Cryptocurrency valuation presents unique challenges compared to historical cost accounting due to its high volatility and lack of physical backing. While historical cost relies on original purchase price, cryptocurrency valuation requires real-time market data to reflect true asset value. Explore how these differing approaches impact financial reporting and asset management.

Why it is important

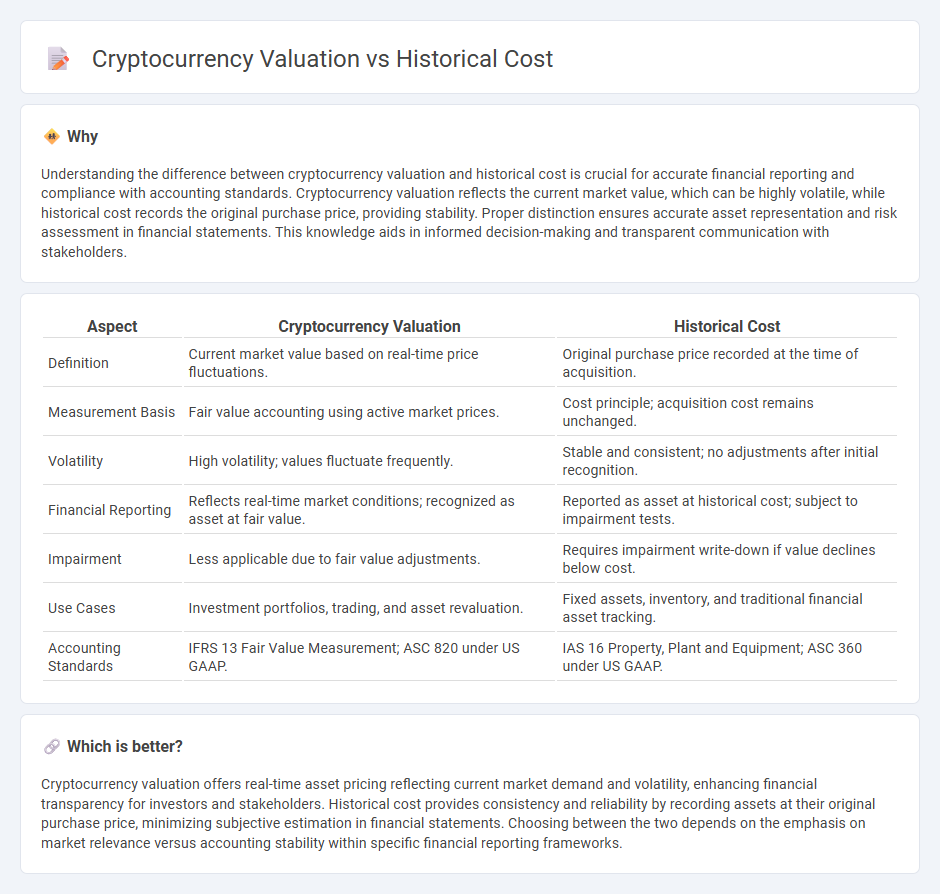

Understanding the difference between cryptocurrency valuation and historical cost is crucial for accurate financial reporting and compliance with accounting standards. Cryptocurrency valuation reflects the current market value, which can be highly volatile, while historical cost records the original purchase price, providing stability. Proper distinction ensures accurate asset representation and risk assessment in financial statements. This knowledge aids in informed decision-making and transparent communication with stakeholders.

Comparison Table

| Aspect | Cryptocurrency Valuation | Historical Cost |

|---|---|---|

| Definition | Current market value based on real-time price fluctuations. | Original purchase price recorded at the time of acquisition. |

| Measurement Basis | Fair value accounting using active market prices. | Cost principle; acquisition cost remains unchanged. |

| Volatility | High volatility; values fluctuate frequently. | Stable and consistent; no adjustments after initial recognition. |

| Financial Reporting | Reflects real-time market conditions; recognized as asset at fair value. | Reported as asset at historical cost; subject to impairment tests. |

| Impairment | Less applicable due to fair value adjustments. | Requires impairment write-down if value declines below cost. |

| Use Cases | Investment portfolios, trading, and asset revaluation. | Fixed assets, inventory, and traditional financial asset tracking. |

| Accounting Standards | IFRS 13 Fair Value Measurement; ASC 820 under US GAAP. | IAS 16 Property, Plant and Equipment; ASC 360 under US GAAP. |

Which is better?

Cryptocurrency valuation offers real-time asset pricing reflecting current market demand and volatility, enhancing financial transparency for investors and stakeholders. Historical cost provides consistency and reliability by recording assets at their original purchase price, minimizing subjective estimation in financial statements. Choosing between the two depends on the emphasis on market relevance versus accounting stability within specific financial reporting frameworks.

Connection

Cryptocurrency valuation and historical cost accounting intersect through the challenge of recording digital assets at their acquisition price while reflecting market fluctuations. Historical cost provides a reliable, verifiable basis for initial recognition, but cryptocurrencies require fair value adjustments due to their volatility and lack of physical form. Accounting standards increasingly emphasize transparent disclosure of both historical cost and current market values to ensure accurate financial reporting.

Key Terms

Fair Value

Historical cost accounting records assets based on their original purchase price, providing a consistent but potentially outdated valuation for cryptocurrency holdings. Fair Value measurement, on the other hand, reflects the current market price of cryptocurrencies, capturing real-time fluctuations and offering a more accurate financial picture. Explore the implications of these valuation methods to better understand their impact on financial reporting and investment decisions.

Volatility

Historical cost accounting records assets at their original purchase price, disregarding market fluctuations, whereas cryptocurrency valuation is highly influenced by extreme price volatility and rapid market changes. Cryptocurrency markets can experience daily price swings exceeding 10%, challenging traditional accounting methods that rely on stable asset valuations. Explore detailed strategies to navigate and understand the impact of volatility on cryptocurrency valuation.

Impairment

Historical cost accounting records assets at their original purchase price, providing a stable but often outdated value. Cryptocurrency valuation, affected by significant market volatility, frequently requires impairment assessments to reflect decreased fair value accurately. Explore how impairment impacts financial reporting and investment decisions in the evolving crypto landscape.

Source and External Links

What is Historical Cost - Historical cost is the original cost of an asset, including all necessary costs to get the asset in place and ready for use.

Advantage of Historical Cost - The use of historical cost provides an objective, unbiased, and verifiable method for recording assets, making it easier to audit and compare financial statements.

Historical Cost - Overview, Example, Accounting Adjustment - Historical cost refers to the original purchase price or acquisition cost of an asset, which is recorded without adjustments for market fluctuations or inflation.

dowidth.com

dowidth.com