Embedded finance reconciliation involves verifying transactions processed within integrated financial services embedded in non-financial platforms, ensuring accuracy between platform records and bank statements. POS transaction reconciliation focuses on matching sales recorded at point-of-sale terminals with payment records to identify discrepancies and prevent revenue loss. Explore the key differences and benefits of each reconciliation method to optimize your financial operations.

Why it is important

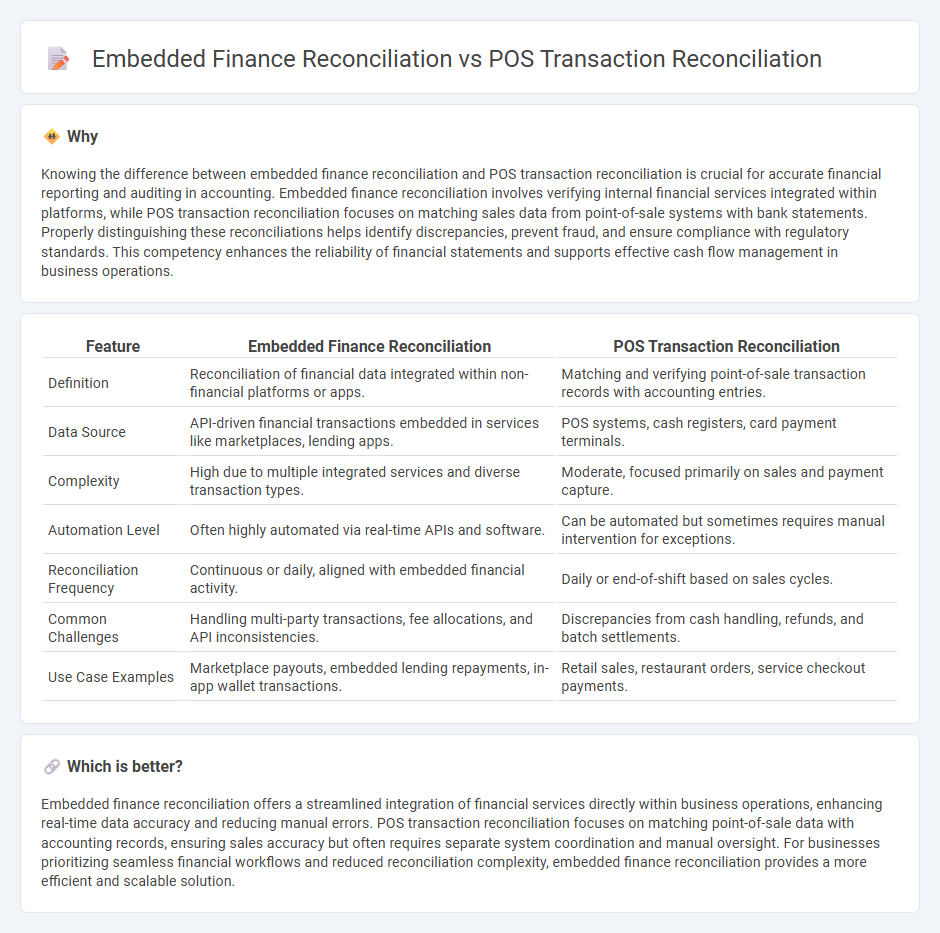

Knowing the difference between embedded finance reconciliation and POS transaction reconciliation is crucial for accurate financial reporting and auditing in accounting. Embedded finance reconciliation involves verifying internal financial services integrated within platforms, while POS transaction reconciliation focuses on matching sales data from point-of-sale systems with bank statements. Properly distinguishing these reconciliations helps identify discrepancies, prevent fraud, and ensure compliance with regulatory standards. This competency enhances the reliability of financial statements and supports effective cash flow management in business operations.

Comparison Table

| Feature | Embedded Finance Reconciliation | POS Transaction Reconciliation |

|---|---|---|

| Definition | Reconciliation of financial data integrated within non-financial platforms or apps. | Matching and verifying point-of-sale transaction records with accounting entries. |

| Data Source | API-driven financial transactions embedded in services like marketplaces, lending apps. | POS systems, cash registers, card payment terminals. |

| Complexity | High due to multiple integrated services and diverse transaction types. | Moderate, focused primarily on sales and payment capture. |

| Automation Level | Often highly automated via real-time APIs and software. | Can be automated but sometimes requires manual intervention for exceptions. |

| Reconciliation Frequency | Continuous or daily, aligned with embedded financial activity. | Daily or end-of-shift based on sales cycles. |

| Common Challenges | Handling multi-party transactions, fee allocations, and API inconsistencies. | Discrepancies from cash handling, refunds, and batch settlements. |

| Use Case Examples | Marketplace payouts, embedded lending repayments, in-app wallet transactions. | Retail sales, restaurant orders, service checkout payments. |

Which is better?

Embedded finance reconciliation offers a streamlined integration of financial services directly within business operations, enhancing real-time data accuracy and reducing manual errors. POS transaction reconciliation focuses on matching point-of-sale data with accounting records, ensuring sales accuracy but often requires separate system coordination and manual oversight. For businesses prioritizing seamless financial workflows and reduced reconciliation complexity, embedded finance reconciliation provides a more efficient and scalable solution.

Connection

Embedded finance reconciliation and POS transaction reconciliation both involve verifying financial records to ensure accuracy in transaction data. Embedded finance reconciliation integrates payment processes directly within platforms, streamlining the matching of transactions with accounting entries. POS transaction reconciliation focuses on confirming sales data from point-of-sale systems against recorded revenue, enabling comprehensive financial oversight.

Key Terms

Settlement Reports

POS transaction reconciliation involves matching sales data from point-of-sale systems with settlement reports to ensure accurate merchant payouts and identify discrepancies. Embedded finance reconciliation integrates financial services directly into non-financial platforms, requiring detailed settlement reports that capture transactions beyond traditional POS, including digital wallets and BNPL (Buy Now, Pay Later) systems. Explore the nuances of settlement report reconciliations in these contexts to optimize financial accuracy and operational efficiency.

Ledger Balances

POS transaction reconciliation ensures accuracy by matching point-of-sale payments with corresponding ledger entries to maintain real-time financial integrity. Embedded finance reconciliation extends beyond typical POS data, integrating multiple financial services such as lending and payments into a unified ledger balance, offering a holistic view of transactional flows. Explore the detailed mechanisms behind these reconciliation processes to optimize your financial operations.

Transaction Matching

POS transaction reconciliation involves matching point-of-sale sales records with payment processor data to ensure accuracy in transaction amounts, timestamps, and payment methods. Embedded finance reconciliation extends beyond traditional POS by integrating multiple financial services within platforms, requiring advanced transaction matching algorithms that handle diverse transaction types, including loans, insurance, and wallets. Explore in-depth comparisons and techniques to optimize transaction matching across these reconciliation methods.

Source and External Links

What Is a POS Transaction? A Short Guide for B2B Sellers - Versapay - POS reconciliation is the process of matching transactions from POS systems to bank statements and internal books to ensure financial accuracy, involving review of sales/refunds, comparison with credit card statements, and investigation of discrepancies, often done daily or monthly.

POS reconciliation: 5 key benefits and 5 steps to do it properly - POS reconciliation includes verifying transaction records between the POS system and bank statements, identifying unmatched items, and conducting three types of reconciliation in retail: bank, vendor, and customer reconciliation.

Mastering POS Reconciliation: Your Essential Guide - Evention LLC - The reconciliation process involves collecting POS data, matching transactions to credit card and bank records, identifying discrepancies, resolving issues, updating records, and generating reports, with automation options available to reduce time and errors.

dowidth.com

dowidth.com