Taxonomy alignment ensures accurate classification and consistency in financial reporting by mapping financial data to a standardized framework such as the IFRS or US GAAP taxonomies. Revenue recognition, governed by standards like ASC 606 or IFRS 15, dictates the precise timing and criteria for recognizing revenue in financial statements. Explore further to understand how integrating taxonomy alignment enhances the precision and compliance of revenue recognition processes.

Why it is important

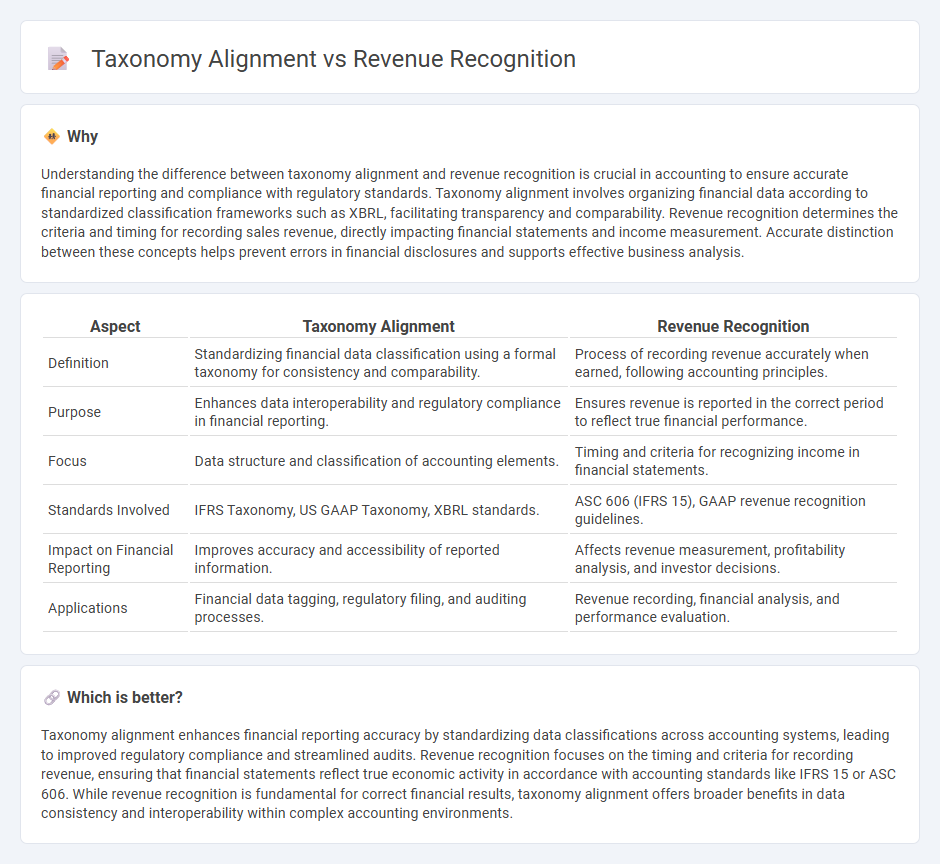

Understanding the difference between taxonomy alignment and revenue recognition is crucial in accounting to ensure accurate financial reporting and compliance with regulatory standards. Taxonomy alignment involves organizing financial data according to standardized classification frameworks such as XBRL, facilitating transparency and comparability. Revenue recognition determines the criteria and timing for recording sales revenue, directly impacting financial statements and income measurement. Accurate distinction between these concepts helps prevent errors in financial disclosures and supports effective business analysis.

Comparison Table

| Aspect | Taxonomy Alignment | Revenue Recognition |

|---|---|---|

| Definition | Standardizing financial data classification using a formal taxonomy for consistency and comparability. | Process of recording revenue accurately when earned, following accounting principles. |

| Purpose | Enhances data interoperability and regulatory compliance in financial reporting. | Ensures revenue is reported in the correct period to reflect true financial performance. |

| Focus | Data structure and classification of accounting elements. | Timing and criteria for recognizing income in financial statements. |

| Standards Involved | IFRS Taxonomy, US GAAP Taxonomy, XBRL standards. | ASC 606 (IFRS 15), GAAP revenue recognition guidelines. |

| Impact on Financial Reporting | Improves accuracy and accessibility of reported information. | Affects revenue measurement, profitability analysis, and investor decisions. |

| Applications | Financial data tagging, regulatory filing, and auditing processes. | Revenue recording, financial analysis, and performance evaluation. |

Which is better?

Taxonomy alignment enhances financial reporting accuracy by standardizing data classifications across accounting systems, leading to improved regulatory compliance and streamlined audits. Revenue recognition focuses on the timing and criteria for recording revenue, ensuring that financial statements reflect true economic activity in accordance with accounting standards like IFRS 15 or ASC 606. While revenue recognition is fundamental for correct financial results, taxonomy alignment offers broader benefits in data consistency and interoperability within complex accounting environments.

Connection

Taxonomy alignment in accounting ensures that financial data is categorized and reported consistently according to regulatory standards, facilitating accurate revenue recognition. Proper taxonomy alignment enables companies to identify revenue streams precisely and apply the correct timing and measurement principles under accounting frameworks like IFRS 15 or ASC 606. Streamlined taxonomy integration reduces errors in revenue reporting and enhances transparency for stakeholders.

Key Terms

Accrual Basis

Revenue recognition under the accrual basis mandates recording income when earned, regardless of cash receipt, ensuring accurate financial reporting and compliance with GAAP or IFRS standards. Taxonomy alignment involves structuring financial data in harmony with specific regulatory or reporting frameworks like XBRL, facilitating transparent and consistent disclosures. Explore how synchronized revenue recognition and taxonomy alignment optimize financial analytics and regulatory adherence.

IFRS 15 / ASC 606

IFRS 15 and ASC 606 establish uniform revenue recognition criteria to enhance comparability and transparency in financial reporting across industries. Taxonomy alignment involves mapping these standards to digital reporting frameworks like XBRL, ensuring accurate presentation and compliance with regulatory requirements. Explore detailed insights on integrating revenue recognition principles with taxonomy frameworks for effective financial disclosures.

ESG Reporting

Revenue recognition and taxonomy alignment play critical roles in ESG reporting by ensuring accurate financial disclosures and adherence to standardized environmental, social, and governance frameworks. Revenue recognition focuses on the precise timing and measurement of income to reflect true financial performance, while taxonomy alignment categorizes activities according to ESG criteria, promoting transparency and comparability for sustainable investing. Explore how integrating revenue recognition with taxonomy alignment enhances the credibility and impact of ESG reports.

Source and External Links

Revenue Recognition: Principles and 5-Step Model - This article discusses the five-step revenue recognition model, which is crucial for accurately reporting revenue under GAAP and IFRS.

Revenue recognition principles & best practices - This guide outlines the principles and best practices of revenue recognition, highlighting the importance of identifying contracts and performance obligations.

Revenue recognition examples - This resource provides examples of how revenue should be recognized for various business types, emphasizing the distinction between cash and revenue.

dowidth.com

dowidth.com