Cryptocurrency taxation involves reporting digital asset transactions as capital gains or income, reflecting the IRS's classification of crypto as property for tax purposes. Property tax, on the other hand, is levied on real estate based on assessed value and often used to fund local services like schools and infrastructure. Explore the nuances between these tax types to optimize compliance and financial planning.

Why it is important

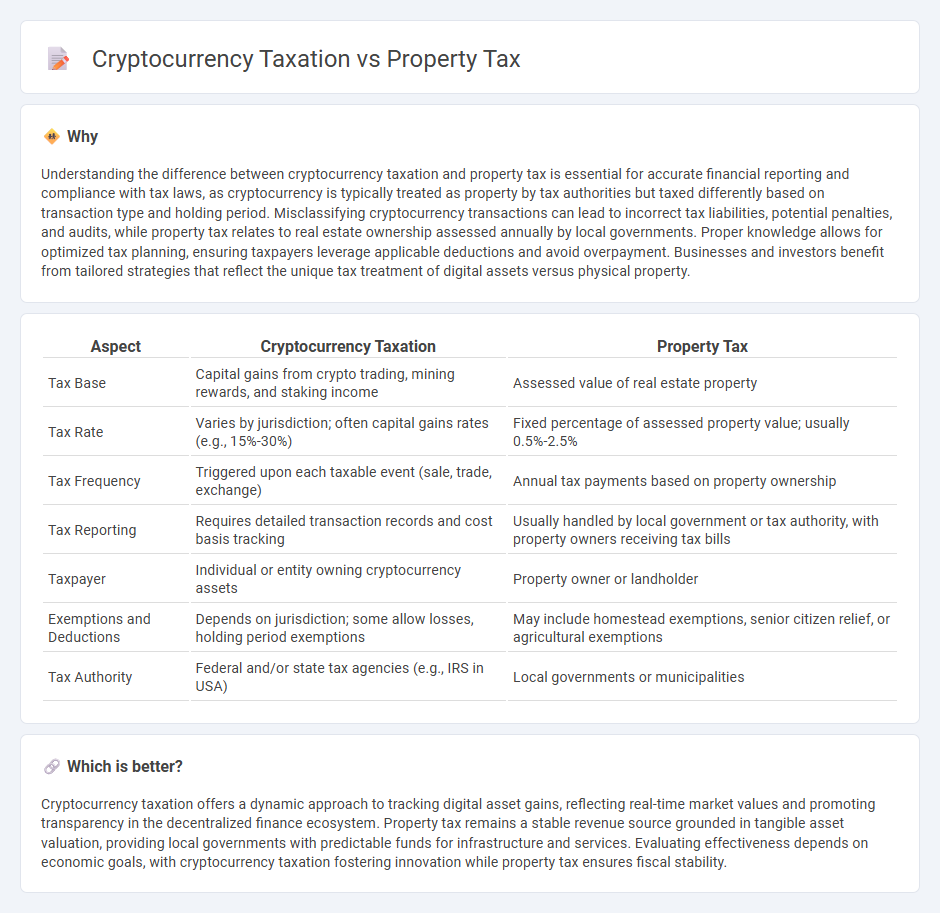

Understanding the difference between cryptocurrency taxation and property tax is essential for accurate financial reporting and compliance with tax laws, as cryptocurrency is typically treated as property by tax authorities but taxed differently based on transaction type and holding period. Misclassifying cryptocurrency transactions can lead to incorrect tax liabilities, potential penalties, and audits, while property tax relates to real estate ownership assessed annually by local governments. Proper knowledge allows for optimized tax planning, ensuring taxpayers leverage applicable deductions and avoid overpayment. Businesses and investors benefit from tailored strategies that reflect the unique tax treatment of digital assets versus physical property.

Comparison Table

| Aspect | Cryptocurrency Taxation | Property Tax |

|---|---|---|

| Tax Base | Capital gains from crypto trading, mining rewards, and staking income | Assessed value of real estate property |

| Tax Rate | Varies by jurisdiction; often capital gains rates (e.g., 15%-30%) | Fixed percentage of assessed property value; usually 0.5%-2.5% |

| Tax Frequency | Triggered upon each taxable event (sale, trade, exchange) | Annual tax payments based on property ownership |

| Tax Reporting | Requires detailed transaction records and cost basis tracking | Usually handled by local government or tax authority, with property owners receiving tax bills |

| Taxpayer | Individual or entity owning cryptocurrency assets | Property owner or landholder |

| Exemptions and Deductions | Depends on jurisdiction; some allow losses, holding period exemptions | May include homestead exemptions, senior citizen relief, or agricultural exemptions |

| Tax Authority | Federal and/or state tax agencies (e.g., IRS in USA) | Local governments or municipalities |

Which is better?

Cryptocurrency taxation offers a dynamic approach to tracking digital asset gains, reflecting real-time market values and promoting transparency in the decentralized finance ecosystem. Property tax remains a stable revenue source grounded in tangible asset valuation, providing local governments with predictable funds for infrastructure and services. Evaluating effectiveness depends on economic goals, with cryptocurrency taxation fostering innovation while property tax ensures fiscal stability.

Connection

Cryptocurrency taxation is linked to property tax because cryptocurrencies are often classified as property by tax authorities, triggering capital gains tax when sold or exchanged. Reporting requirements and valuation methods for cryptocurrencies mirror those used in property tax assessments, impacting taxable income calculations. Understanding these connections helps taxpayers navigate compliance and optimize tax liability related to digital asset holdings.

Key Terms

Assessed Value

Property tax is based on the assessed value of real estate, which local governments determine through periodic appraisals reflecting market conditions and property characteristics. Cryptocurrency taxation, however, relies on calculating fair market value at the time of each transaction rather than an ongoing assessed value, complicating valuation due to price volatility and lack of centralized appraisals. Explore more about how assessed value impacts taxation strategies for both property and cryptocurrency assets.

Capital Gains

Capital gains tax on cryptocurrency varies widely depending on jurisdiction rules, often taxed at rates similar to or higher than property tax levies. Property tax is generally a recurring tax based on the assessed value of real estate, whereas capital gains tax on cryptocurrency applies only upon the sale or exchange of the asset, reflecting profit made. Explore detailed comparisons and tax strategies for optimizing your cryptocurrency capital gains and property tax obligations.

Tax Basis

Property tax is typically calculated based on the assessed value of real estate at a specific point in time, while cryptocurrency taxation centers around the tax basis, which is the original purchase price plus any transaction fees. Tax basis is crucial for determining capital gains or losses when cryptocurrencies are sold or exchanged, directly affecting the taxable amount. Explore the complexities of tax basis to better understand how property tax and cryptocurrency taxation differ.

Source and External Links

Sacramento Property Tax: A Guide for Homeowners - In Sacramento, property tax is typically about 1.3% of the property's assessed value, with payments due in two installments: November 1 and February 1, to fund local services like education and safety.

Property Taxes - Lookup - Alameda County's Official Website - Property taxes can be paid and looked up online for various tax types including real property and business personal property, with multiple payment methods available including e-check and credit card.

Sacramento County, Property Tax Payment Notification - Annual secured property tax bills in Sacramento County are mailed by November 1 and can be paid in two installments, with specific deadlines to avoid penalties and options for online or phone payments.

dowidth.com

dowidth.com