Fractional CFO services provide strategic financial management and leadership on a part-time basis, helping businesses optimize cash flow, budgeting, and financial planning without the cost of a full-time executive. Audit services focus on systematically examining financial statements and records to ensure accuracy, compliance, and transparency for stakeholders. Discover how choosing between Fractional CFO and audit services can elevate your company's financial health.

Why it is important

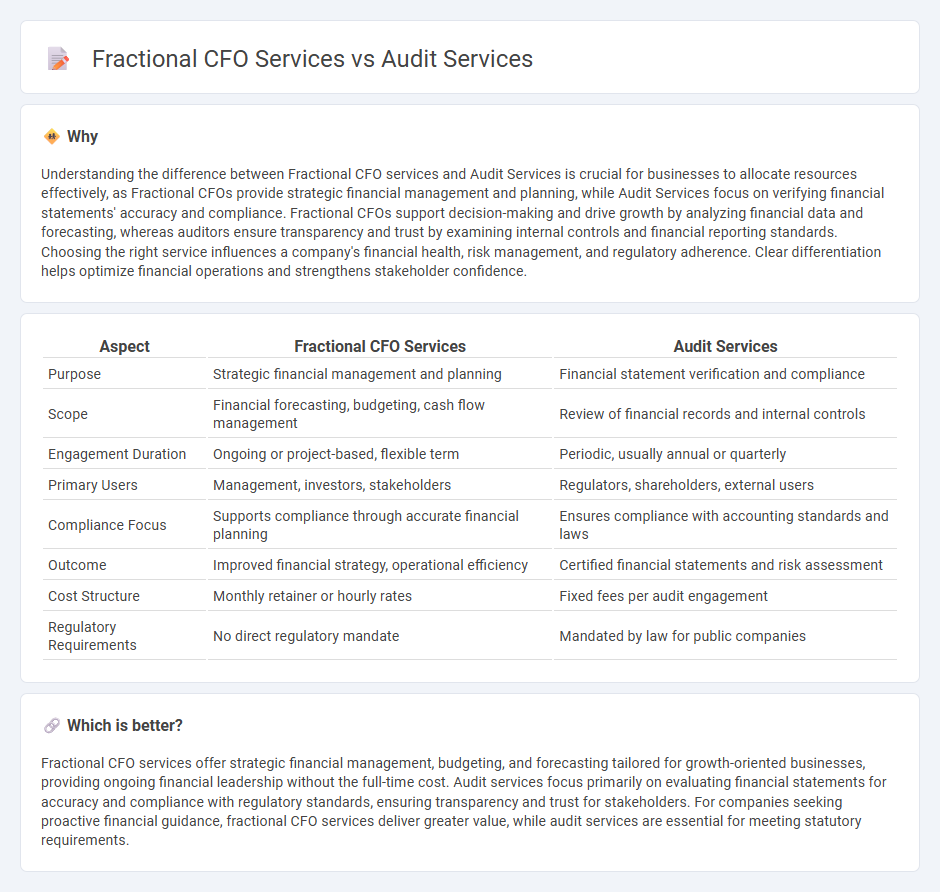

Understanding the difference between Fractional CFO services and Audit Services is crucial for businesses to allocate resources effectively, as Fractional CFOs provide strategic financial management and planning, while Audit Services focus on verifying financial statements' accuracy and compliance. Fractional CFOs support decision-making and drive growth by analyzing financial data and forecasting, whereas auditors ensure transparency and trust by examining internal controls and financial reporting standards. Choosing the right service influences a company's financial health, risk management, and regulatory adherence. Clear differentiation helps optimize financial operations and strengthens stakeholder confidence.

Comparison Table

| Aspect | Fractional CFO Services | Audit Services |

|---|---|---|

| Purpose | Strategic financial management and planning | Financial statement verification and compliance |

| Scope | Financial forecasting, budgeting, cash flow management | Review of financial records and internal controls |

| Engagement Duration | Ongoing or project-based, flexible term | Periodic, usually annual or quarterly |

| Primary Users | Management, investors, stakeholders | Regulators, shareholders, external users |

| Compliance Focus | Supports compliance through accurate financial planning | Ensures compliance with accounting standards and laws |

| Outcome | Improved financial strategy, operational efficiency | Certified financial statements and risk assessment |

| Cost Structure | Monthly retainer or hourly rates | Fixed fees per audit engagement |

| Regulatory Requirements | No direct regulatory mandate | Mandated by law for public companies |

Which is better?

Fractional CFO services offer strategic financial management, budgeting, and forecasting tailored for growth-oriented businesses, providing ongoing financial leadership without the full-time cost. Audit services focus primarily on evaluating financial statements for accuracy and compliance with regulatory standards, ensuring transparency and trust for stakeholders. For companies seeking proactive financial guidance, fractional CFO services deliver greater value, while audit services are essential for meeting statutory requirements.

Connection

Fractional CFO services provide businesses with expert financial strategy and oversight on a part-time basis, enhancing financial reporting accuracy and compliance. Audit services systematically evaluate these financial reports to ensure transparency and adherence to regulatory standards. The collaboration between Fractional CFOs and auditors strengthens internal controls and fosters reliable fiscal management.

Key Terms

Assurance

Audit services provide independent assurance by thoroughly examining financial statements to confirm accuracy and compliance with accounting standards. Fractional CFO services focus on strategic financial leadership and decision-making without the comprehensive assurance scope of audits. Explore the key differences to determine which service best supports your business assurance needs.

Financial Strategy

Audit services provide an objective evaluation of an organization's financial statements to ensure accuracy and regulatory compliance, enhancing transparency for stakeholders. Fractional CFO services concentrate on developing and executing tailored financial strategies that drive business growth, optimize cash flow, and improve profitability. Explore how integrating both services can strengthen your financial strategy and business performance.

Compliance

Audit services primarily focus on ensuring compliance with regulatory standards by independently examining financial statements to verify accuracy and adherence to established accounting principles. Fractional CFO services provide strategic financial leadership, including compliance oversight, risk management, and financial planning for organizations that require part-time expertise. Discover how integrating both services can optimize your company's financial integrity and regulatory adherence.

Source and External Links

Types of Audit Services - Provides operational, financial, compliance, and information technology audits, consulting services, special investigations, follow-up engagements, and coordination of external audits.

Audit Services by BDO - Offers audit services for private and public companies to enhance stakeholder trust and provide business insights through high-quality audits.

KPMG Audit Services - Provides financial statement audits, ESG assurance, and technology assurance services across all industries, focusing on agility and integrity.

dowidth.com

dowidth.com