Payroll crypto taxation requires specialized knowledge of cryptocurrency regulations and tax reporting standards, as digital assets introduce complexities absent in traditional payroll systems. Payroll software streamlines tax calculations, compliance, and reporting by automating processes aligned with current tax laws but may lack built-in support for cryptocurrency transactions. Explore the evolving landscape of payroll solutions to understand which approach best fits your business needs in managing crypto assets.

Why it is important

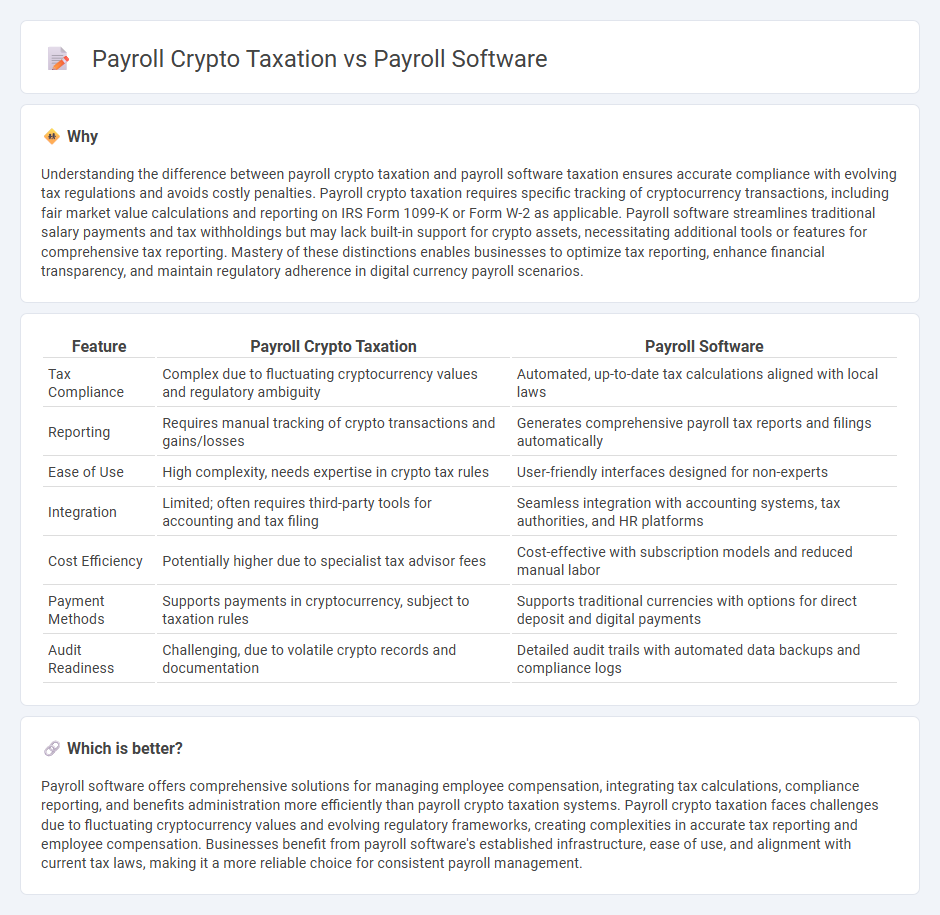

Understanding the difference between payroll crypto taxation and payroll software taxation ensures accurate compliance with evolving tax regulations and avoids costly penalties. Payroll crypto taxation requires specific tracking of cryptocurrency transactions, including fair market value calculations and reporting on IRS Form 1099-K or Form W-2 as applicable. Payroll software streamlines traditional salary payments and tax withholdings but may lack built-in support for crypto assets, necessitating additional tools or features for comprehensive tax reporting. Mastery of these distinctions enables businesses to optimize tax reporting, enhance financial transparency, and maintain regulatory adherence in digital currency payroll scenarios.

Comparison Table

| Feature | Payroll Crypto Taxation | Payroll Software |

|---|---|---|

| Tax Compliance | Complex due to fluctuating cryptocurrency values and regulatory ambiguity | Automated, up-to-date tax calculations aligned with local laws |

| Reporting | Requires manual tracking of crypto transactions and gains/losses | Generates comprehensive payroll tax reports and filings automatically |

| Ease of Use | High complexity, needs expertise in crypto tax rules | User-friendly interfaces designed for non-experts |

| Integration | Limited; often requires third-party tools for accounting and tax filing | Seamless integration with accounting systems, tax authorities, and HR platforms |

| Cost Efficiency | Potentially higher due to specialist tax advisor fees | Cost-effective with subscription models and reduced manual labor |

| Payment Methods | Supports payments in cryptocurrency, subject to taxation rules | Supports traditional currencies with options for direct deposit and digital payments |

| Audit Readiness | Challenging, due to volatile crypto records and documentation | Detailed audit trails with automated data backups and compliance logs |

Which is better?

Payroll software offers comprehensive solutions for managing employee compensation, integrating tax calculations, compliance reporting, and benefits administration more efficiently than payroll crypto taxation systems. Payroll crypto taxation faces challenges due to fluctuating cryptocurrency values and evolving regulatory frameworks, creating complexities in accurate tax reporting and employee compensation. Businesses benefit from payroll software's established infrastructure, ease of use, and alignment with current tax laws, making it a more reliable choice for consistent payroll management.

Connection

Payroll crypto taxation requires accurate tracking of cryptocurrency payments as part of employee compensation, necessitating specialized payroll software capable of managing crypto transactions and calculating tax obligations. Payroll software integrated with blockchain technology ensures compliance by automating tax reporting, withholding, and record-keeping for crypto assets. Efficient handling of payroll crypto taxation reduces errors and streamlines regulatory adherence in businesses utilizing digital currencies for employee salaries.

Key Terms

**Payroll Software:**

Payroll software automates employee salary calculations, tax withholdings, and compliance with local labor laws, ensuring accuracy and efficiency in processing payments. It integrates with accounting systems and typically supports multiple payment methods, but does not natively handle cryptocurrency transactions or the unique tax implications they involve. Discover how modern payroll solutions adapt to evolving financial technologies and regulatory requirements for comprehensive workforce management.

Automation

Payroll software automates salary calculations, tax withholdings, and compliance with labor laws to streamline employee compensation processes. Payroll crypto taxation involves automated tracking and reporting of cryptocurrency transactions for accurate tax compliance, leveraging blockchain data integration. Discover how automation transforms both traditional and crypto payroll management for efficient financial operations.

Compliance

Payroll software ensures accurate calculation, timely tax withholdings, and compliance with federal and state regulations through automated updates and integration with government tax filings. Payroll crypto taxation presents unique challenges due to fluctuating cryptocurrency values, detailed record-keeping requirements, and evolving IRS guidance on virtual currency transactions. Explore how specialized solutions can help businesses navigate compliance complexities in traditional payroll and crypto tax reporting.

Source and External Links

Payroll software for business - ADP - ADP offers easy, affordable payroll software with automated calculations, tax withholdings, and seamless integration with HR systems to help businesses save time and remain compliant.

Easy pay runs with Xero and Gusto payroll software - Xero and Gusto provide automated payroll solutions that calculate taxes, withhold deductions, send payday notifications, and allow employees to self-manage their pay info online for streamlined compliance.

Best Payroll Software for Small Businesses 2025 - Equal Pay Today - QuickBooks Payroll is ideal for small to midsize businesses already using QuickBooks, offering seamless accounting integration, automated tax filing, and same-day deposits to reduce errors and save time.

dowidth.com

dowidth.com