Environmental Social Governance (ESG) accounting integrates sustainability metrics into financial reporting frameworks, emphasizing a company's impact on environmental and social factors alongside traditional financial performance. Stakeholder reporting broadens this focus by addressing the concerns and interests of diverse groups such as investors, employees, communities, and regulators, ensuring transparent communication of both financial and non-financial data. Explore further to understand how these accounting approaches shape corporate responsibility and strategic decision-making.

Why it is important

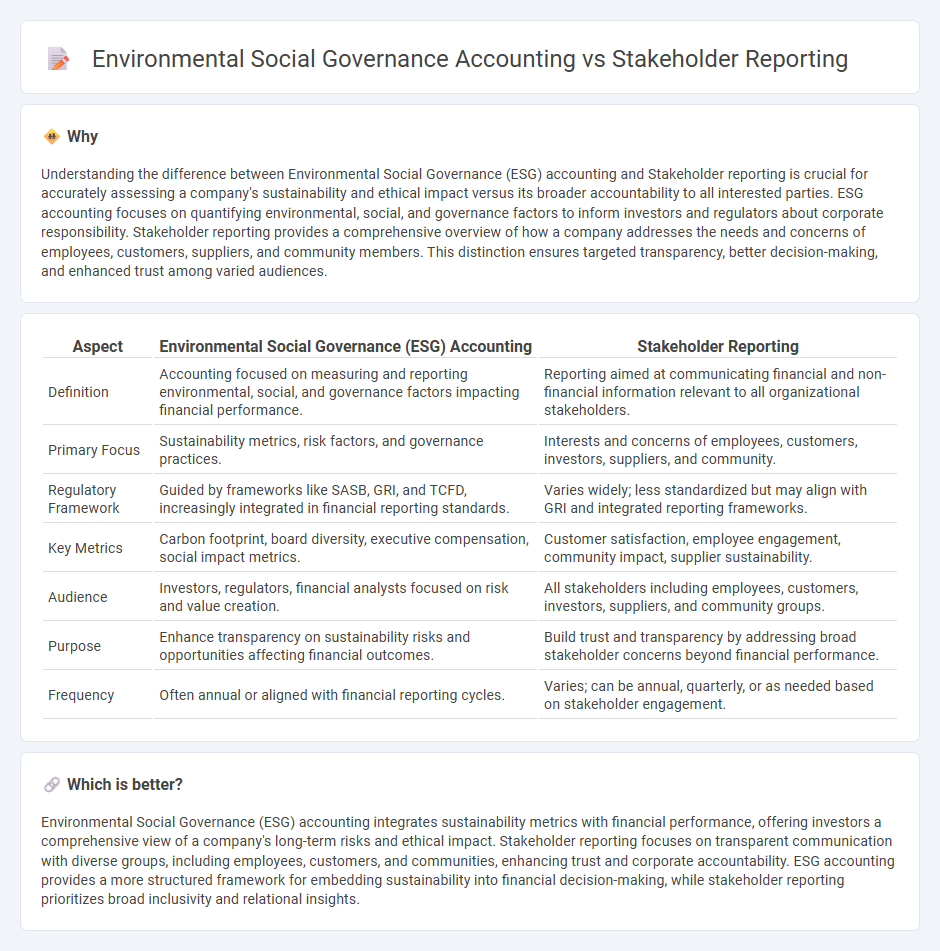

Understanding the difference between Environmental Social Governance (ESG) accounting and Stakeholder reporting is crucial for accurately assessing a company's sustainability and ethical impact versus its broader accountability to all interested parties. ESG accounting focuses on quantifying environmental, social, and governance factors to inform investors and regulators about corporate responsibility. Stakeholder reporting provides a comprehensive overview of how a company addresses the needs and concerns of employees, customers, suppliers, and community members. This distinction ensures targeted transparency, better decision-making, and enhanced trust among varied audiences.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Stakeholder Reporting |

|---|---|---|

| Definition | Accounting focused on measuring and reporting environmental, social, and governance factors impacting financial performance. | Reporting aimed at communicating financial and non-financial information relevant to all organizational stakeholders. |

| Primary Focus | Sustainability metrics, risk factors, and governance practices. | Interests and concerns of employees, customers, investors, suppliers, and community. |

| Regulatory Framework | Guided by frameworks like SASB, GRI, and TCFD, increasingly integrated in financial reporting standards. | Varies widely; less standardized but may align with GRI and integrated reporting frameworks. |

| Key Metrics | Carbon footprint, board diversity, executive compensation, social impact metrics. | Customer satisfaction, employee engagement, community impact, supplier sustainability. |

| Audience | Investors, regulators, financial analysts focused on risk and value creation. | All stakeholders including employees, customers, investors, suppliers, and community groups. |

| Purpose | Enhance transparency on sustainability risks and opportunities affecting financial outcomes. | Build trust and transparency by addressing broad stakeholder concerns beyond financial performance. |

| Frequency | Often annual or aligned with financial reporting cycles. | Varies; can be annual, quarterly, or as needed based on stakeholder engagement. |

Which is better?

Environmental Social Governance (ESG) accounting integrates sustainability metrics with financial performance, offering investors a comprehensive view of a company's long-term risks and ethical impact. Stakeholder reporting focuses on transparent communication with diverse groups, including employees, customers, and communities, enhancing trust and corporate accountability. ESG accounting provides a more structured framework for embedding sustainability into financial decision-making, while stakeholder reporting prioritizes broad inclusivity and relational insights.

Connection

Environmental Social Governance (ESG) accounting integrates non-financial metrics such as carbon emissions, labor practices, and board diversity into traditional financial reporting frameworks. Stakeholder reporting leverages ESG data to provide transparent insights to investors, customers, and regulators, enhancing corporate accountability and long-term value creation. This connection drives firms to adopt sustainable business practices while meeting the rising demand for comprehensive, impact-focused disclosures.

Key Terms

**Stakeholder reporting:**

Stakeholder reporting emphasizes transparent communication of a company's performance and impacts to its diverse stakeholders, including investors, employees, customers, and communities. It integrates financial and non-financial data to demonstrate accountability and foster trust, often guided by frameworks like GRI or SASB. Explore the key differences and benefits of stakeholder reporting versus ESG accounting to enhance strategic decision-making.

Transparency

Stakeholder reporting emphasizes comprehensive disclosure to inform investors, employees, and communities about organizational impact, prioritizing transparency in social and economic performance. Environmental, Social, and Governance (ESG) accounting integrates non-financial metrics into financial reporting, enhancing transparency by linking sustainability factors with corporate financial outcomes. Explore how transparent practices in both frameworks drive accountability and stakeholder trust in today's corporate environment.

Accountability

Stakeholder reporting emphasizes transparent communication of a company's impact on various stakeholder groups, including employees, customers, and communities, fostering accountability through inclusive disclosures. Environmental Social Governance (ESG) accounting integrates non-financial metrics related to environmental sustainability, social responsibility, and corporate governance into financial reporting to enhance accountability toward investors and regulatory bodies. Discover more about how these approaches drive accountability and sustainable business practices.

Source and External Links

Reporting to Stakeholders - International Finance Corporation - Stakeholder reporting provides a platform to communicate the environmental, social, economic, and governance performance of a business, and regularly update stakeholders on engagement processes, commitments, and outcomes, ensuring transparency and accountability through clear, localized communication.

Stakeholder Reporting: Guide for Board Members [+Templates] - Stakeholder reporting is essential for transparency, accountability, and building trust between a company's board and its primary stakeholders, such as investors, employees, customers, and suppliers, enabling effective engagement and progress monitoring.

Stakeholder Reporting Made Easy: 9 Practical Tips - Stakeholder reporting is a critical part of stakeholder engagement that helps build trust, increase accountability and transparency, improve stakeholder relationships, and supports ongoing dialogue, with best practices including identifying reporting requirements and integrating systems to streamline reporting.

dowidth.com

dowidth.com