Cryptocurrency taxation involves reporting digital asset transactions, where gains and losses are calculated based on the fair market value at the time of each trade, purchase, or sale, leading to complex tax implications for traders and investors. Barter transactions, in contrast, require reporting the fair market value of goods or services exchanged as income, posing challenges in valuation and record-keeping. Explore detailed guidelines to understand how accounting standards apply differently to these types of transactions.

Why it is important

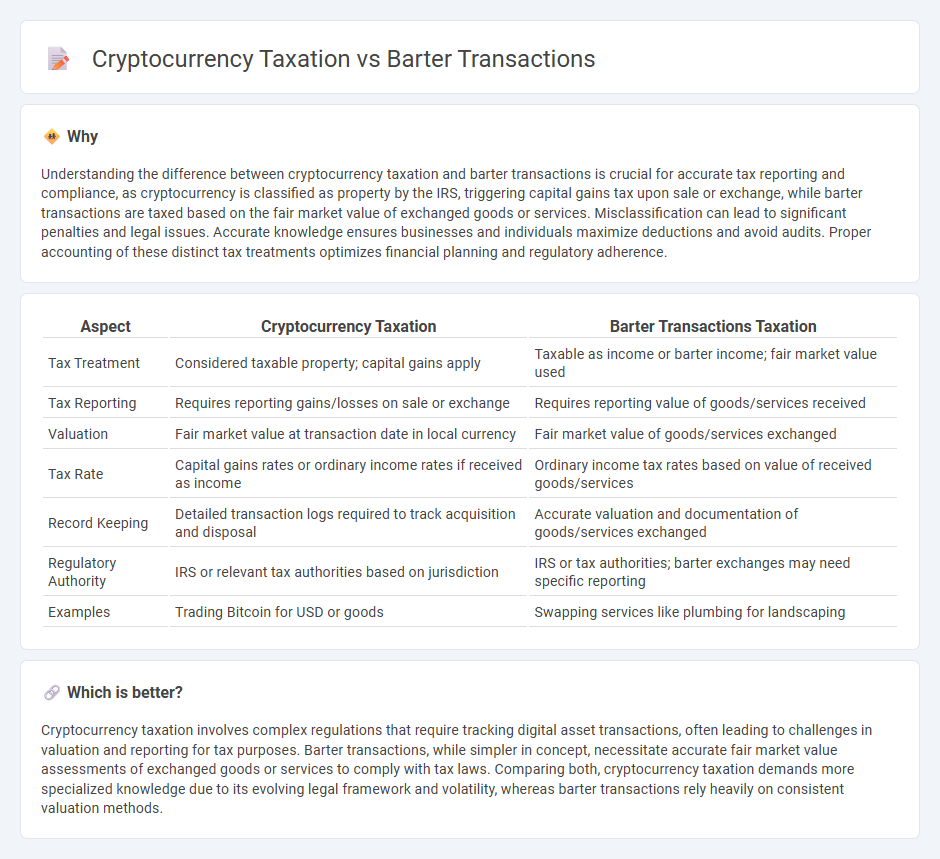

Understanding the difference between cryptocurrency taxation and barter transactions is crucial for accurate tax reporting and compliance, as cryptocurrency is classified as property by the IRS, triggering capital gains tax upon sale or exchange, while barter transactions are taxed based on the fair market value of exchanged goods or services. Misclassification can lead to significant penalties and legal issues. Accurate knowledge ensures businesses and individuals maximize deductions and avoid audits. Proper accounting of these distinct tax treatments optimizes financial planning and regulatory adherence.

Comparison Table

| Aspect | Cryptocurrency Taxation | Barter Transactions Taxation |

|---|---|---|

| Tax Treatment | Considered taxable property; capital gains apply | Taxable as income or barter income; fair market value used |

| Tax Reporting | Requires reporting gains/losses on sale or exchange | Requires reporting value of goods/services received |

| Valuation | Fair market value at transaction date in local currency | Fair market value of goods/services exchanged |

| Tax Rate | Capital gains rates or ordinary income rates if received as income | Ordinary income tax rates based on value of received goods/services |

| Record Keeping | Detailed transaction logs required to track acquisition and disposal | Accurate valuation and documentation of goods/services exchanged |

| Regulatory Authority | IRS or relevant tax authorities based on jurisdiction | IRS or tax authorities; barter exchanges may need specific reporting |

| Examples | Trading Bitcoin for USD or goods | Swapping services like plumbing for landscaping |

Which is better?

Cryptocurrency taxation involves complex regulations that require tracking digital asset transactions, often leading to challenges in valuation and reporting for tax purposes. Barter transactions, while simpler in concept, necessitate accurate fair market value assessments of exchanged goods or services to comply with tax laws. Comparing both, cryptocurrency taxation demands more specialized knowledge due to its evolving legal framework and volatility, whereas barter transactions rely heavily on consistent valuation methods.

Connection

Cryptocurrency taxation intersects with barter transactions as both involve non-cash exchanges that require accurate valuation for tax reporting. The IRS treats virtual currency as property, necessitating taxpayers to report gains or losses when cryptos are used in barter trades. Proper documentation of fair market value during these transactions ensures compliance with tax regulations and prevents underreporting income.

Key Terms

Fair Market Value

Barter transactions are taxed based on the Fair Market Value (FMV) of the goods or services exchanged at the time of the transaction, similar to cryptocurrency transactions which require reporting FMV in USD when cryptocurrencies are used for payment or trade. The IRS treats cryptocurrency as property, mandating that each exchange or barter involving crypto assets is valued at FMV for accurate income calculation and capital gains determination. Explore detailed guidelines and compliance strategies to optimize your tax reporting for both barter and cryptocurrency transactions.

Realization Event

Barter transactions, where goods or services are exchanged directly, trigger a realization event for tax purposes at the point of exchange, requiring the fair market value of the received item to be reported as income. Cryptocurrency taxation similarly recognizes realization events upon disposing of digital assets, including selling, trading, or using crypto to purchase goods or services, with gains or losses calculated based on the difference between the acquisition cost and the fair market value at the time of the transaction. Understanding how realization events impact tax obligations in barter and cryptocurrency transactions is essential for compliance--explore more detailed guidance and examples here.

Basis Calculation

Barter transactions require calculating the basis based on the fair market value of goods or services exchanged at the time of the trade, which determines the gain or loss for tax purposes. Cryptocurrency taxation involves calculating the basis using the acquisition cost, adjusted for factors like fees and forks, to accurately report capital gains or losses upon disposition. Explore detailed guidance on basis calculation methods to ensure compliance and optimize tax reporting for both barter and cryptocurrency transactions.

Source and External Links

Bartering transactions are taxable - Barter transactions, where goods or services are exchanged without money, must be reported as taxable income based on the value of what is received or accrued, and may be subject to business, occupation, and retail sales taxes where applicable.

What Are Contra and Barter Transactions - Bartering is the direct exchange of goods or services of equal value between two parties, with no money changing hands, and can be used by individuals, businesses, or organizations for mutual benefit.

Topic no. 420, Bartering income - Bartering involves trading property or services; barter exchanges (organized networks for such trades) may be required to issue information returns (Form 1099-B) for tax reporting purposes.

dowidth.com

dowidth.com