Digital twin accounting leverages virtual replicas of financial processes to simulate and optimize data accuracy and operational efficiency, while blockchain accounting employs decentralized ledgers to ensure transaction transparency and immutability. Both technologies enhance auditability and trust but differ in their core mechanisms and applications within financial management. Discover how integrating these innovative approaches can transform modern accounting practices.

Why it is important

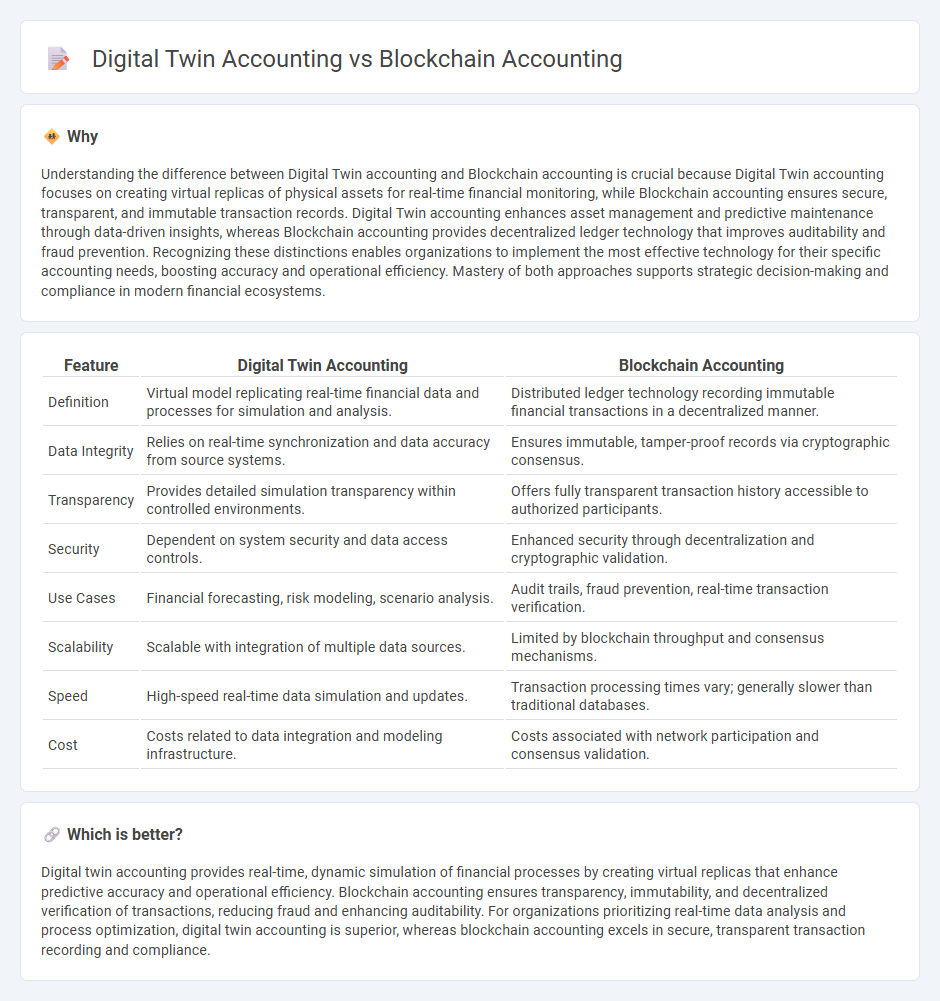

Understanding the difference between Digital Twin accounting and Blockchain accounting is crucial because Digital Twin accounting focuses on creating virtual replicas of physical assets for real-time financial monitoring, while Blockchain accounting ensures secure, transparent, and immutable transaction records. Digital Twin accounting enhances asset management and predictive maintenance through data-driven insights, whereas Blockchain accounting provides decentralized ledger technology that improves auditability and fraud prevention. Recognizing these distinctions enables organizations to implement the most effective technology for their specific accounting needs, boosting accuracy and operational efficiency. Mastery of both approaches supports strategic decision-making and compliance in modern financial ecosystems.

Comparison Table

| Feature | Digital Twin Accounting | Blockchain Accounting |

|---|---|---|

| Definition | Virtual model replicating real-time financial data and processes for simulation and analysis. | Distributed ledger technology recording immutable financial transactions in a decentralized manner. |

| Data Integrity | Relies on real-time synchronization and data accuracy from source systems. | Ensures immutable, tamper-proof records via cryptographic consensus. |

| Transparency | Provides detailed simulation transparency within controlled environments. | Offers fully transparent transaction history accessible to authorized participants. |

| Security | Dependent on system security and data access controls. | Enhanced security through decentralization and cryptographic validation. |

| Use Cases | Financial forecasting, risk modeling, scenario analysis. | Audit trails, fraud prevention, real-time transaction verification. |

| Scalability | Scalable with integration of multiple data sources. | Limited by blockchain throughput and consensus mechanisms. |

| Speed | High-speed real-time data simulation and updates. | Transaction processing times vary; generally slower than traditional databases. |

| Cost | Costs related to data integration and modeling infrastructure. | Costs associated with network participation and consensus validation. |

Which is better?

Digital twin accounting provides real-time, dynamic simulation of financial processes by creating virtual replicas that enhance predictive accuracy and operational efficiency. Blockchain accounting ensures transparency, immutability, and decentralized verification of transactions, reducing fraud and enhancing auditability. For organizations prioritizing real-time data analysis and process optimization, digital twin accounting is superior, whereas blockchain accounting excels in secure, transparent transaction recording and compliance.

Connection

Digital twin accounting leverages real-time data replication for accurate financial modeling, while blockchain accounting ensures secure, transparent transaction records through decentralized ledgers. Both technologies enhance financial accuracy and auditability by providing immutable data trails and synchronized digital representations of assets and transactions. Integrating digital twin systems with blockchain enables dynamic, trustless reconciliation and automated compliance in complex accounting environments.

Key Terms

Immutable Ledger (Blockchain accounting)

Blockchain accounting utilizes an immutable ledger to ensure transactional data integrity by recording entries in a tamper-proof, decentralized system that enhances transparency and traceability. Digital twin accounting, while offering real-time simulation and replication of financial processes, lacks the inherent immutability and resistance to fraud found in blockchain's distributed ledger technology. Explore deeper insights into how immutable ledgers revolutionize accounting accuracy and security for comprehensive financial management.

Real-time Simulation (Digital twin accounting)

Blockchain accounting ensures transaction immutability and transparency through decentralized ledgers, while Digital Twin accounting excels in real-time simulation by replicating physical assets and processes in a virtual environment for dynamic financial analysis. Real-time simulation in Digital Twin accounting enables continuous monitoring, forecasting, and scenario testing that drive proactive decision-making and operational efficiency. Explore the transformative benefits of real-time simulation in digital twin accounting for enhanced financial management and strategic insights.

Smart Contracts (Blockchain accounting)

Blockchain accounting leverages smart contracts to automate, verify, and enforce financial transactions with increased transparency and security, reducing human error and fraud risks. Digital twin accounting, while simulating real-time asset performance and lifecycle data, lacks the decentralized verification layer provided by blockchain smart contracts. Explore how smart contract integration enhances accountability and efficiency in financial recordkeeping.

Source and External Links

How Blockchain is Changing Accounting Practices - Blockchain creates a secure, transparent, and immutable ledger that transforms financial transaction recording, verification, auditing, and automates reconciliations and smart contracts in accounting.

What is Blockchain Accounting? - Blockchain accounting enhances audit efficiency by providing a consensus-verified transaction ledger but still requires traditional accounting for transactional details and categorization.

Blockchain Accounting - Guide & Use Cases - Blockchain enables real-time recording on shared ledgers within a triple entry accounting system, combining immutability and automation to reduce fraud, errors, and auditing costs.

dowidth.com

dowidth.com