Continuous audit leverages real-time data analysis and automated controls to provide ongoing assurance on financial transactions and compliance, enhancing accuracy and timeliness. Tax audit focuses on verifying tax returns and compliance with tax laws, typically conducted periodically to identify discrepancies and ensure correct tax liabilities. Explore the distinct methodologies and benefits of continuous and tax audits to optimize your financial oversight.

Why it is important

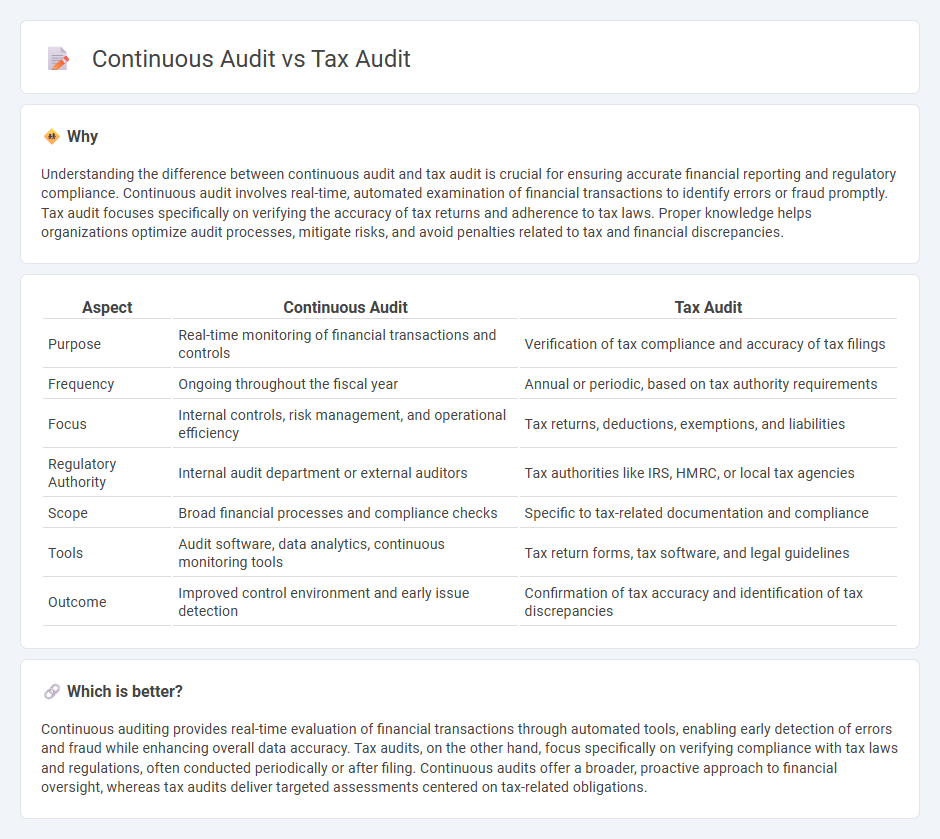

Understanding the difference between continuous audit and tax audit is crucial for ensuring accurate financial reporting and regulatory compliance. Continuous audit involves real-time, automated examination of financial transactions to identify errors or fraud promptly. Tax audit focuses specifically on verifying the accuracy of tax returns and adherence to tax laws. Proper knowledge helps organizations optimize audit processes, mitigate risks, and avoid penalties related to tax and financial discrepancies.

Comparison Table

| Aspect | Continuous Audit | Tax Audit |

|---|---|---|

| Purpose | Real-time monitoring of financial transactions and controls | Verification of tax compliance and accuracy of tax filings |

| Frequency | Ongoing throughout the fiscal year | Annual or periodic, based on tax authority requirements |

| Focus | Internal controls, risk management, and operational efficiency | Tax returns, deductions, exemptions, and liabilities |

| Regulatory Authority | Internal audit department or external auditors | Tax authorities like IRS, HMRC, or local tax agencies |

| Scope | Broad financial processes and compliance checks | Specific to tax-related documentation and compliance |

| Tools | Audit software, data analytics, continuous monitoring tools | Tax return forms, tax software, and legal guidelines |

| Outcome | Improved control environment and early issue detection | Confirmation of tax accuracy and identification of tax discrepancies |

Which is better?

Continuous auditing provides real-time evaluation of financial transactions through automated tools, enabling early detection of errors and fraud while enhancing overall data accuracy. Tax audits, on the other hand, focus specifically on verifying compliance with tax laws and regulations, often conducted periodically or after filing. Continuous audits offer a broader, proactive approach to financial oversight, whereas tax audits deliver targeted assessments centered on tax-related obligations.

Connection

Continuous audit leverages real-time data analysis and automated tools to monitor financial transactions, ensuring accuracy and compliance throughout the fiscal period. Tax audits rely on comprehensive and accurate accounting records generated and maintained via continuous auditing processes to assess tax liabilities effectively. The integration of continuous audit practices enhances the reliability of tax audits by providing consistent verification and early detection of discrepancies.

Key Terms

**Tax Audit:**

Tax audit involves a thorough examination of a company's financial records and tax returns by tax authorities to ensure compliance with tax laws and detect any discrepancies or underreported income. It focuses on verifying the accuracy of tax filings, identifying potential tax liabilities, and preventing tax evasion. Learn more about how tax audits impact your business and ensure regulatory compliance.

Compliance

Tax audits primarily assess a company's adherence to tax laws and regulations at a specific point in time, ensuring accurate reporting and payment of taxes. Continuous audits involve ongoing monitoring of financial transactions and compliance controls to detect issues promptly, minimizing risks and improving regulatory adherence. Explore how integrating continuous audit techniques enhances tax compliance and mitigates penalties.

Documentation

Tax audits primarily emphasize thorough documentation review to verify compliance with tax regulations, ensuring all records such as receipts, invoices, and tax returns are accurately maintained and accessible. Continuous audits integrate real-time data analytics and automated monitoring of financial transactions, enabling ongoing documentation validation and quicker identification of discrepancies. Explore how continuous audit technology transforms documentation processes for comprehensive tax compliance.

Source and External Links

What Are Tax Audits? - TurboTax Tax Tips & Videos - Provides an overview of tax audits, including triggers, preparation, and outcomes.

Tax Audit | Direktorat Jenderal Pajak - Describes the purpose and process of tax audits for assessing tax compliance.

IRS Audits | Internal Revenue Service - Explains the reasons for IRS audits, the notification process, and taxpayer rights during an audit.

dowidth.com

dowidth.com