Blockchain reconciliation ensures real-time verification of transactions through automated, immutable ledgers that enhance transparency and reduce errors. In contrast, post-transactional reconciliation involves manually matching and validating transactions after they occur, often causing delays and increasing the risk of discrepancies. Explore more to understand how these reconciliation methods impact accounting accuracy and efficiency.

Why it is important

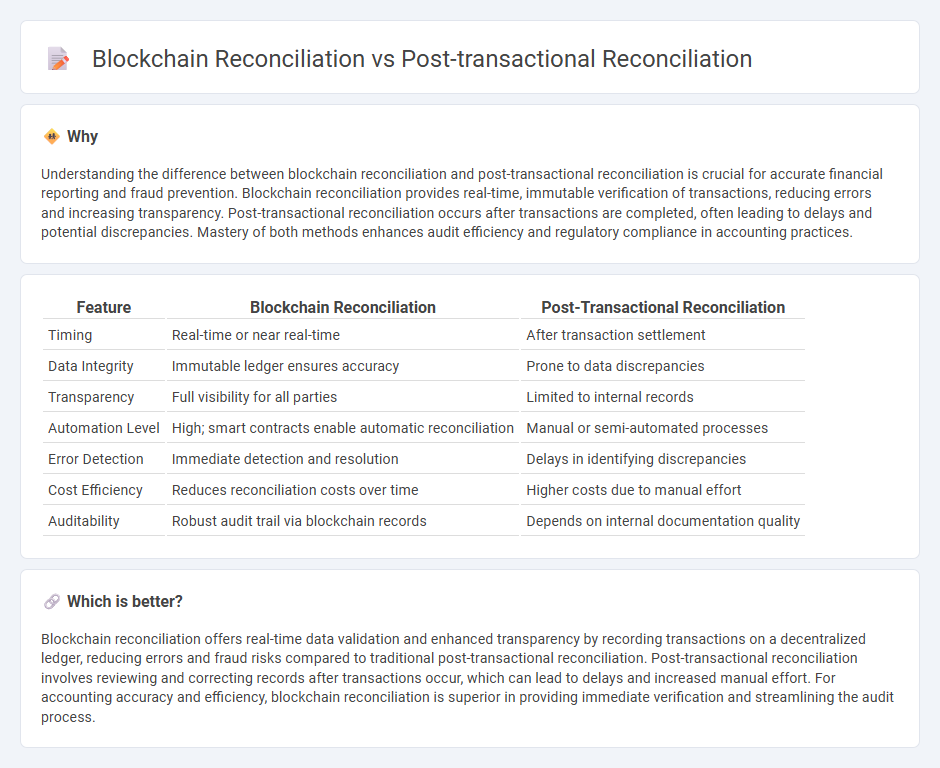

Understanding the difference between blockchain reconciliation and post-transactional reconciliation is crucial for accurate financial reporting and fraud prevention. Blockchain reconciliation provides real-time, immutable verification of transactions, reducing errors and increasing transparency. Post-transactional reconciliation occurs after transactions are completed, often leading to delays and potential discrepancies. Mastery of both methods enhances audit efficiency and regulatory compliance in accounting practices.

Comparison Table

| Feature | Blockchain Reconciliation | Post-Transactional Reconciliation |

|---|---|---|

| Timing | Real-time or near real-time | After transaction settlement |

| Data Integrity | Immutable ledger ensures accuracy | Prone to data discrepancies |

| Transparency | Full visibility for all parties | Limited to internal records |

| Automation Level | High; smart contracts enable automatic reconciliation | Manual or semi-automated processes |

| Error Detection | Immediate detection and resolution | Delays in identifying discrepancies |

| Cost Efficiency | Reduces reconciliation costs over time | Higher costs due to manual effort |

| Auditability | Robust audit trail via blockchain records | Depends on internal documentation quality |

Which is better?

Blockchain reconciliation offers real-time data validation and enhanced transparency by recording transactions on a decentralized ledger, reducing errors and fraud risks compared to traditional post-transactional reconciliation. Post-transactional reconciliation involves reviewing and correcting records after transactions occur, which can lead to delays and increased manual effort. For accounting accuracy and efficiency, blockchain reconciliation is superior in providing immediate verification and streamlining the audit process.

Connection

Blockchain reconciliation enhances post-transactional reconciliation by providing an immutable and transparent ledger that records every transaction in real-time, reducing discrepancies and errors. Traditional post-transactional reconciliation relies on comparing records across ledgers after the fact, whereas blockchain enables continuous, automated verification to accelerate the reconciliation process. This connection streamlines financial audits, improves accuracy, and strengthens trust between parties by ensuring data consistency and integrity throughout the accounting cycle.

Key Terms

**Post-Transactional Reconciliation:**

Post-Transactional Reconciliation involves verifying and matching financial records after transactions have been completed, ensuring accuracy and detecting discrepancies between ledgers and bank statements. This method relies on traditional centralized databases and manual or automated systems to identify errors or fraud post-factum, which can delay resolution and impact financial reporting timelines. Explore how Post-Transactional Reconciliation compares to blockchain reconciliation to enhance your understanding of evolving financial processes.

Bank Statement Matching

Post-transactional reconciliation involves verifying bank statements against internal records after transactions have been completed, often leading to delays and discrepancies. Blockchain reconciliation leverages distributed ledger technology to provide real-time, tamper-proof matching of transactions, enhancing accuracy and reducing reconciliation cycles. Explore how blockchain can transform bank statement matching processes to improve financial transparency and efficiency.

Manual Ledger Review

Post-transactional reconciliation involves manual ledger review to identify discrepancies after financial activities are recorded, often leading to delays and increased error risks due to human intervention. Blockchain reconciliation automates this process by offering a real-time, immutable ledger that significantly reduces the need for manual verification, enhancing accuracy and efficiency. Explore how these methods shape financial transparency and operational workflows in detail.

Source and External Links

What is Transaction Reconciliation? - Transaction reconciliation involves matching different data sets at the transaction level to verify accuracy and resolve discrepancies.

Transaction Reconciliation - This process allows for the reconciliation of transactions across different sets, such as intercompany or credit card transactions, to identify differences.

Payment Reconciliation: What it is and how it's done - Payment reconciliation involves matching and comparing transaction records to ensure consistency between financial statements and actual payments.

dowidth.com

dowidth.com