Supply chain finance accounting focuses on managing payments, financing, and risk optimization between buyers and suppliers to improve cash flow and operational efficiency. Revenue recognition accounting determines the specific conditions under which revenue is recorded, ensuring compliance with accounting standards like IFRS 15 and ASC 606. Explore the detailed distinctions and practical implications of both accounting methods to enhance financial strategy and reporting accuracy.

Why it is important

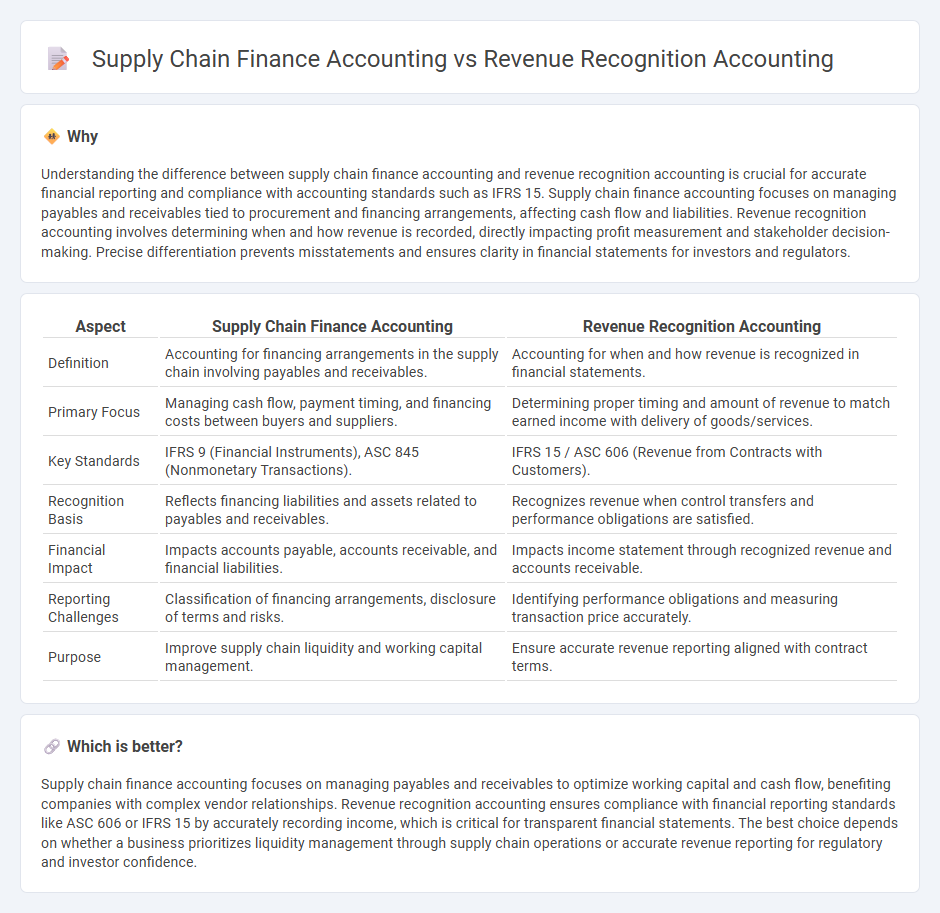

Understanding the difference between supply chain finance accounting and revenue recognition accounting is crucial for accurate financial reporting and compliance with accounting standards such as IFRS 15. Supply chain finance accounting focuses on managing payables and receivables tied to procurement and financing arrangements, affecting cash flow and liabilities. Revenue recognition accounting involves determining when and how revenue is recorded, directly impacting profit measurement and stakeholder decision-making. Precise differentiation prevents misstatements and ensures clarity in financial statements for investors and regulators.

Comparison Table

| Aspect | Supply Chain Finance Accounting | Revenue Recognition Accounting |

|---|---|---|

| Definition | Accounting for financing arrangements in the supply chain involving payables and receivables. | Accounting for when and how revenue is recognized in financial statements. |

| Primary Focus | Managing cash flow, payment timing, and financing costs between buyers and suppliers. | Determining proper timing and amount of revenue to match earned income with delivery of goods/services. |

| Key Standards | IFRS 9 (Financial Instruments), ASC 845 (Nonmonetary Transactions). | IFRS 15 / ASC 606 (Revenue from Contracts with Customers). |

| Recognition Basis | Reflects financing liabilities and assets related to payables and receivables. | Recognizes revenue when control transfers and performance obligations are satisfied. |

| Financial Impact | Impacts accounts payable, accounts receivable, and financial liabilities. | Impacts income statement through recognized revenue and accounts receivable. |

| Reporting Challenges | Classification of financing arrangements, disclosure of terms and risks. | Identifying performance obligations and measuring transaction price accurately. |

| Purpose | Improve supply chain liquidity and working capital management. | Ensure accurate revenue reporting aligned with contract terms. |

Which is better?

Supply chain finance accounting focuses on managing payables and receivables to optimize working capital and cash flow, benefiting companies with complex vendor relationships. Revenue recognition accounting ensures compliance with financial reporting standards like ASC 606 or IFRS 15 by accurately recording income, which is critical for transparent financial statements. The best choice depends on whether a business prioritizes liquidity management through supply chain operations or accurate revenue reporting for regulatory and investor confidence.

Connection

Supply chain finance accounting impacts revenue recognition accounting by influencing when and how revenue is recorded, particularly through payment terms and financing arrangements. The timing of cash flows in supply chain finance affects the identification of performance obligations and the fulfillment criteria under IFRS 15 and ASC 606 standards. Accurate integration of these accounting areas ensures compliance and transparent financial reporting across procurement, payment, and revenue streams.

Key Terms

Revenue recognition criteria

Revenue recognition accounting requires adhering to the Five-Step Model under ASC 606, emphasizing the identification of performance obligations and the transfer of control to recognize revenue accurately. Supply chain finance accounting, while primarily focused on optimizing cash flow and payment terms, incorporates revenue recognition principles to ensure that financing activities align with recognized sales transactions without prematurely recording revenue. Explore the detailed criteria distinguishing revenue recognition in both accounting practices to enhance financial accuracy and compliance.

Performance obligations

Revenue recognition accounting centers on identifying and satisfying performance obligations as defined by IFRS 15 and ASC 606 standards, ensuring that revenue is recorded when control of goods or services transfers to the customer. Supply chain finance accounting, however, emphasizes the management of payment obligations and financing arrangements between buyers and suppliers, without directly affecting revenue recognition criteria. Explore the nuances between these accounting approaches to optimize financial reporting and cash flow management.

Discounting of receivables

Revenue recognition accounting applies discounting of receivables to accurately measure revenue at present value, ensuring compliance with IFRS 15 or ASC 606 standards. Supply chain finance accounting uses discounting primarily to account for the time value of money in early payment programs sponsored by buyers or financiers. Explore detailed methodologies and impacts on financial statements for a deeper understanding of discounting in these accounting practices.

Source and External Links

Revenue Recognition: Principles and 5-Step Model - NetSuite - Revenue recognition is an accounting principle requiring revenue to be recognized as earned, following a five-step model that includes identifying contracts, performance obligations, transaction prices, allocation, and recognition timing under GAAP and IFRS standards.

Revenue recognition principles & best practices - Stripe - Revenue recognition is an accrual accounting principle mandating that businesses record revenue when earned rather than when cash is received, governed by the joint FASB and IASB framework ASC 606/IFRS 15 for consistent global standards.

Revenue Recognition: A Complete Guide for 2024 | Trullion - This principle governs when and how much revenue should be recognized, requiring revenue to be recorded when realized and earned under accrual accounting, even if payment is received upfront but services are delivered over time, as outlined in ASC 606 and IFRS 15.

dowidth.com

dowidth.com