Cryptofinance reconciliation involves verifying cryptocurrency transactions and wallet balances to ensure accuracy in digital asset accounting. Petty cash reconciliation focuses on tracking small cash expenditures and matching receipts with the recorded amounts to maintain accurate physical cash records. Explore detailed methods and best practices for both reconciliation types to enhance your accounting precision.

Why it is important

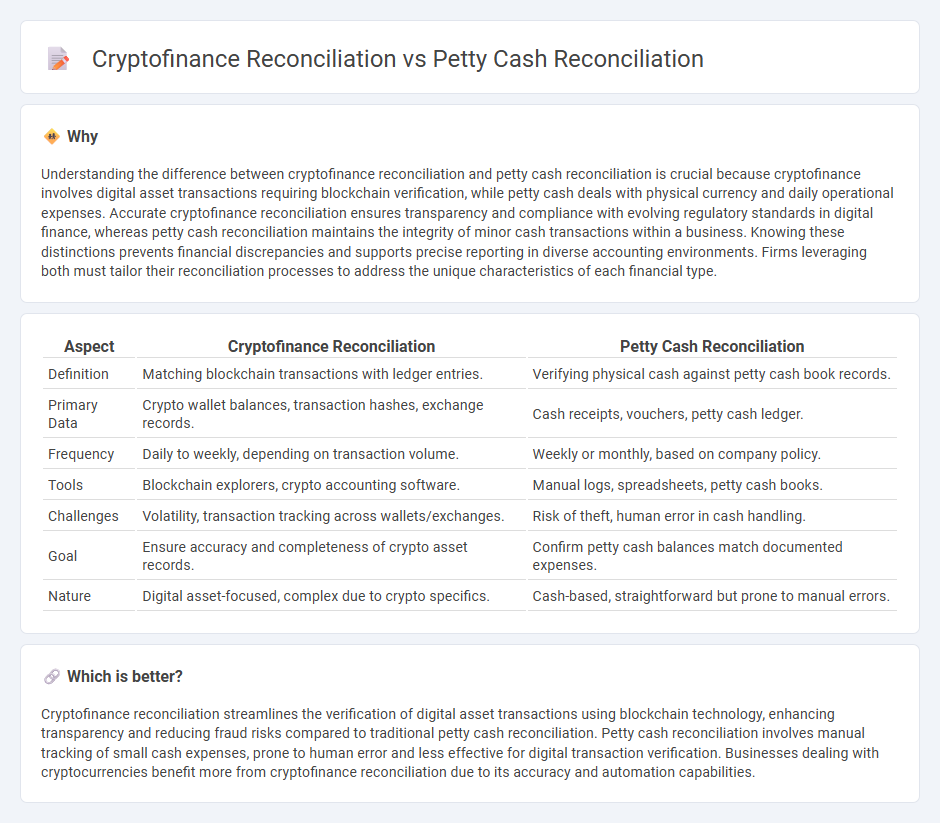

Understanding the difference between cryptofinance reconciliation and petty cash reconciliation is crucial because cryptofinance involves digital asset transactions requiring blockchain verification, while petty cash deals with physical currency and daily operational expenses. Accurate cryptofinance reconciliation ensures transparency and compliance with evolving regulatory standards in digital finance, whereas petty cash reconciliation maintains the integrity of minor cash transactions within a business. Knowing these distinctions prevents financial discrepancies and supports precise reporting in diverse accounting environments. Firms leveraging both must tailor their reconciliation processes to address the unique characteristics of each financial type.

Comparison Table

| Aspect | Cryptofinance Reconciliation | Petty Cash Reconciliation |

|---|---|---|

| Definition | Matching blockchain transactions with ledger entries. | Verifying physical cash against petty cash book records. |

| Primary Data | Crypto wallet balances, transaction hashes, exchange records. | Cash receipts, vouchers, petty cash ledger. |

| Frequency | Daily to weekly, depending on transaction volume. | Weekly or monthly, based on company policy. |

| Tools | Blockchain explorers, crypto accounting software. | Manual logs, spreadsheets, petty cash books. |

| Challenges | Volatility, transaction tracking across wallets/exchanges. | Risk of theft, human error in cash handling. |

| Goal | Ensure accuracy and completeness of crypto asset records. | Confirm petty cash balances match documented expenses. |

| Nature | Digital asset-focused, complex due to crypto specifics. | Cash-based, straightforward but prone to manual errors. |

Which is better?

Cryptofinance reconciliation streamlines the verification of digital asset transactions using blockchain technology, enhancing transparency and reducing fraud risks compared to traditional petty cash reconciliation. Petty cash reconciliation involves manual tracking of small cash expenses, prone to human error and less effective for digital transaction verification. Businesses dealing with cryptocurrencies benefit more from cryptofinance reconciliation due to its accuracy and automation capabilities.

Connection

Cryptofinance reconciliation and petty cash reconciliation both involve verifying and matching transaction records to ensure financial accuracy and prevent discrepancies. Cryptofinance reconciliation focuses on digital asset transactions, comparing blockchain records with internal accounting systems, while petty cash reconciliation audits small cash expenses against vouchers and receipts. Both processes enhance internal controls by maintaining accurate records and detecting unauthorized or erroneous transactions.

Key Terms

**Petty cash reconciliation:**

Petty cash reconciliation involves verifying physical cash on hand against recorded transactions to ensure accuracy in expense tracking and prevent discrepancies. This process requires meticulous documentation, including receipts and vouchers, to confirm that all petty cash disbursements align with accounting records and internal controls. Explore detailed methods and best practices for effective petty cash reconciliation.

Voucher

Petty cash reconciliation involves verifying physical vouchers against recorded expenses to ensure all transactions are accounted for and accurately documented. Cryptofinance reconciliation centers on digital vouchers or transaction tokens, requiring blockchain verification and cross-referencing with crypto wallets and ledger entries for authenticity. Explore how integrating voucher management enhances accuracy and control in both reconciliation processes.

Cash on hand

Petty cash reconciliation involves verifying physical cash on hand against recorded transactions to ensure accuracy in small, daily expenses, typically maintained in a cash box. Cryptofinance reconciliation focuses on digital cash balances across cryptocurrency wallets and exchanges, requiring blockchain transaction verification to confirm holdings and movements. Explore detailed comparison methods to optimize your cash on hand management in both traditional and digital finance.

Source and External Links

How to Reconcile Petty Cash - This webpage provides a step-by-step guide to reconciling petty cash, including calculating withdrawn cash and investigating variances.

Petty Cash Reconciliation: How to Manage Company - This article details the process of petty cash reconciliation, emphasizing the importance of matching recorded transactions with actual cash disbursed.

Reconcile a Petty Cash Fund - This resource from Stanford University outlines the monthly reconciliation process for petty cash, ensuring consistency with the original fund amount.

dowidth.com

dowidth.com