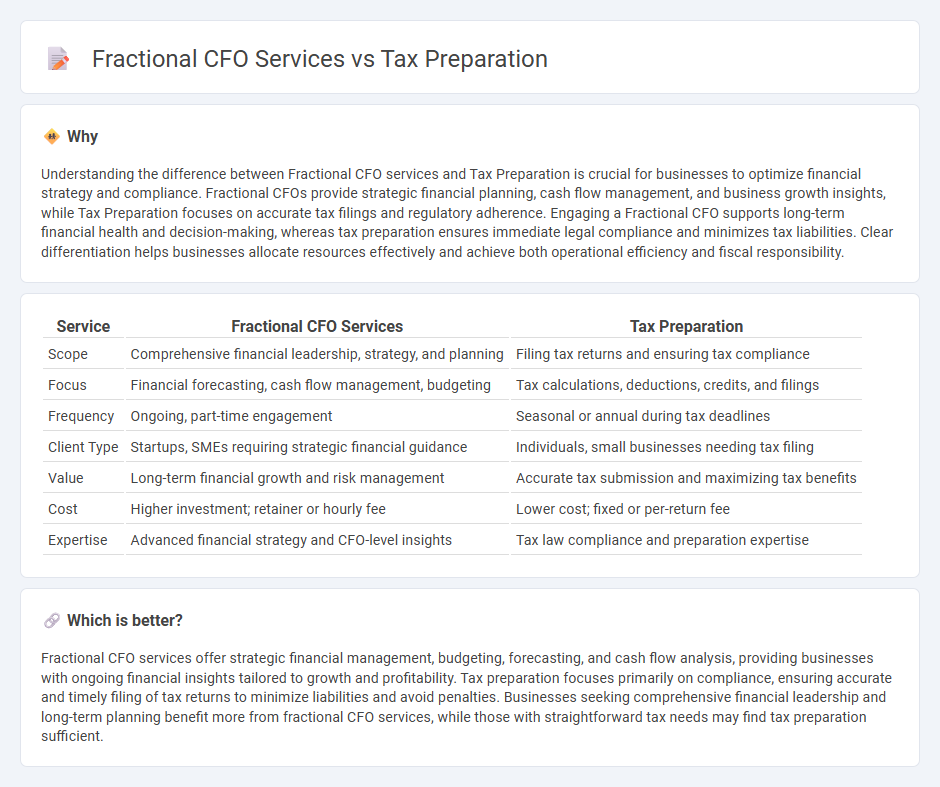

Understanding the difference between Fractional CFO services and Tax Preparation is crucial for businesses to optimize financial strategy and compliance. Fractional CFOs provide strategic financial planning, cash flow management, and business growth insights, while Tax Preparation focuses on accurate tax filings and regulatory adherence. Engaging a Fractional CFO supports long-term financial health and decision-making, whereas tax preparation ensures immediate legal compliance and minimizes tax liabilities. Clear differentiation helps businesses allocate resources effectively and achieve both operational efficiency and fiscal responsibility.

Comparison Table

| Service | Fractional CFO Services | Tax Preparation |

|---|---|---|

| Scope | Comprehensive financial leadership, strategy, and planning | Filing tax returns and ensuring tax compliance |

| Focus | Financial forecasting, cash flow management, budgeting | Tax calculations, deductions, credits, and filings |

| Frequency | Ongoing, part-time engagement | Seasonal or annual during tax deadlines |

| Client Type | Startups, SMEs requiring strategic financial guidance | Individuals, small businesses needing tax filing |

| Value | Long-term financial growth and risk management | Accurate tax submission and maximizing tax benefits |

| Cost | Higher investment; retainer or hourly fee | Lower cost; fixed or per-return fee |

| Expertise | Advanced financial strategy and CFO-level insights | Tax law compliance and preparation expertise |

Which is better?

Fractional CFO services offer strategic financial management, budgeting, forecasting, and cash flow analysis, providing businesses with ongoing financial insights tailored to growth and profitability. Tax preparation focuses primarily on compliance, ensuring accurate and timely filing of tax returns to minimize liabilities and avoid penalties. Businesses seeking comprehensive financial leadership and long-term planning benefit more from fractional CFO services, while those with straightforward tax needs may find tax preparation sufficient.

Connection

Fractional CFO services and tax preparation are interconnected through their shared focus on financial strategy and compliance, enabling businesses to optimize tax liabilities while maintaining accurate financial records. Fractional CFOs analyze financial data to provide strategic insights that inform tax planning, ensuring adherence to tax regulations and maximizing deductions. This integrated approach enhances overall financial health by aligning accounting practices with tax obligations, improving cash flow management and minimizing audit risks.

Key Terms

Tax Compliance

Tax preparation services primarily ensure accurate filing and adherence to tax laws, minimizing penalties and optimizing deductions for individuals and businesses. Fractional CFO services encompass comprehensive financial oversight, including strategic tax planning and compliance integration with broader financial management to enhance long-term fiscal health. Explore the distinct benefits each service offers to find the best fit for your tax compliance and financial strategy needs.

Financial Strategy

Tax preparation services primarily focus on accurate filing and compliance with tax regulations to minimize liabilities and avoid penalties. Fractional CFO services provide strategic financial planning, cash flow management, and long-term growth strategies tailored to the business's unique needs. Discover how integrating fractional CFO expertise can transform your financial strategy beyond traditional tax preparation.

Reporting & Analysis

Tax preparation focuses on accurately compiling and filing financial records to meet regulatory requirements, ensuring compliance with tax laws and minimizing liabilities. Fractional CFO services emphasize strategic financial reporting and analysis, providing insights into cash flow, profitability, and growth opportunities for informed decision-making. Explore the benefits of integrating comprehensive financial analysis with expert tax management to optimize your business performance.

Source and External Links

How to become a tax preparer - A comprehensive guide to becoming a tax preparer, including IRS requirements and career progression.

IRS Free File - Offers free online tax preparation for qualified taxpayers using guided software.

Get Free Tax Prep Help - Provides free tax preparation assistance through IRS programs like VITA and TCE.

dowidth.com

dowidth.com