Embedded finance accounting integrates financial services directly into non-financial platforms, enabling seamless transactions and real-time bookkeeping within the user environment. Marketplace accounting manages diverse transactions across multiple vendors, tracking sales, commissions, and payouts on a centralized platform for accurate revenue recognition. Explore the differences between embedded finance accounting and marketplace accounting to optimize your financial operations.

Why it is important

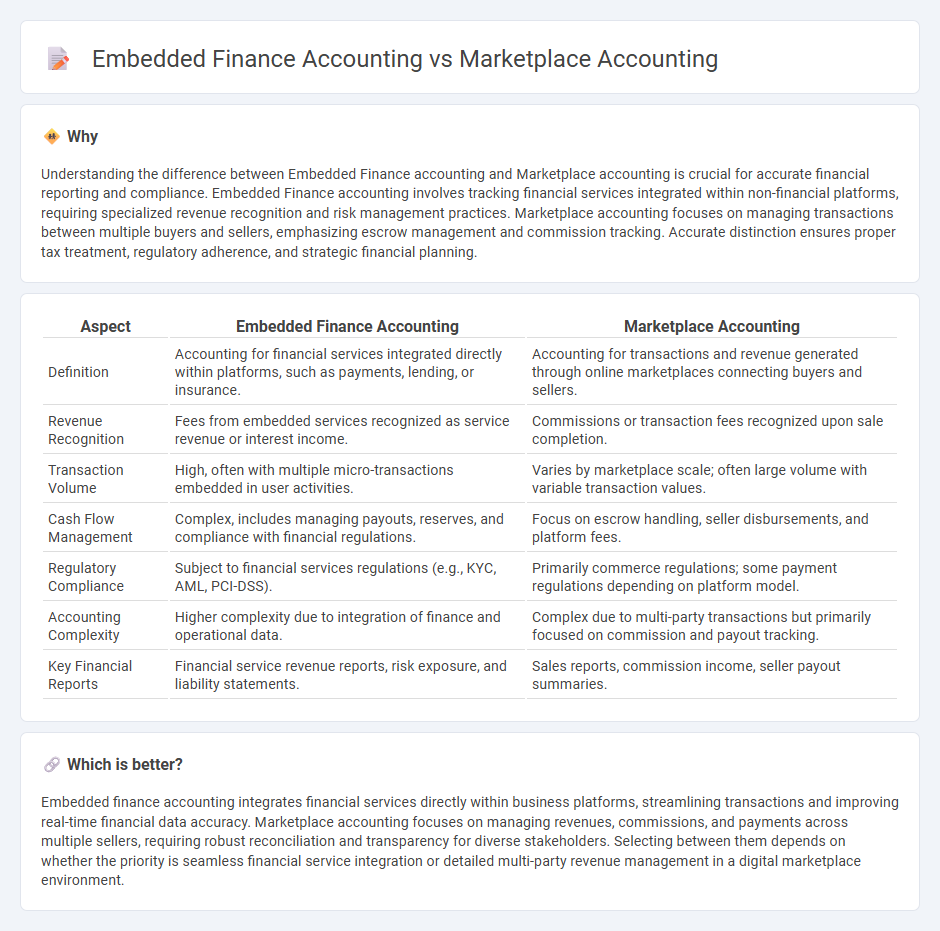

Understanding the difference between Embedded Finance accounting and Marketplace accounting is crucial for accurate financial reporting and compliance. Embedded Finance accounting involves tracking financial services integrated within non-financial platforms, requiring specialized revenue recognition and risk management practices. Marketplace accounting focuses on managing transactions between multiple buyers and sellers, emphasizing escrow management and commission tracking. Accurate distinction ensures proper tax treatment, regulatory adherence, and strategic financial planning.

Comparison Table

| Aspect | Embedded Finance Accounting | Marketplace Accounting |

|---|---|---|

| Definition | Accounting for financial services integrated directly within platforms, such as payments, lending, or insurance. | Accounting for transactions and revenue generated through online marketplaces connecting buyers and sellers. |

| Revenue Recognition | Fees from embedded services recognized as service revenue or interest income. | Commissions or transaction fees recognized upon sale completion. |

| Transaction Volume | High, often with multiple micro-transactions embedded in user activities. | Varies by marketplace scale; often large volume with variable transaction values. |

| Cash Flow Management | Complex, includes managing payouts, reserves, and compliance with financial regulations. | Focus on escrow handling, seller disbursements, and platform fees. |

| Regulatory Compliance | Subject to financial services regulations (e.g., KYC, AML, PCI-DSS). | Primarily commerce regulations; some payment regulations depending on platform model. |

| Accounting Complexity | Higher complexity due to integration of finance and operational data. | Complex due to multi-party transactions but primarily focused on commission and payout tracking. |

| Key Financial Reports | Financial service revenue reports, risk exposure, and liability statements. | Sales reports, commission income, seller payout summaries. |

Which is better?

Embedded finance accounting integrates financial services directly within business platforms, streamlining transactions and improving real-time financial data accuracy. Marketplace accounting focuses on managing revenues, commissions, and payments across multiple sellers, requiring robust reconciliation and transparency for diverse stakeholders. Selecting between them depends on whether the priority is seamless financial service integration or detailed multi-party revenue management in a digital marketplace environment.

Connection

Embedded finance accounting integrates financial services directly into non-financial platforms, enabling seamless transaction tracking and revenue recognition within a single system. Marketplace accounting manages the financial flows among multiple participants, ensuring accurate allocation of commissions, fees, and settlements. Both approaches rely on real-time data synchronization and transparent reporting to optimize financial operations and compliance in digital ecosystems.

Key Terms

Revenue Recognition

Marketplace accounting recognizes revenue based on commission fees or transaction facilitation, reflecting the platform's role as an intermediary rather than a principal seller. Embedded finance accounting involves recognizing revenue from financial services directly integrated into non-financial platforms, often requiring treatment of interest income, fees, or other financial gains as principal activities. Discover the nuances of revenue recognition rules to optimize financial reporting in digital commerce environments.

Commission Structures

Marketplace accounting centers on tracking commission revenue generated from sellers using the platform, often requiring detailed split accounting to allocate fees fairly. Embedded finance accounting integrates financial services within platforms, necessitating precise recording of commission income alongside interest, fees, and transactional data for comprehensive financial reporting. Explore more about how commission structures impact financial transparency and operational efficiency in these business models.

Float Management

Marketplace accounting emphasizes managing transaction flows between buyers and sellers, with a key focus on accurately recording hold periods and pending payments to optimize cash flow. Embedded finance accounting integrates financial services directly into platforms, necessitating precise float management to handle real-time fund availability and regulatory compliance. Explore detailed strategies for enhancing float management in both models to improve liquidity and operational efficiency.

Source and External Links

Accounting for Marketplace Companies - This article discusses the unique accounting needs of digital marketplace companies, highlighting the importance of specialized financial management and the roles required to succeed in this space.

E-commerce Platforms and Marketplace Accounting - This resource provides best practices for managing accounting in e-commerce platforms, focusing on specialized accounting practices and integration with financial systems.

For Ecommerce Success, Untangle the Marketplace Accounting Maze - This article highlights the challenges and opportunities in marketplace accounting for e-commerce businesses, emphasizing the need for mastering accounting practices to ensure cash flow and profit margins.

dowidth.com

dowidth.com