Real-time expense reconciliation offers immediate matching of transactions with recorded expenses, ensuring up-to-date financial records and enhanced cash flow management. Accrual-based reconciliation records expenses when incurred, not when paid, providing a comprehensive view of financial obligations and aligning with standard accounting principles. Explore the advantages of both methods to optimize your financial accuracy and reporting.

Why it is important

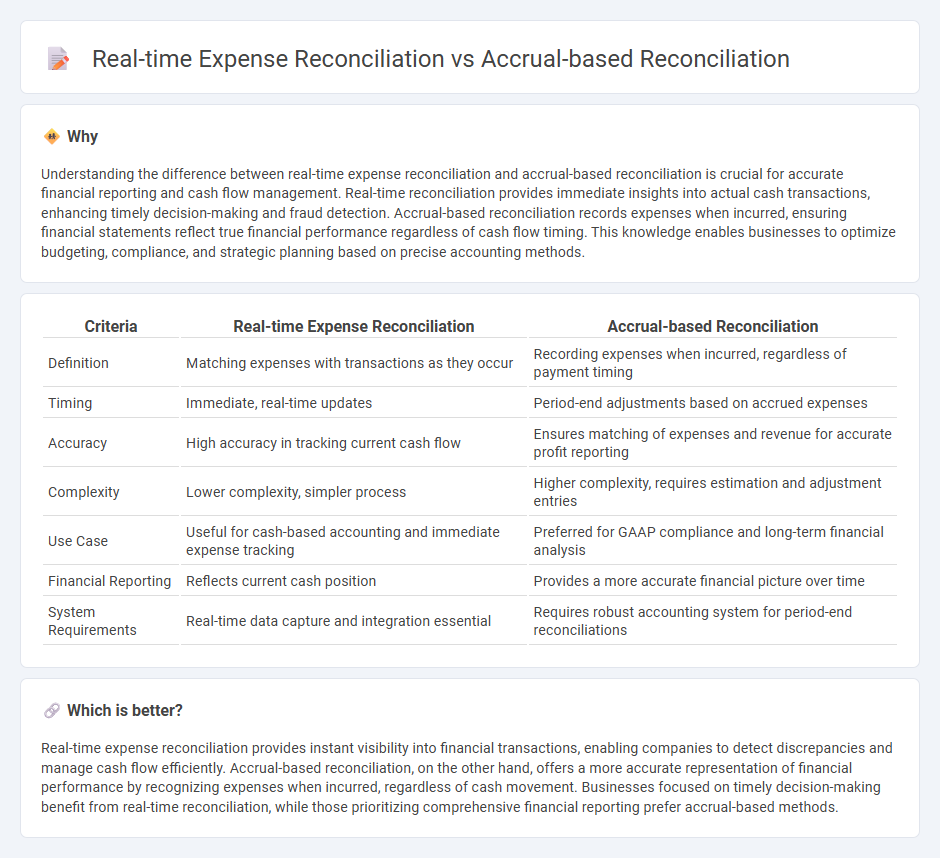

Understanding the difference between real-time expense reconciliation and accrual-based reconciliation is crucial for accurate financial reporting and cash flow management. Real-time reconciliation provides immediate insights into actual cash transactions, enhancing timely decision-making and fraud detection. Accrual-based reconciliation records expenses when incurred, ensuring financial statements reflect true financial performance regardless of cash flow timing. This knowledge enables businesses to optimize budgeting, compliance, and strategic planning based on precise accounting methods.

Comparison Table

| Criteria | Real-time Expense Reconciliation | Accrual-based Reconciliation |

|---|---|---|

| Definition | Matching expenses with transactions as they occur | Recording expenses when incurred, regardless of payment timing |

| Timing | Immediate, real-time updates | Period-end adjustments based on accrued expenses |

| Accuracy | High accuracy in tracking current cash flow | Ensures matching of expenses and revenue for accurate profit reporting |

| Complexity | Lower complexity, simpler process | Higher complexity, requires estimation and adjustment entries |

| Use Case | Useful for cash-based accounting and immediate expense tracking | Preferred for GAAP compliance and long-term financial analysis |

| Financial Reporting | Reflects current cash position | Provides a more accurate financial picture over time |

| System Requirements | Real-time data capture and integration essential | Requires robust accounting system for period-end reconciliations |

Which is better?

Real-time expense reconciliation provides instant visibility into financial transactions, enabling companies to detect discrepancies and manage cash flow efficiently. Accrual-based reconciliation, on the other hand, offers a more accurate representation of financial performance by recognizing expenses when incurred, regardless of cash movement. Businesses focused on timely decision-making benefit from real-time reconciliation, while those prioritizing comprehensive financial reporting prefer accrual-based methods.

Connection

Real-time expense reconciliation and accrual-based reconciliation are connected through their focus on accurately matching expenses to the period they are incurred, ensuring financial statements reflect true liabilities and expenses at any given time. Real-time expense reconciliation provides up-to-date transaction matching and verification, while accrual-based reconciliation adjusts these entries to align expenses with earned or incurred periods regardless of cash flow timing. Together, they enhance financial accuracy by integrating immediate transaction tracking with period-end accrual adjustments in accounting systems.

Key Terms

Timing of recognition

Accrual-based reconciliation records expenses when incurred, aligning with accounting periods and providing a comprehensive financial overview through delayed yet accurate recognition. Real-time expense reconciliation captures transactions immediately, enhancing cash flow visibility and supporting prompt decision-making by reflecting current financial status. Explore more to understand which approach suits your business's timing and reporting needs best.

Matching principle

Accrual-based reconciliation aligns expenses and revenues according to the matching principle by recording transactions when they are incurred, ensuring financial statements reflect accurate earned and owed amounts. Real-time expense reconciliation, while providing up-to-date financial data, may struggle to fully adhere to the matching principle since expenses and related revenues can be recorded asynchronously. Discover how integrating both methods can optimize financial accuracy and operational efficiency.

Cash flow tracking

Accrual-based reconciliation records expenses and revenues when they are incurred, providing a comprehensive view of obligations and income that impacts cash flow tracking over accounting periods. Real-time expense reconciliation updates cash flow data instantly by capturing transactions as they occur, enabling immediate and accurate financial insights for proactive cash management. Explore detailed comparisons to optimize your cash flow tracking strategy.

Source and External Links

Excel in Accrual Reconciliation for Clear Financials - Accrual-based reconciliation is the process of comparing and aligning accrued expenses and revenues with actual transactions to ensure financial statements accurately reflect a company's financial position, typically acting as a critical step in the month-end close to maintain financial accuracy and compliance under accrual accounting principles.

Accrual Reconciliation Report (Oracle Purchasing Help) - The accrual reconciliation report is a tool used to monitor and identify discrepancies in accounts payable accrual accounts related to purchasing and receiving activities, ensuring accuracy by grouping and reviewing transactions affecting accrued expenses.

Accrual-Based Accounting Explained - Accrual-based reconciliation supports the accrual accounting method that records revenues and matching expenses when they are generated, not when cash changes hands, ensuring expenses are matched to the period they help generate revenue and allowing a clearer and more accurate financial picture.

dowidth.com

dowidth.com