Predictive close leverages advanced algorithms and historical financial data to forecast and automate the closing process, significantly reducing errors and time. Manual close relies on accountants' direct input and judgment to finalize accounts, allowing for detailed review but often requiring more resources and time. Explore how integrating predictive close can enhance accuracy and efficiency in your accounting workflows.

Why it is important

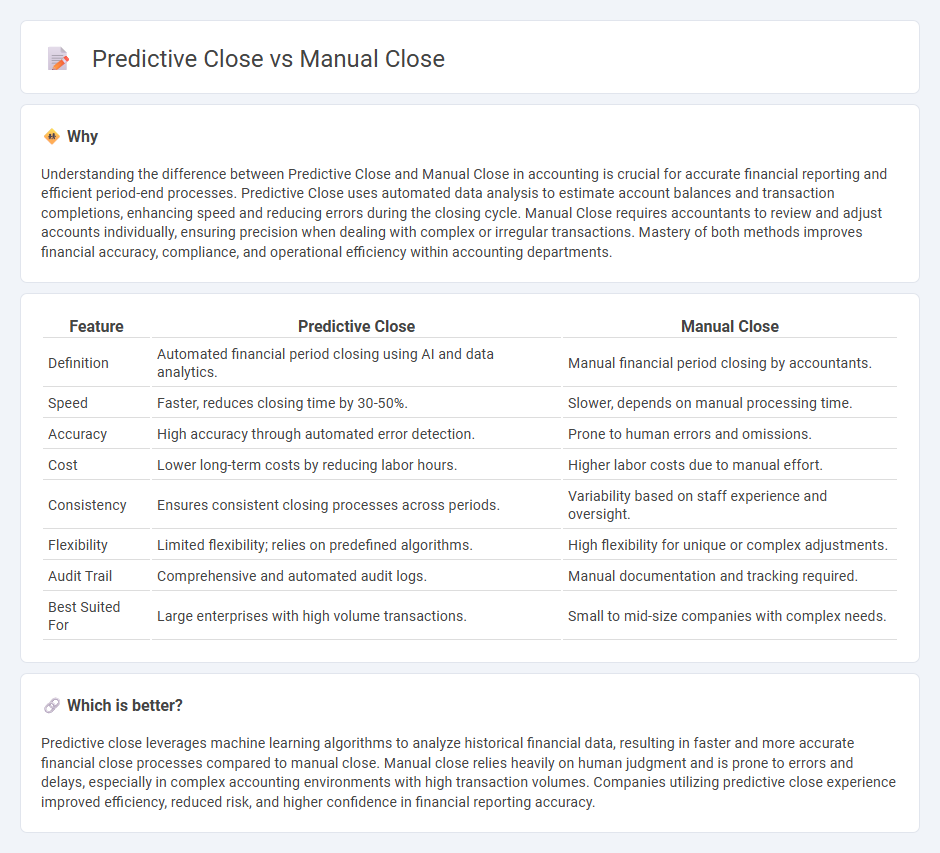

Understanding the difference between Predictive Close and Manual Close in accounting is crucial for accurate financial reporting and efficient period-end processes. Predictive Close uses automated data analysis to estimate account balances and transaction completions, enhancing speed and reducing errors during the closing cycle. Manual Close requires accountants to review and adjust accounts individually, ensuring precision when dealing with complex or irregular transactions. Mastery of both methods improves financial accuracy, compliance, and operational efficiency within accounting departments.

Comparison Table

| Feature | Predictive Close | Manual Close |

|---|---|---|

| Definition | Automated financial period closing using AI and data analytics. | Manual financial period closing by accountants. |

| Speed | Faster, reduces closing time by 30-50%. | Slower, depends on manual processing time. |

| Accuracy | High accuracy through automated error detection. | Prone to human errors and omissions. |

| Cost | Lower long-term costs by reducing labor hours. | Higher labor costs due to manual effort. |

| Consistency | Ensures consistent closing processes across periods. | Variability based on staff experience and oversight. |

| Flexibility | Limited flexibility; relies on predefined algorithms. | High flexibility for unique or complex adjustments. |

| Audit Trail | Comprehensive and automated audit logs. | Manual documentation and tracking required. |

| Best Suited For | Large enterprises with high volume transactions. | Small to mid-size companies with complex needs. |

Which is better?

Predictive close leverages machine learning algorithms to analyze historical financial data, resulting in faster and more accurate financial close processes compared to manual close. Manual close relies heavily on human judgment and is prone to errors and delays, especially in complex accounting environments with high transaction volumes. Companies utilizing predictive close experience improved efficiency, reduced risk, and higher confidence in financial reporting accuracy.

Connection

Predictive close leverages automated data analysis to estimate the likely financial outcomes before finalization, while manual close involves human verification and adjustments to ensure accuracy. Both processes integrate to enhance the reliability and efficiency of the accounting close cycle by combining data-driven forecasts with expert judgment. This synergy minimizes errors and accelerates the period-end closing, providing timely and accurate financial statements.

Key Terms

Journal Entries

Manual close requires recording journal entries by accountants at the end of a period, ensuring accuracy through direct intervention and review. Predictive close leverages automation and AI to generate expected journal entries, significantly reducing closing time and minimizing errors by forecasting financial activity. Explore how both methods impact the efficiency and accuracy of your financial close process.

Automation

Manual close processes in financial operations rely heavily on human intervention for tasks such as data entry, reconciliations, and approvals, which can lead to inefficiencies and errors. Predictive close uses automation powered by AI and machine learning to analyze data trends, forecast potential issues, and expedite closing activities with higher accuracy and reduced cycle times. Discover how automation-driven predictive close solutions can transform your financial closing process by minimizing risks and enhancing operational efficiency.

Financial Forecasting

Manual close in financial forecasting involves closing accounting books based on predefined schedules and human intervention, ensuring accuracy through detailed review processes. Predictive close leverages AI and machine learning algorithms to automate closing activities, accelerating the process and improving forecast precision by analyzing historical data and trends. Explore how integrating predictive close technology can optimize financial forecasting efficiency and accuracy.

Source and External Links

How To Manually Open And Close Your Garage Door | Steps - To manually close a garage door, pull the emergency release cord to disengage the opener, then hold the door in the center and guide it until it closes, securing it by locking the door at the bottom.

How to Open and Close Your Garage Door Manually - Manual closing involves pulling the emergency release to disconnect the opener, lowering the door gently by hand, and locking it manually if your door has a lock, ensuring safety and security especially during power outages or mechanical failure.

How To Manually Close The Garage Door? - Safely manually closing a garage door requires first disengaging the automatic opener and then carefully moving the door down by hand to properly secure it, emphasizing safety and understanding the mechanics involved.

dowidth.com

dowidth.com