Forensic accounting software specializes in detecting fraud, analyzing financial records for legal evidence, and supporting investigations with detailed audit trails. Expense management software focuses on tracking, controlling, and optimizing employee spending and company expenses through automated reporting and policy enforcement. Explore the key differences and benefits of each solution to determine the best fit for your financial oversight needs.

Why it is important

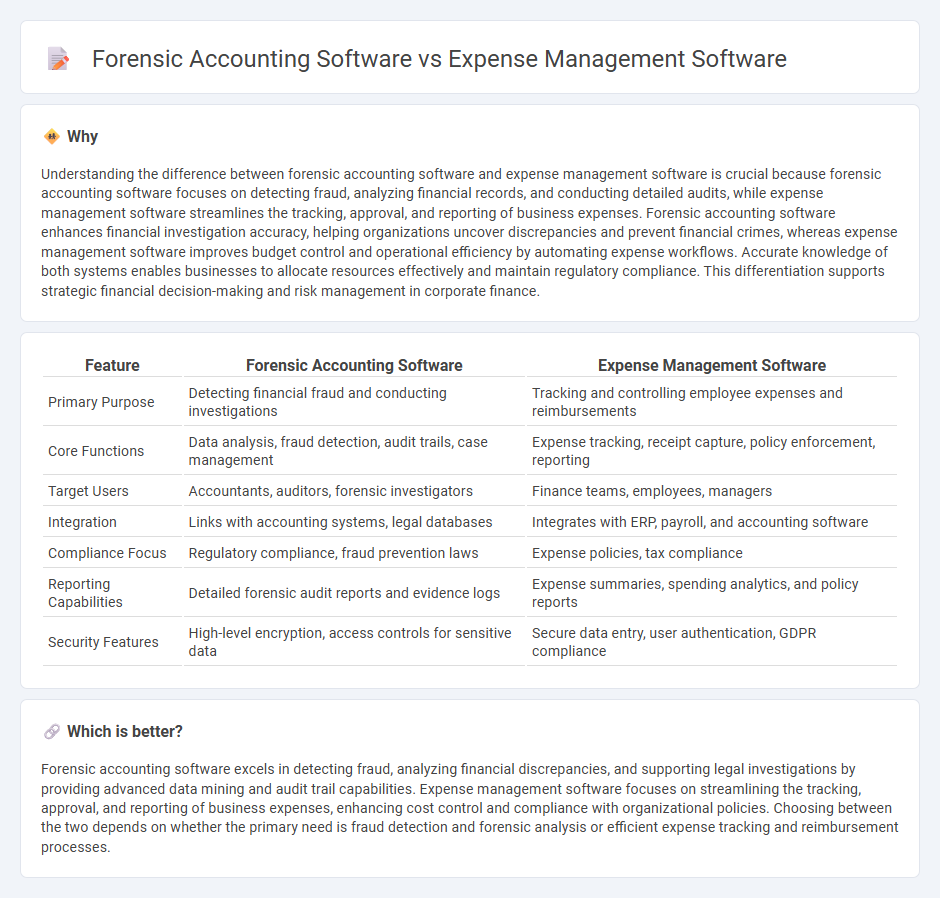

Understanding the difference between forensic accounting software and expense management software is crucial because forensic accounting software focuses on detecting fraud, analyzing financial records, and conducting detailed audits, while expense management software streamlines the tracking, approval, and reporting of business expenses. Forensic accounting software enhances financial investigation accuracy, helping organizations uncover discrepancies and prevent financial crimes, whereas expense management software improves budget control and operational efficiency by automating expense workflows. Accurate knowledge of both systems enables businesses to allocate resources effectively and maintain regulatory compliance. This differentiation supports strategic financial decision-making and risk management in corporate finance.

Comparison Table

| Feature | Forensic Accounting Software | Expense Management Software |

|---|---|---|

| Primary Purpose | Detecting financial fraud and conducting investigations | Tracking and controlling employee expenses and reimbursements |

| Core Functions | Data analysis, fraud detection, audit trails, case management | Expense tracking, receipt capture, policy enforcement, reporting |

| Target Users | Accountants, auditors, forensic investigators | Finance teams, employees, managers |

| Integration | Links with accounting systems, legal databases | Integrates with ERP, payroll, and accounting software |

| Compliance Focus | Regulatory compliance, fraud prevention laws | Expense policies, tax compliance |

| Reporting Capabilities | Detailed forensic audit reports and evidence logs | Expense summaries, spending analytics, and policy reports |

| Security Features | High-level encryption, access controls for sensitive data | Secure data entry, user authentication, GDPR compliance |

Which is better?

Forensic accounting software excels in detecting fraud, analyzing financial discrepancies, and supporting legal investigations by providing advanced data mining and audit trail capabilities. Expense management software focuses on streamlining the tracking, approval, and reporting of business expenses, enhancing cost control and compliance with organizational policies. Choosing between the two depends on whether the primary need is fraud detection and forensic analysis or efficient expense tracking and reimbursement processes.

Connection

Forensic accounting software and expense management software are connected through their ability to enhance financial transparency and detect irregularities in business transactions. Forensic accounting software analyzes and audits expense reports generated by expense management systems to identify fraud, embezzlement, and compliance violations. Integrating these tools enables organizations to streamline financial investigations and improve accuracy in monitoring corporate spending.

Key Terms

Expense tracking

Expense management software streamlines expense tracking by automating receipt capture, categorizing expenditures, and generating real-time reports to enhance budgeting accuracy. Forensic accounting software specializes in analyzing suspicious financial activities and detecting fraud through detailed transaction scrutiny and data analytics. Explore the distinctive capabilities of both to optimize your financial oversight.

Fraud detection

Expense management software automates the tracking and categorization of company expenditures, enabling real-time monitoring and flagging of unusual transactions to prevent financial misstatements. Forensic accounting software specializes in in-depth analysis of financial records to uncover evidence of fraud, providing detailed investigative tools for tracing illicit activity and supporting legal proceedings. Explore how integrating both solutions can enhance your organization's fraud detection and financial integrity efforts.

Audit trail

Expense management software provides detailed audit trails by tracking and recording every expense transaction, allowing businesses to monitor spending patterns and ensure compliance with internal policies. Forensic accounting software emphasizes audit trail analysis to detect discrepancies, fraud, or financial anomalies by reconstructing transaction histories and providing comprehensive documentation for investigations. Explore the key features and benefits of both tools to enhance your financial oversight and security.

Source and External Links

Pleo Expense Management - Pleo is a comprehensive spending solution providing smart company cards for streamlined expense management and real-time spending visibility.

Paychex Flex Expense Management - This software integrates with Paychex Flex to manage expenses seamlessly, offering features like receipt capture and automated reimbursement.

Expensify - Expensify simplifies receipt and expense tracking by automating reports and integrating with various accounting software to control spending.

dowidth.com

dowidth.com