Blockchain reconciliation leverages distributed ledger technology to provide transparent, tamper-proof records that enhance accuracy and reduce fraud in financial transactions. Automated reconciliation employs software solutions to streamline matching processes, minimize manual errors, and accelerate financial close cycles. Explore the advantages and applications of both methods to optimize your accounting workflows.

Why it is important

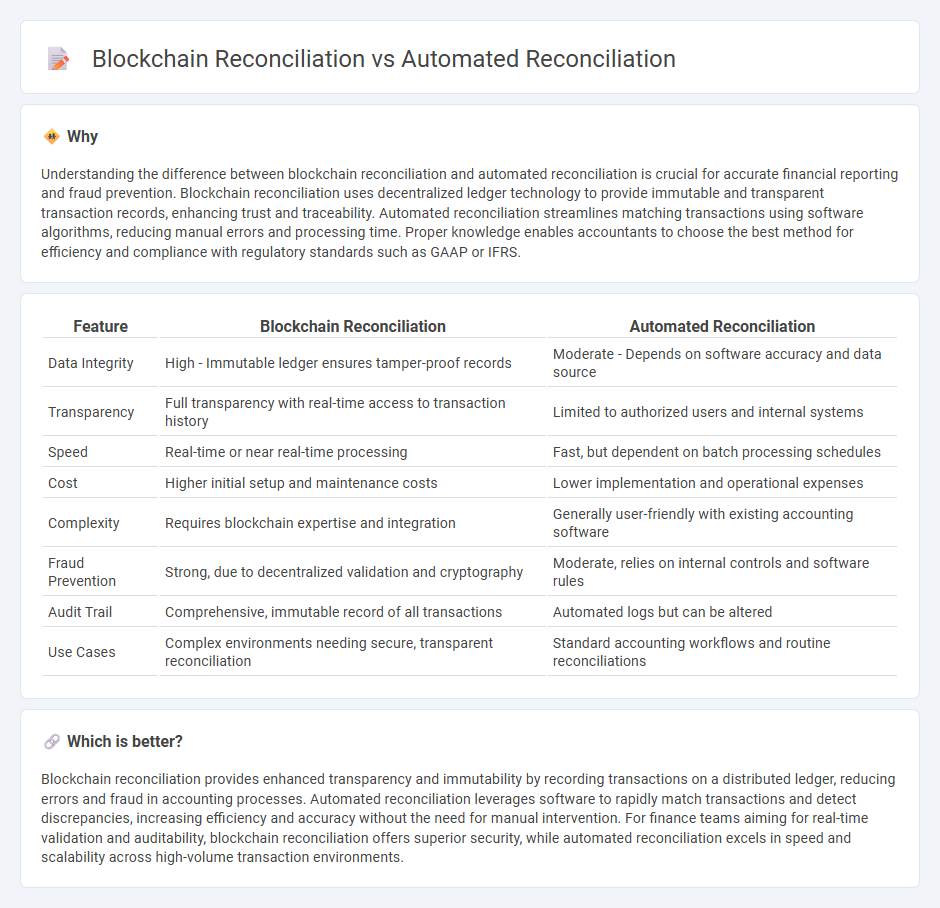

Understanding the difference between blockchain reconciliation and automated reconciliation is crucial for accurate financial reporting and fraud prevention. Blockchain reconciliation uses decentralized ledger technology to provide immutable and transparent transaction records, enhancing trust and traceability. Automated reconciliation streamlines matching transactions using software algorithms, reducing manual errors and processing time. Proper knowledge enables accountants to choose the best method for efficiency and compliance with regulatory standards such as GAAP or IFRS.

Comparison Table

| Feature | Blockchain Reconciliation | Automated Reconciliation |

|---|---|---|

| Data Integrity | High - Immutable ledger ensures tamper-proof records | Moderate - Depends on software accuracy and data source |

| Transparency | Full transparency with real-time access to transaction history | Limited to authorized users and internal systems |

| Speed | Real-time or near real-time processing | Fast, but dependent on batch processing schedules |

| Cost | Higher initial setup and maintenance costs | Lower implementation and operational expenses |

| Complexity | Requires blockchain expertise and integration | Generally user-friendly with existing accounting software |

| Fraud Prevention | Strong, due to decentralized validation and cryptography | Moderate, relies on internal controls and software rules |

| Audit Trail | Comprehensive, immutable record of all transactions | Automated logs but can be altered |

| Use Cases | Complex environments needing secure, transparent reconciliation | Standard accounting workflows and routine reconciliations |

Which is better?

Blockchain reconciliation provides enhanced transparency and immutability by recording transactions on a distributed ledger, reducing errors and fraud in accounting processes. Automated reconciliation leverages software to rapidly match transactions and detect discrepancies, increasing efficiency and accuracy without the need for manual intervention. For finance teams aiming for real-time validation and auditability, blockchain reconciliation offers superior security, while automated reconciliation excels in speed and scalability across high-volume transaction environments.

Connection

Blockchain reconciliation enhances automated reconciliation by providing a decentralized, immutable ledger that ensures transaction accuracy and transparency. Automated reconciliation systems leverage blockchain data to match transactions in real-time, significantly reducing errors and processing time. Integrating blockchain with automated reconciliation improves audit trails and financial integrity in accounting processes.

Key Terms

Data Integrity

Automated reconciliation utilizes algorithms and software to match transactions and identify discrepancies, enhancing data accuracy but still relying on centralized databases vulnerable to tampering. Blockchain reconciliation, on the other hand, leverages a decentralized ledger with cryptographic hashing to ensure immutable records and superior data integrity across all participants. Explore how blockchain technology revolutionizes secure reconciliation for unparalleled trust and transparency.

Smart Contracts

Automated reconciliation streamlines financial processes using AI and machine learning to match transactions across systems, enhancing accuracy and efficiency. Blockchain reconciliation leverages decentralized ledgers and smart contracts to ensure transparent, tamper-proof, and real-time validation of transactions without intermediaries. Explore how smart contracts revolutionize reconciliation by automating verification and settlement with unmatched security and trust.

Real-Time Processing

Automated reconciliation streamlines financial data matching by using algorithms to compare transactions instantly, significantly reducing manual errors and processing time. Blockchain reconciliation enhances this by enabling real-time, transparent, and immutable transaction verification across decentralized ledgers, ensuring data integrity and auditability. Explore how these innovations are transforming financial operations with real-time processing capabilities.

Source and External Links

What is Automated Reconciliation? - Automated reconciliation software streamlines the financial record matching process by automatically comparing transactions, reducing manual intervention and errors.

Manual vs. Automated Reconciliation: Why Automation Wins - Automated reconciliation uses AI-powered software to match data entries across systems in real-time, increasing speed and accuracy while reducing audit exposure.

5 Advantages of Automated Reconciliation for Your Business - HighRadius' AI-powered software automates up to 95% of journal posting tasks, enhancing financial record accuracy and compliance with real-time reconciliation capabilities.

dowidth.com

dowidth.com