Digital asset reporting enhances accuracy and efficiency by automating transaction tracking and real-time data analysis, reducing errors common in manual bookkeeping. Manual bookkeeping demands meticulous entry and reconciliation, often leading to delays and discrepancies in financial records. Explore the advantages of digital asset reporting to transform your accounting practices.

Why it is important

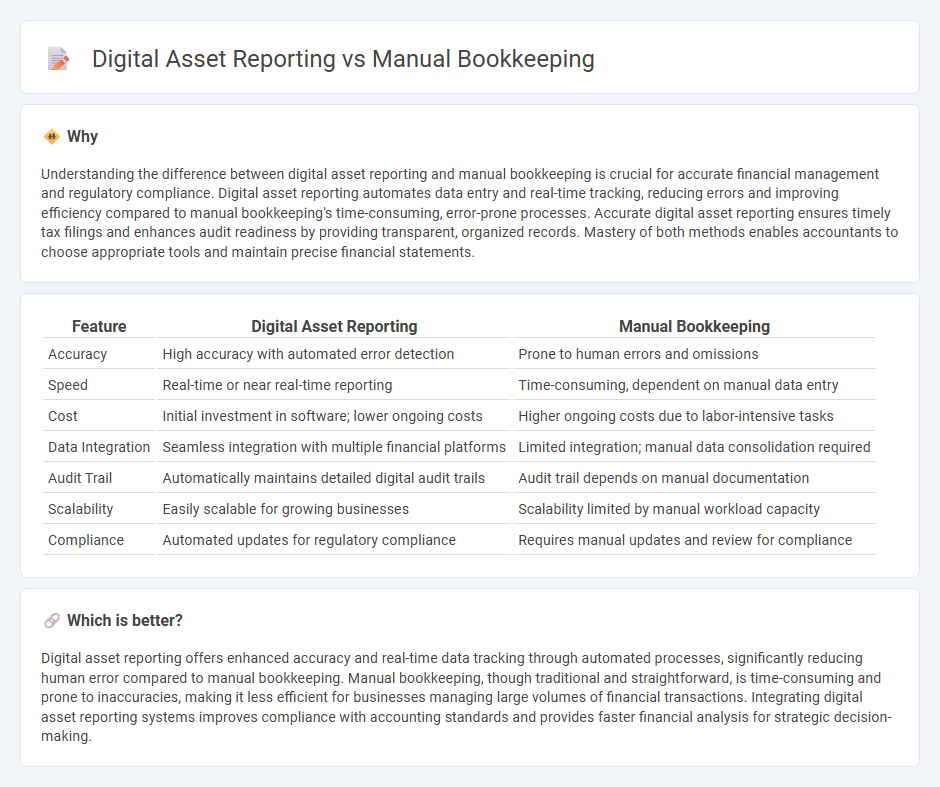

Understanding the difference between digital asset reporting and manual bookkeeping is crucial for accurate financial management and regulatory compliance. Digital asset reporting automates data entry and real-time tracking, reducing errors and improving efficiency compared to manual bookkeeping's time-consuming, error-prone processes. Accurate digital asset reporting ensures timely tax filings and enhances audit readiness by providing transparent, organized records. Mastery of both methods enables accountants to choose appropriate tools and maintain precise financial statements.

Comparison Table

| Feature | Digital Asset Reporting | Manual Bookkeeping |

|---|---|---|

| Accuracy | High accuracy with automated error detection | Prone to human errors and omissions |

| Speed | Real-time or near real-time reporting | Time-consuming, dependent on manual data entry |

| Cost | Initial investment in software; lower ongoing costs | Higher ongoing costs due to labor-intensive tasks |

| Data Integration | Seamless integration with multiple financial platforms | Limited integration; manual data consolidation required |

| Audit Trail | Automatically maintains detailed digital audit trails | Audit trail depends on manual documentation |

| Scalability | Easily scalable for growing businesses | Scalability limited by manual workload capacity |

| Compliance | Automated updates for regulatory compliance | Requires manual updates and review for compliance |

Which is better?

Digital asset reporting offers enhanced accuracy and real-time data tracking through automated processes, significantly reducing human error compared to manual bookkeeping. Manual bookkeeping, though traditional and straightforward, is time-consuming and prone to inaccuracies, making it less efficient for businesses managing large volumes of financial transactions. Integrating digital asset reporting systems improves compliance with accounting standards and provides faster financial analysis for strategic decision-making.

Connection

Digital asset reporting enhances the accuracy and efficiency of manual bookkeeping by automating data collection and classification of blockchain transactions. Integration of digital wallets and accounting software streamlines reconciliation processes, reducing human error and ensuring compliance with regulatory standards. Accurate reporting of digital assets supports better financial oversight and audit readiness in traditional bookkeeping systems.

Key Terms

Manual Bookkeeping:

Manual bookkeeping involves recording financial transactions by hand, using ledgers and journals to track income, expenses, and other financial data. This traditional method requires meticulous attention to detail and can be time-consuming but provides a tangible and thorough record of financial activities. Explore comprehensive insights on the benefits and challenges of manual bookkeeping to optimize your financial management.

Ledger

Ledger technology enhances digital asset reporting by automating transaction recording, reducing errors, and ensuring real-time data accuracy compared to manual bookkeeping. Manual bookkeeping relies on manual entry, increasing the risk of inaccuracies and time consumption, which hinders efficient financial management. Explore the significant benefits of integrating Ledger systems in your asset reporting for improved transparency and control.

Journal Entry

Manual bookkeeping for journal entries involves physically recording transactions in a ledger, which can be time-consuming and prone to human error. Digital asset reporting automates journal entries through software that ensures accuracy, real-time updates, and easier audit trails. Explore how integrating these methods can streamline financial management and enhance reporting precision.

Source and External Links

An Easy-to-Use Manual Bookkeeping System - This guide provides a simple process for setting up a manual bookkeeping system using file folders and labeling income and expenses.

The Complete Guide to Manual Bookkeeping - This guide outlines the steps involved in manual bookkeeping, including gathering source documents and entering information into journals and ledgers.

Manual vs. Automated Accounting: What's the Difference - This resource explains the differences between manual and automated accounting systems, highlighting the advantages and limitations of manual bookkeeping.

dowidth.com

dowidth.com