Sustainability assurance evaluates the accuracy and reliability of non-financial environmental, social, and governance (ESG) disclosures, ensuring stakeholders receive trustworthy information on a company's sustainability practices. Tax audits focus on verifying compliance with tax laws and the accurate reporting of taxable income to prevent fraud and penalties. Discover how these two distinct assurance processes complement corporate transparency and accountability.

Why it is important

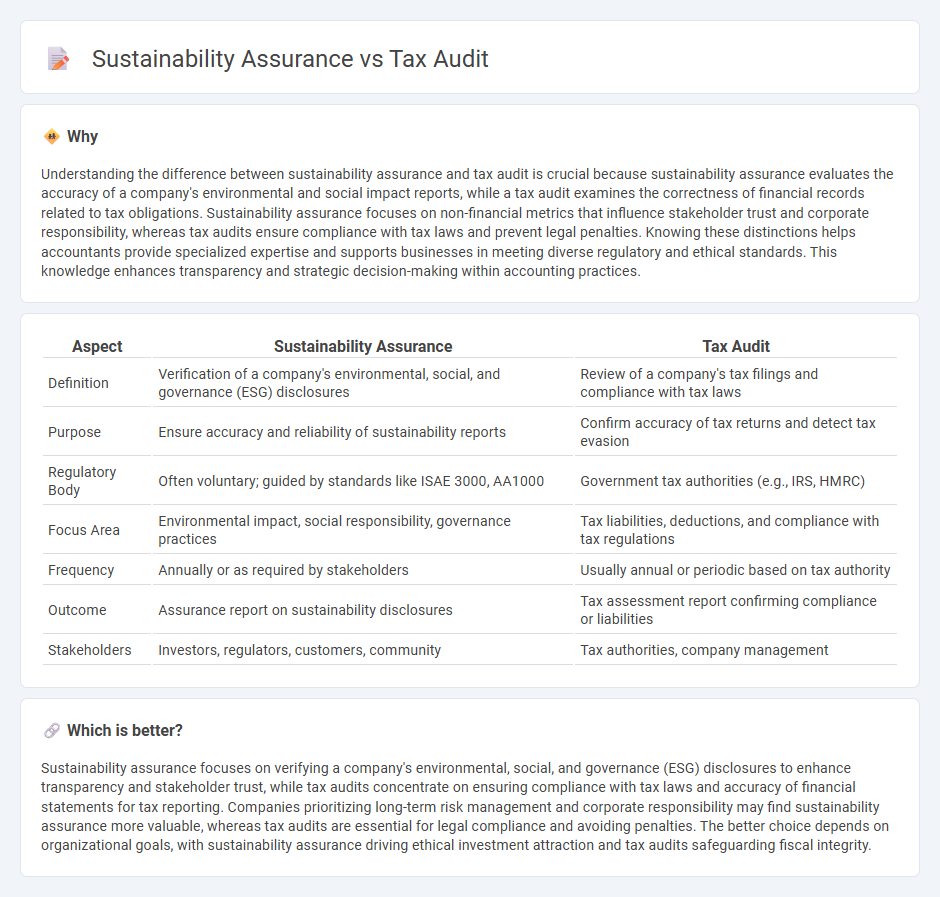

Understanding the difference between sustainability assurance and tax audit is crucial because sustainability assurance evaluates the accuracy of a company's environmental and social impact reports, while a tax audit examines the correctness of financial records related to tax obligations. Sustainability assurance focuses on non-financial metrics that influence stakeholder trust and corporate responsibility, whereas tax audits ensure compliance with tax laws and prevent legal penalties. Knowing these distinctions helps accountants provide specialized expertise and supports businesses in meeting diverse regulatory and ethical standards. This knowledge enhances transparency and strategic decision-making within accounting practices.

Comparison Table

| Aspect | Sustainability Assurance | Tax Audit |

|---|---|---|

| Definition | Verification of a company's environmental, social, and governance (ESG) disclosures | Review of a company's tax filings and compliance with tax laws |

| Purpose | Ensure accuracy and reliability of sustainability reports | Confirm accuracy of tax returns and detect tax evasion |

| Regulatory Body | Often voluntary; guided by standards like ISAE 3000, AA1000 | Government tax authorities (e.g., IRS, HMRC) |

| Focus Area | Environmental impact, social responsibility, governance practices | Tax liabilities, deductions, and compliance with tax regulations |

| Frequency | Annually or as required by stakeholders | Usually annual or periodic based on tax authority |

| Outcome | Assurance report on sustainability disclosures | Tax assessment report confirming compliance or liabilities |

| Stakeholders | Investors, regulators, customers, community | Tax authorities, company management |

Which is better?

Sustainability assurance focuses on verifying a company's environmental, social, and governance (ESG) disclosures to enhance transparency and stakeholder trust, while tax audits concentrate on ensuring compliance with tax laws and accuracy of financial statements for tax reporting. Companies prioritizing long-term risk management and corporate responsibility may find sustainability assurance more valuable, whereas tax audits are essential for legal compliance and avoiding penalties. The better choice depends on organizational goals, with sustainability assurance driving ethical investment attraction and tax audits safeguarding fiscal integrity.

Connection

Sustainability assurance and tax audit intersect through the verification of corporate disclosures and compliance with regulatory frameworks, enhancing transparency and accountability. Both processes assess financial and non-financial information, ensuring alignment with environmental, social, and governance (ESG) criteria as well as tax regulations. This integration supports risk management, improves stakeholder confidence, and promotes ethical business practices.

Key Terms

**Tax Audit:**

Tax audit involves a comprehensive examination of an organization's financial records and tax returns to ensure compliance with tax laws and regulations, identifying discrepancies and potential liabilities. It primarily focuses on verifying tax accuracy, preventing tax evasion, and providing assurance to tax authorities about the correctness of reported tax positions. Learn more about the distinct roles and processes involved in tax audit and sustainability assurance.

Compliance

Tax audit primarily focuses on ensuring compliance with tax laws and regulations by verifying the accuracy of financial records and tax filings. Sustainability assurance evaluates the reliability of environmental, social, and governance (ESG) disclosures to confirm adherence to sustainability standards and ethical commitments. Explore how these assurance processes complement compliance frameworks in corporate governance and risk management.

Tax Liability

Tax audits primarily evaluate a company's compliance with tax laws and accuracy in reporting taxable income, focusing on identifying underpayments or errors in tax liability. Sustainability assurance expands this scope by assessing environmental, social, and governance (ESG) disclosures, including tax transparency as a component of corporate responsibility and ethical tax practices. Explore how these two processes differ in scope and impact on corporate tax strategies to enhance your understanding.

Source and External Links

What Are Tax Audits? - TurboTax Tax Tips & Videos - This webpage provides an overview of tax audits, including triggers, preparation, and outcomes.

Tax Audit | Direktorat Jenderal Pajak - This page explains the purpose and process of tax audits in assessing taxpayer compliance with tax laws.

IRS audits | Internal Revenue Service - This webpage offers detailed information about IRS audits, including selection methods and the audit process.

dowidth.com

dowidth.com