Revenue recognition automation enhances financial accuracy by systematically capturing earned income in compliance with accounting standards, reducing manual errors and accelerating close cycles. Budgeting automation streamlines forecasting and expense management through real-time data integration, enabling dynamic adjustments and improved resource allocation. Explore how integrating these automation solutions can optimize your financial operations and drive strategic growth.

Why it is important

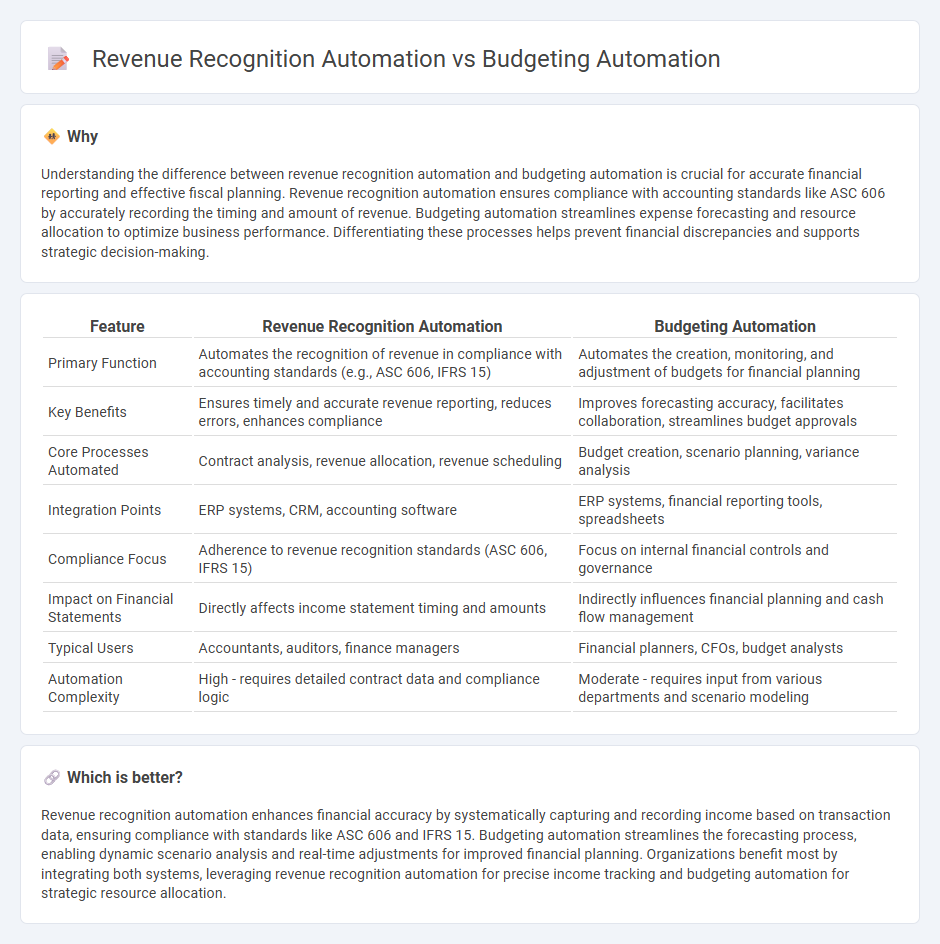

Understanding the difference between revenue recognition automation and budgeting automation is crucial for accurate financial reporting and effective fiscal planning. Revenue recognition automation ensures compliance with accounting standards like ASC 606 by accurately recording the timing and amount of revenue. Budgeting automation streamlines expense forecasting and resource allocation to optimize business performance. Differentiating these processes helps prevent financial discrepancies and supports strategic decision-making.

Comparison Table

| Feature | Revenue Recognition Automation | Budgeting Automation |

|---|---|---|

| Primary Function | Automates the recognition of revenue in compliance with accounting standards (e.g., ASC 606, IFRS 15) | Automates the creation, monitoring, and adjustment of budgets for financial planning |

| Key Benefits | Ensures timely and accurate revenue reporting, reduces errors, enhances compliance | Improves forecasting accuracy, facilitates collaboration, streamlines budget approvals |

| Core Processes Automated | Contract analysis, revenue allocation, revenue scheduling | Budget creation, scenario planning, variance analysis |

| Integration Points | ERP systems, CRM, accounting software | ERP systems, financial reporting tools, spreadsheets |

| Compliance Focus | Adherence to revenue recognition standards (ASC 606, IFRS 15) | Focus on internal financial controls and governance |

| Impact on Financial Statements | Directly affects income statement timing and amounts | Indirectly influences financial planning and cash flow management |

| Typical Users | Accountants, auditors, finance managers | Financial planners, CFOs, budget analysts |

| Automation Complexity | High - requires detailed contract data and compliance logic | Moderate - requires input from various departments and scenario modeling |

Which is better?

Revenue recognition automation enhances financial accuracy by systematically capturing and recording income based on transaction data, ensuring compliance with standards like ASC 606 and IFRS 15. Budgeting automation streamlines the forecasting process, enabling dynamic scenario analysis and real-time adjustments for improved financial planning. Organizations benefit most by integrating both systems, leveraging revenue recognition automation for precise income tracking and budgeting automation for strategic resource allocation.

Connection

Revenue recognition automation enhances accuracy and speed in recording earned income by applying standardized accounting principles, which directly informs budgeting automation processes. Budgeting automation leverages precise revenue data to generate more reliable forecasts and allocate resources effectively, reducing manual errors and improving financial planning. The integration of both automations streamlines financial workflows, supports compliance with accounting standards such as ASC 606, and optimizes overall fiscal management.

Key Terms

**Budgeting Automation:**

Budgeting automation streamlines financial planning by integrating real-time data, reducing manual errors, and accelerating forecast updates for enhanced accuracy and agility. It enables dynamic budget adjustments aligned with business objectives and market changes, providing a clear view of resource allocation and cost management. Discover how budgeting automation can transform your financial strategy and drive operational efficiency.

Forecasting

Budgeting automation streamlines the allocation of financial resources by generating accurate expense forecasts based on historical data, leading to improved fiscal planning and resource management. Revenue recognition automation enhances forecasting by ensuring compliance with accounting standards such as ASC 606, delivering precise timing and amounts of revenue entries that inform future cash flow projections. Explore how integrating these automation solutions can optimize forecasting accuracy and financial decision-making.

Variance Analysis

Budgeting automation streamlines the process of forecasting expenditures and resource allocation, enabling precise variance analysis by comparing actual performance against budgeted figures to identify discrepancies. Revenue recognition automation ensures compliance with accounting standards by accurately timing revenue entries, which improves the reliability of financial statements and supports variance analysis in assessing revenue deviations. Explore how integrating both automation solutions enhances financial accuracy and operational efficiency in variance analysis.

Source and External Links

What is Budget Automation? - Kosh.ai - Budget automation uses advanced software to streamline the creation, approval, monitoring, and analysis of budgets, reducing manual tasks and improving real-time financial visibility.

Higher Ed Budget Automation: Uses & Benefits - Budget automation leverages AI and cloud-based platforms to process financial data, enable real-time budget updates, and facilitate cross-departmental collaboration in higher education institutions.

7 Ways to Automate the Project Budget Management Process - Automation in project budget management includes using templates, auto-reconciliation, and real-time capacity planning tools to enhance accuracy, provide overspend alerts, and optimize resource allocation.

dowidth.com

dowidth.com