Tax technology streamlines complex tax compliance processes through automation, real-time data analysis, and enhanced reporting capabilities. Payroll systems focus on accurately managing employee compensation, benefits, and tax withholdings while ensuring regulatory compliance and timely payments. Explore further to understand how each system transforms financial operations and business efficiency.

Why it is important

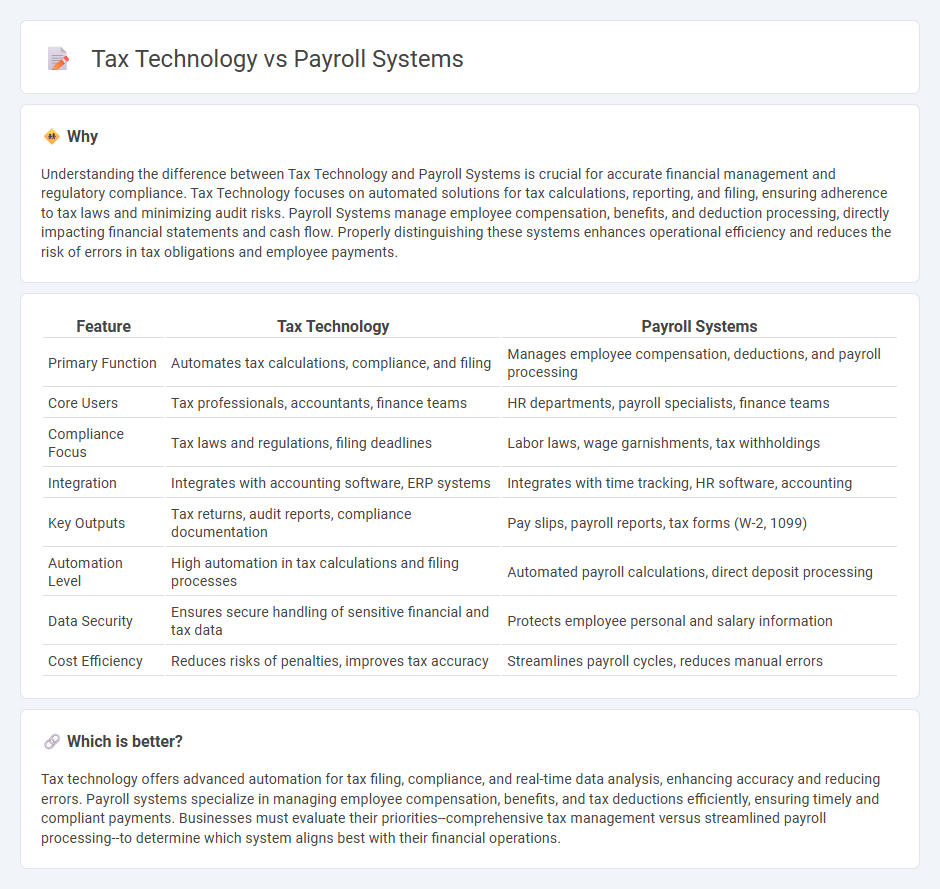

Understanding the difference between Tax Technology and Payroll Systems is crucial for accurate financial management and regulatory compliance. Tax Technology focuses on automated solutions for tax calculations, reporting, and filing, ensuring adherence to tax laws and minimizing audit risks. Payroll Systems manage employee compensation, benefits, and deduction processing, directly impacting financial statements and cash flow. Properly distinguishing these systems enhances operational efficiency and reduces the risk of errors in tax obligations and employee payments.

Comparison Table

| Feature | Tax Technology | Payroll Systems |

|---|---|---|

| Primary Function | Automates tax calculations, compliance, and filing | Manages employee compensation, deductions, and payroll processing |

| Core Users | Tax professionals, accountants, finance teams | HR departments, payroll specialists, finance teams |

| Compliance Focus | Tax laws and regulations, filing deadlines | Labor laws, wage garnishments, tax withholdings |

| Integration | Integrates with accounting software, ERP systems | Integrates with time tracking, HR software, accounting |

| Key Outputs | Tax returns, audit reports, compliance documentation | Pay slips, payroll reports, tax forms (W-2, 1099) |

| Automation Level | High automation in tax calculations and filing processes | Automated payroll calculations, direct deposit processing |

| Data Security | Ensures secure handling of sensitive financial and tax data | Protects employee personal and salary information |

| Cost Efficiency | Reduces risks of penalties, improves tax accuracy | Streamlines payroll cycles, reduces manual errors |

Which is better?

Tax technology offers advanced automation for tax filing, compliance, and real-time data analysis, enhancing accuracy and reducing errors. Payroll systems specialize in managing employee compensation, benefits, and tax deductions efficiently, ensuring timely and compliant payments. Businesses must evaluate their priorities--comprehensive tax management versus streamlined payroll processing--to determine which system aligns best with their financial operations.

Connection

Tax technology integrates with payroll systems to automate accurate tax calculations, compliance reporting, and timely filing of tax returns, reducing errors and saving time. Payroll systems utilize tax technology to manage deductions, tax withholdings, and regulatory updates, ensuring employee compensation aligns with current tax laws. This connection enhances overall financial accuracy and streamlines organizational tax-related processes.

Key Terms

Withholding

Payroll systems automate employee compensation calculations, including gross pay, deductions, and statutory withholdings such as income tax and Social Security contributions. Tax technology specializes in accurate tax withholding compliance by leveraging real-time tax law updates and automated calculations to minimize errors and penalties. Explore in-depth insights on how integrating payroll systems with advanced tax technology enhances withholding accuracy and regulatory compliance.

Compliance

Payroll systems automate employee compensation processing, ensuring accurate calculation of wages, taxes, and deductions aligned with labor laws, while tax technology specializes in automating tax compliance, reporting, and filing to meet evolving regulatory requirements. Payroll integrates seamlessly with tax technology to prevent errors, reduce penalties, and maintain up-to-date compliance with federal, state, and local tax regulations. Explore our comprehensive guide to understand how combining payroll systems with advanced tax technology maximizes compliance and operational efficiency.

Automation

Payroll systems automate employee salary calculations, tax deductions, and direct deposits, reducing manual errors and ensuring compliance with employment laws. Tax technology specializes in automating complex tax filing processes, real-time tax data analytics, and regulatory reporting to optimize tax liabilities and deadlines. Explore the latest advancements in payroll and tax automation to enhance business efficiency and accuracy.

Source and External Links

ADP Payroll Services - Offers automated payroll solutions with features like gross pay calculation, deductions processing, and flexible payment options for over a million clients.

Paycor Payroll Software - Provides an intuitive and flexible payroll solution with robust features for tax compliance and employee financial tools, trusted by over 50,000 businesses.

Paycom Online Payroll Services - Offers a single-database HR and payroll software that automates payroll processes, allowing employees to manage their own payroll for streamlined efficiency.

dowidth.com

dowidth.com