Neobank reconciliation involves matching transactions from digital-only bank statements with internal financial records, focusing on automated, real-time updates and integration with fintech platforms, whereas cash account reconciliation deals with verifying physical cash balances against ledger entries, emphasizing manual counting and error detection. Both processes are crucial for ensuring financial accuracy and preventing discrepancies in business accounting. Explore deeper insights into how these reconciliation methods enhance financial control and reporting accuracy.

Why it is important

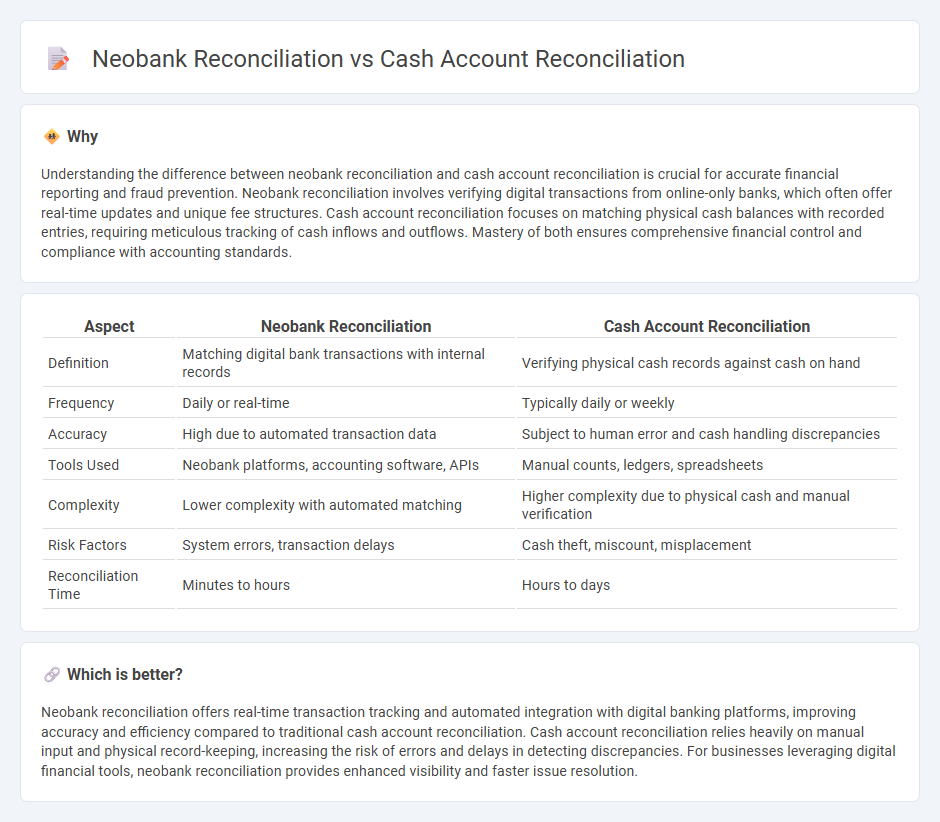

Understanding the difference between neobank reconciliation and cash account reconciliation is crucial for accurate financial reporting and fraud prevention. Neobank reconciliation involves verifying digital transactions from online-only banks, which often offer real-time updates and unique fee structures. Cash account reconciliation focuses on matching physical cash balances with recorded entries, requiring meticulous tracking of cash inflows and outflows. Mastery of both ensures comprehensive financial control and compliance with accounting standards.

Comparison Table

| Aspect | Neobank Reconciliation | Cash Account Reconciliation |

|---|---|---|

| Definition | Matching digital bank transactions with internal records | Verifying physical cash records against cash on hand |

| Frequency | Daily or real-time | Typically daily or weekly |

| Accuracy | High due to automated transaction data | Subject to human error and cash handling discrepancies |

| Tools Used | Neobank platforms, accounting software, APIs | Manual counts, ledgers, spreadsheets |

| Complexity | Lower complexity with automated matching | Higher complexity due to physical cash and manual verification |

| Risk Factors | System errors, transaction delays | Cash theft, miscount, misplacement |

| Reconciliation Time | Minutes to hours | Hours to days |

Which is better?

Neobank reconciliation offers real-time transaction tracking and automated integration with digital banking platforms, improving accuracy and efficiency compared to traditional cash account reconciliation. Cash account reconciliation relies heavily on manual input and physical record-keeping, increasing the risk of errors and delays in detecting discrepancies. For businesses leveraging digital financial tools, neobank reconciliation provides enhanced visibility and faster issue resolution.

Connection

Neobank reconciliation and cash account reconciliation are interconnected processes that ensure financial accuracy by matching digital transaction records from neobanks with internal cash account statements. Effective reconciliation identifies discrepancies such as unauthorized transactions or data entry errors, enhancing financial transparency and compliance. Incorporating automated reconciliation tools streamlines this process, reducing manual effort and improving audit readiness.

Key Terms

Bank Statement

Cash account reconciliation involves verifying every transaction against the bank statement to ensure accuracy and identify discrepancies. Neobank reconciliation leverages digital tools to automatically match transactions with real-time bank statement data, enhancing efficiency and reducing errors. Explore detailed comparisons to optimize your reconciliation process and improve financial accuracy.

Transaction Matching

Cash account reconciliation involves verifying each transaction in traditional bank accounts against internal records to ensure accuracy and detect discrepancies. Neobank reconciliation emphasizes automated transaction matching using advanced algorithms and real-time data integration, improving efficiency and reducing manual errors. Discover how transaction matching techniques differ and optimize financial accuracy in both contexts.

Digital Integration

Cash account reconciliation involves matching financial transactions recorded in cash accounts with bank statements or receipts to ensure accuracy and prevent discrepancies. Neobank reconciliation leverages advanced digital integration, using APIs and real-time data synchronization to automate transaction matching and reduce manual errors. Explore how digital integration enhances efficiency and accuracy in reconciliation processes.

Source and External Links

What is Cash Reconciliation: Steps, Examples and Implementation - This webpage provides a detailed guide on the steps involved in cash reconciliation, including obtaining bank statements, verifying transactions, and documenting findings.

How to Perform a Cash Reconciliation: A Step-By-Step Guide for Accountants - This guide outlines a step-by-step process for performing cash reconciliation, focusing on determining the accounting period, downloading financial reports, and calculating cash transactions.

What is Cash Reconciliation? - Modern Treasury - This webpage explains the concept of cash reconciliation, emphasizing its role in ensuring the accuracy of financial statements by matching internal records with bank statements.

dowidth.com

dowidth.com