Invoice factoring platforms provide businesses with immediate cash flow by selling outstanding invoices to a third party, which then manages collections and assumes credit risk. In contrast, invoice discounting allows companies to borrow against unpaid invoices while retaining control over the sales ledger and customer relationships. Explore the key differences and benefits of each financing option to determine the best fit for your accounting needs.

Why it is important

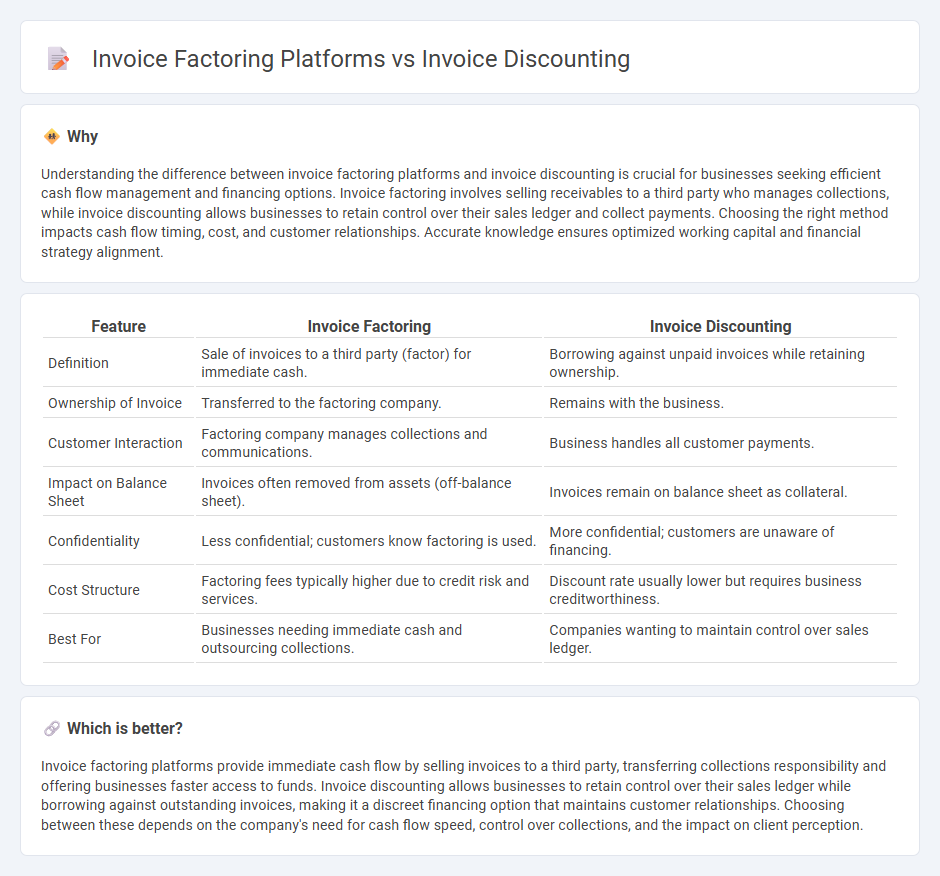

Understanding the difference between invoice factoring platforms and invoice discounting is crucial for businesses seeking efficient cash flow management and financing options. Invoice factoring involves selling receivables to a third party who manages collections, while invoice discounting allows businesses to retain control over their sales ledger and collect payments. Choosing the right method impacts cash flow timing, cost, and customer relationships. Accurate knowledge ensures optimized working capital and financial strategy alignment.

Comparison Table

| Feature | Invoice Factoring | Invoice Discounting |

|---|---|---|

| Definition | Sale of invoices to a third party (factor) for immediate cash. | Borrowing against unpaid invoices while retaining ownership. |

| Ownership of Invoice | Transferred to the factoring company. | Remains with the business. |

| Customer Interaction | Factoring company manages collections and communications. | Business handles all customer payments. |

| Impact on Balance Sheet | Invoices often removed from assets (off-balance sheet). | Invoices remain on balance sheet as collateral. |

| Confidentiality | Less confidential; customers know factoring is used. | More confidential; customers are unaware of financing. |

| Cost Structure | Factoring fees typically higher due to credit risk and services. | Discount rate usually lower but requires business creditworthiness. |

| Best For | Businesses needing immediate cash and outsourcing collections. | Companies wanting to maintain control over sales ledger. |

Which is better?

Invoice factoring platforms provide immediate cash flow by selling invoices to a third party, transferring collections responsibility and offering businesses faster access to funds. Invoice discounting allows businesses to retain control over their sales ledger while borrowing against outstanding invoices, making it a discreet financing option that maintains customer relationships. Choosing between these depends on the company's need for cash flow speed, control over collections, and the impact on client perception.

Connection

Invoice factoring platforms and invoice discounting both provide businesses with immediate cash flow solutions by leveraging outstanding invoices as collateral. Invoice factoring involves selling invoices to a third party at a discount, allowing the factoring company to assume responsibility for collections, while invoice discounting allows businesses to retain control over their sales ledger and collections. Both financial services use invoices as assets to improve liquidity, but factoring transfers credit risk, whereas discounting maintains it with the business.

Key Terms

Receivables

Invoice discounting platforms offer businesses immediate cash by using their receivables as collateral while maintaining control over customer collections, enhancing cash flow without alerting clients. Invoice factoring platforms, in contrast, sell receivables outright to a third party that manages collections, transferring the credit risk but potentially impacting client relationships. Explore detailed insights on optimizing receivables management through these financing solutions.

Advance Rate

Invoice discounting platforms typically offer higher advance rates, often up to 90%, allowing businesses to unlock cash flow quickly while maintaining control over debtor collections. Invoice factoring platforms usually provide lower advance rates, around 70-85%, as they assume responsibility for collecting payments and manage credit risk on behalf of the business. Explore more about how advance rates impact financing options and cash flow management on specialized invoice financing platforms.

Credit Control

Invoice discounting platforms empower businesses to retain control over their credit management by allowing them to manage customer relationships and collections while receiving early payment on invoices. Invoice factoring platforms take over credit control entirely, handling collections and credit risk assessment, which can ease administrative burden but reduce direct customer interaction. Explore the distinct credit control advantages of both platforms to determine the best fit for your business.

Source and External Links

What is invoice discounting and how does it work? - Invoice discounting is a short-term financing method allowing businesses to access funds tied up in unpaid invoices by borrowing up to about 95% of the invoice value from a lender, while retaining responsibility for collecting payments and keeping the arrangement confidential from customers.

Invoice Discounting: A Comprehensive Guide - This method involves submitting unpaid invoices to a provider who advances typically 70%-90% of the invoice value immediately, with the business responsible for collecting payments and repaying the advance plus fees upon receipt.

Invoice Discounting: What It Is & How It Works - Invoice discounting works by a business applying for an advance on an unpaid invoice, receiving around 80-90% upfront from the lender, then receiving the remainder minus fees after the customer pays the invoice.

dowidth.com

dowidth.com