Real-time expense reconciliation enables immediate matching of transactions with records, reducing errors and improving cash flow management compared to traditional general ledger reconciliation, which occurs periodically and may delay issue detection. This approach leverages automation and integrated software to enhance accuracy and streamline financial reporting processes. Explore how real-time expense reconciliation can transform your accounting efficiency and decision-making.

Why it is important

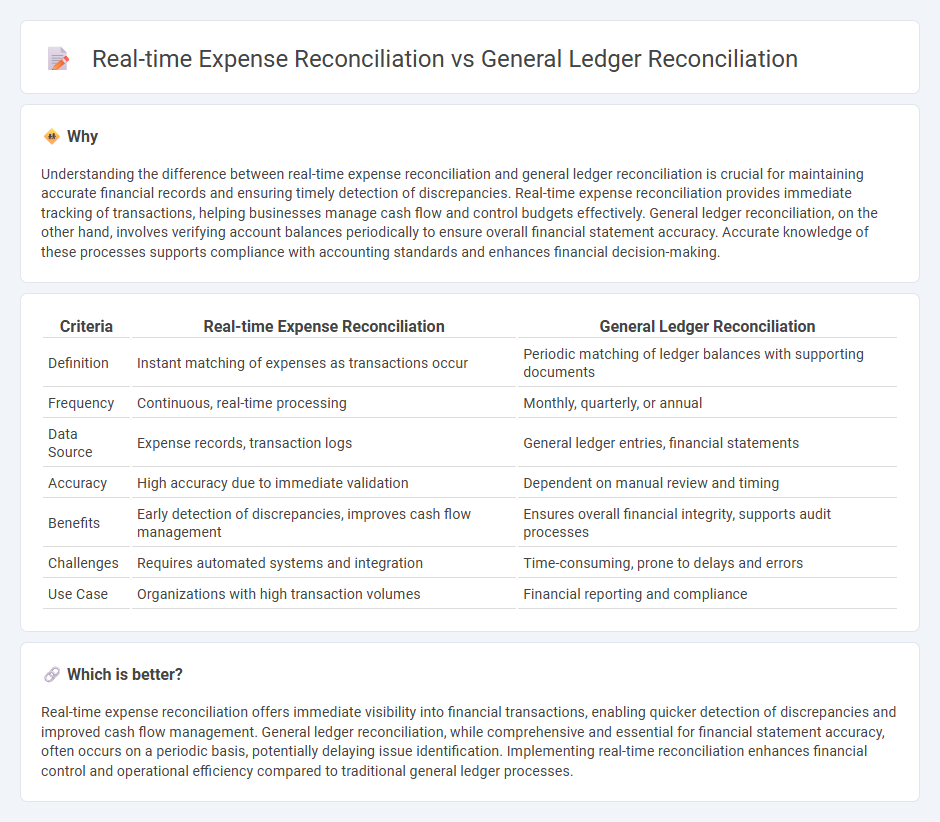

Understanding the difference between real-time expense reconciliation and general ledger reconciliation is crucial for maintaining accurate financial records and ensuring timely detection of discrepancies. Real-time expense reconciliation provides immediate tracking of transactions, helping businesses manage cash flow and control budgets effectively. General ledger reconciliation, on the other hand, involves verifying account balances periodically to ensure overall financial statement accuracy. Accurate knowledge of these processes supports compliance with accounting standards and enhances financial decision-making.

Comparison Table

| Criteria | Real-time Expense Reconciliation | General Ledger Reconciliation |

|---|---|---|

| Definition | Instant matching of expenses as transactions occur | Periodic matching of ledger balances with supporting documents |

| Frequency | Continuous, real-time processing | Monthly, quarterly, or annual |

| Data Source | Expense records, transaction logs | General ledger entries, financial statements |

| Accuracy | High accuracy due to immediate validation | Dependent on manual review and timing |

| Benefits | Early detection of discrepancies, improves cash flow management | Ensures overall financial integrity, supports audit processes |

| Challenges | Requires automated systems and integration | Time-consuming, prone to delays and errors |

| Use Case | Organizations with high transaction volumes | Financial reporting and compliance |

Which is better?

Real-time expense reconciliation offers immediate visibility into financial transactions, enabling quicker detection of discrepancies and improved cash flow management. General ledger reconciliation, while comprehensive and essential for financial statement accuracy, often occurs on a periodic basis, potentially delaying issue identification. Implementing real-time reconciliation enhances financial control and operational efficiency compared to traditional general ledger processes.

Connection

Real-time expense reconciliation ensures accurate and immediate tracking of expenditures, which directly feeds into the general ledger reconciliation process by providing up-to-date transaction data. This connection reduces discrepancies between recorded expenses and ledger balances, enhancing financial accuracy and integrity. Seamless integration between these processes streamlines audit readiness and improves overall accounting efficiency.

Key Terms

General ledger reconciliation

General ledger reconciliation ensures accuracy by systematically comparing ledger entries with supporting documentation, identifying discrepancies within financial records. This process is crucial for maintaining compliance with accounting standards and preventing errors in financial statements. Explore comprehensive strategies to optimize your general ledger reconciliation for improved financial integrity.

Real-time expense tracking

Real-time expense tracking enables immediate matching of transactions with budgets, significantly reducing discrepancies compared to traditional general ledger reconciliation, which occurs periodically and may delay issue detection. This approach enhances accuracy and financial control by capturing expenses as they happen, facilitating quicker decision-making and improved cash flow management. Discover how real-time expense tracking transforms financial operations for businesses seeking greater efficiency.

Timing differences

General ledger reconciliation involves the periodic matching of financial records to ensure accuracy, often resulting in timing differences due to batch processing and delayed data entry. Real-time expense reconciliation minimizes these timing discrepancies by instantly capturing and matching transactions as they occur, enhancing financial visibility and accuracy. Explore how adopting real-time systems can streamline your reconciliation processes and improve financial management.

Source and External Links

General ledger reconciliation: A simple guide - Sage Advice US - General ledger reconciliation involves verifying that the figures in your general ledger accounts match supporting documents such as bank statements and invoices, identifying errors like missed or duplicate transactions, and then making correcting journal entries to ensure accuracy before financial statements are published.

A complete guide to general ledger reconciliation - The process typically includes running a trial balance, comparing the general ledger balances to sub-ledgers or independent documents, investigating discrepancies, documenting reconciliation items, and obtaining review and approval, usually done monthly or quarterly depending on business needs.

What Is General Ledger Reconciliation: Types, Best ... - General ledger reconciliation is essential for confirming the accuracy and integrity of financial records, ensuring compliance with accounting standards, aiding management decisions, and detecting errors or fraud by matching ledger balances with actual transactions and external records.

dowidth.com

dowidth.com