Cryptocurrency taxation involves tracking and reporting digital asset transactions to comply with tax regulations, whereas anonymous transactions pose challenges due to the lack of identifiable information. Tax authorities increasingly use blockchain analytics and software tools to detect taxable events within cryptocurrency transfers. Explore how evolving regulations impact compliance and privacy in the digital currency landscape.

Why it is important

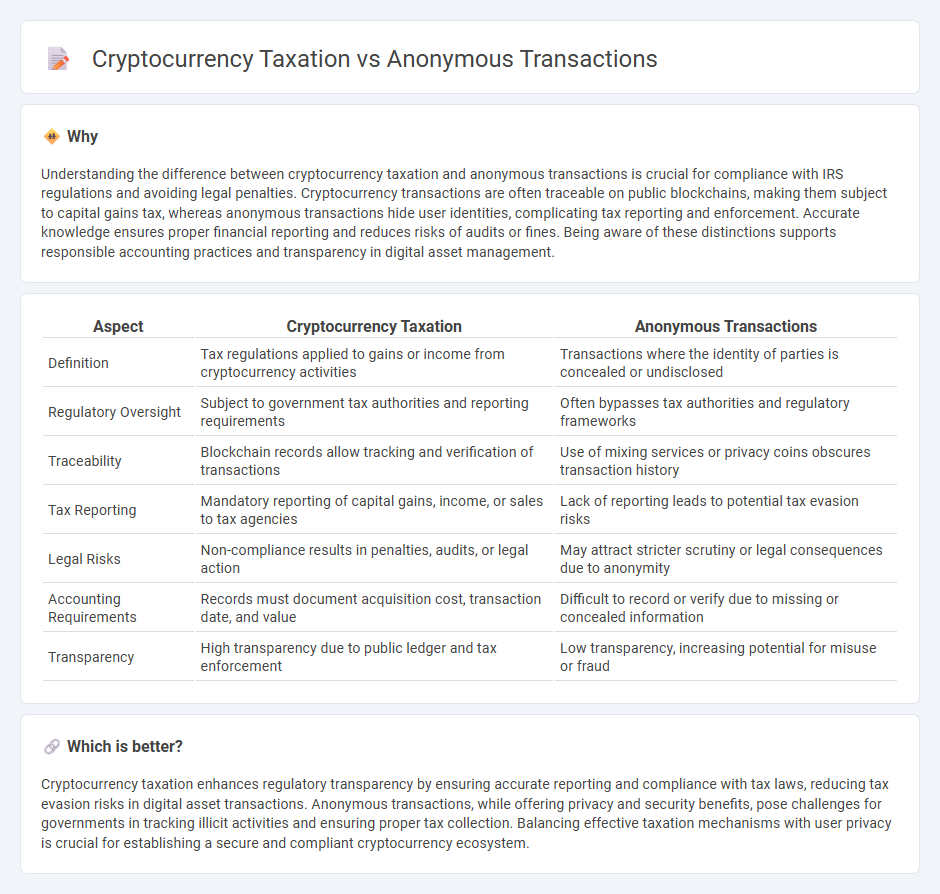

Understanding the difference between cryptocurrency taxation and anonymous transactions is crucial for compliance with IRS regulations and avoiding legal penalties. Cryptocurrency transactions are often traceable on public blockchains, making them subject to capital gains tax, whereas anonymous transactions hide user identities, complicating tax reporting and enforcement. Accurate knowledge ensures proper financial reporting and reduces risks of audits or fines. Being aware of these distinctions supports responsible accounting practices and transparency in digital asset management.

Comparison Table

| Aspect | Cryptocurrency Taxation | Anonymous Transactions |

|---|---|---|

| Definition | Tax regulations applied to gains or income from cryptocurrency activities | Transactions where the identity of parties is concealed or undisclosed |

| Regulatory Oversight | Subject to government tax authorities and reporting requirements | Often bypasses tax authorities and regulatory frameworks |

| Traceability | Blockchain records allow tracking and verification of transactions | Use of mixing services or privacy coins obscures transaction history |

| Tax Reporting | Mandatory reporting of capital gains, income, or sales to tax agencies | Lack of reporting leads to potential tax evasion risks |

| Legal Risks | Non-compliance results in penalties, audits, or legal action | May attract stricter scrutiny or legal consequences due to anonymity |

| Accounting Requirements | Records must document acquisition cost, transaction date, and value | Difficult to record or verify due to missing or concealed information |

| Transparency | High transparency due to public ledger and tax enforcement | Low transparency, increasing potential for misuse or fraud |

Which is better?

Cryptocurrency taxation enhances regulatory transparency by ensuring accurate reporting and compliance with tax laws, reducing tax evasion risks in digital asset transactions. Anonymous transactions, while offering privacy and security benefits, pose challenges for governments in tracking illicit activities and ensuring proper tax collection. Balancing effective taxation mechanisms with user privacy is crucial for establishing a secure and compliant cryptocurrency ecosystem.

Connection

Cryptocurrency taxation hinges on tracing anonymous transactions to ensure accurate reporting of capital gains and income. Blockchain analysis tools enable tax authorities to link pseudonymous wallets to individuals, reducing tax evasion risks. Compliance challenges arise from privacy features in certain cryptocurrencies that obscure transaction details and ownership.

Key Terms

Anonymity

Anonymous transactions in cryptocurrency prioritize user privacy by concealing identities and transaction details, leveraging technologies like mixers and privacy coins such as Monero and Zcash. Cryptocurrency taxation challenges arise due to this anonymity, complicating regulatory enforcement as authorities struggle to trace taxable events and verify compliance. Explore how evolving regulations and advanced blockchain analysis tools aim to balance privacy with tax obligations.

Tax Reporting

Anonymous transactions challenge cryptocurrency taxation by obscuring the traceability required for accurate tax reporting, complicating compliance efforts for both taxpayers and authorities. The IRS and similar agencies increasingly employ blockchain analysis tools to identify unreported transactions and enforce tax obligations on digital assets. Explore effective strategies to navigate tax reporting requirements amid rising scrutiny of anonymous cryptocurrency activity.

Blockchain Traceability

Blockchain traceability significantly limits the anonymity of cryptocurrency transactions by recording every transfer on a public ledger, enabling forensic tools to link transactions to real-world identities. Anonymous transactions, often facilitated by privacy coins or mixing services, challenge taxation authorities by obscuring the source and destination of funds, complicating income reporting and tax compliance. Explore deeper insights into blockchain analysis techniques and regulatory approaches to better understand the evolving landscape of cryptocurrency taxation.

Source and External Links

Ultimate Guide to Private & Anonymous Payments in 2025 - Anonymous transactions allow individuals to send and receive payments without revealing their real identities to the transaction counterpart, such as with Cash App's $Cashtag system, though the platform itself may still know user identities due to linked bank accounts.

Shielding Against Illicit Activities: Curbing Anonymous Transactions ... - Cryptocurrencies facilitate pseudonymous transactions by hiding users behind cryptographic addresses, but advanced analytic techniques and privacy-enhancing technologies like zero-knowledge proofs and ring signatures aim to increase transaction anonymity.

Anonymous payment methods: A guide for businesses - Stripe - Common anonymous transaction methods include physical cash, prepaid cards, certain privacy-focused cryptocurrencies (e.g., Monero, Zcash), money orders, and gift cards, though the level of anonymity and regulatory restrictions vary by method and jurisdiction.

dowidth.com

dowidth.com