Fractional CFO services provide businesses with part-time financial leadership, offering strategic guidance and financial management without the cost of a full-time executive. Virtual CFOs deliver similar expertise remotely, leveraging digital tools to manage finances, budgeting, and forecasting efficiently. Explore more to understand which CFO solution best fits your company's growth and financial oversight needs.

Why it is important

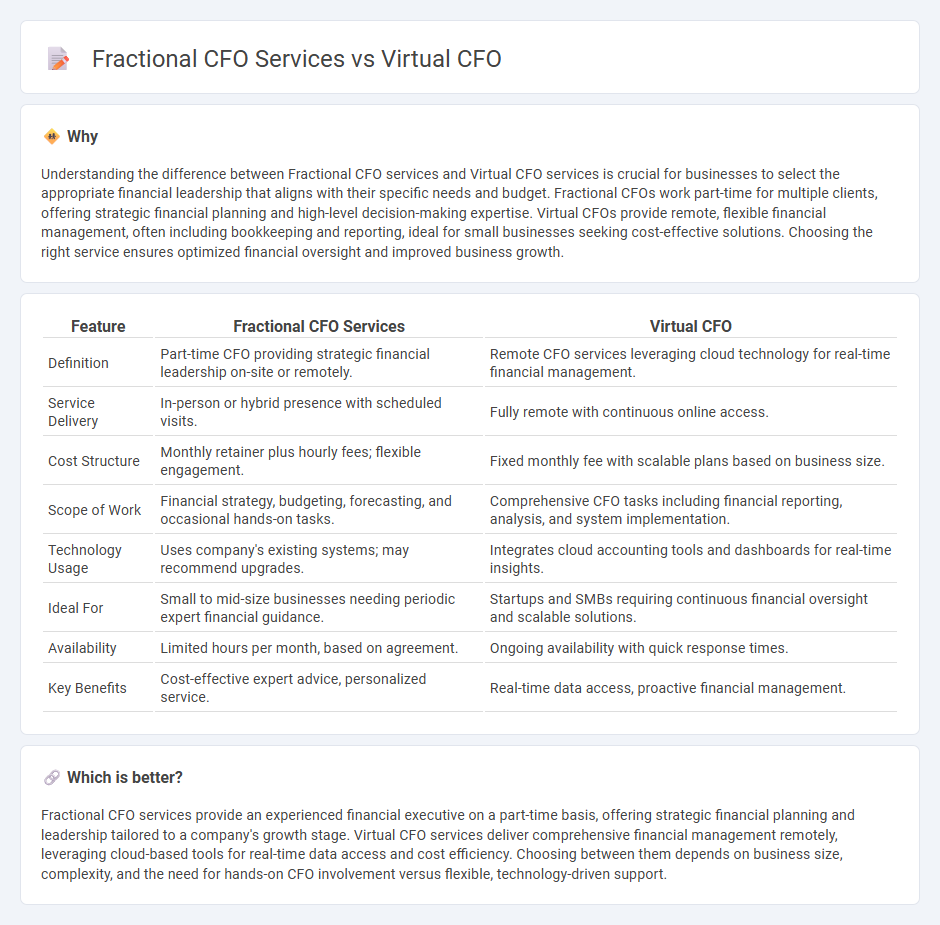

Understanding the difference between Fractional CFO services and Virtual CFO services is crucial for businesses to select the appropriate financial leadership that aligns with their specific needs and budget. Fractional CFOs work part-time for multiple clients, offering strategic financial planning and high-level decision-making expertise. Virtual CFOs provide remote, flexible financial management, often including bookkeeping and reporting, ideal for small businesses seeking cost-effective solutions. Choosing the right service ensures optimized financial oversight and improved business growth.

Comparison Table

| Feature | Fractional CFO Services | Virtual CFO |

|---|---|---|

| Definition | Part-time CFO providing strategic financial leadership on-site or remotely. | Remote CFO services leveraging cloud technology for real-time financial management. |

| Service Delivery | In-person or hybrid presence with scheduled visits. | Fully remote with continuous online access. |

| Cost Structure | Monthly retainer plus hourly fees; flexible engagement. | Fixed monthly fee with scalable plans based on business size. |

| Scope of Work | Financial strategy, budgeting, forecasting, and occasional hands-on tasks. | Comprehensive CFO tasks including financial reporting, analysis, and system implementation. |

| Technology Usage | Uses company's existing systems; may recommend upgrades. | Integrates cloud accounting tools and dashboards for real-time insights. |

| Ideal For | Small to mid-size businesses needing periodic expert financial guidance. | Startups and SMBs requiring continuous financial oversight and scalable solutions. |

| Availability | Limited hours per month, based on agreement. | Ongoing availability with quick response times. |

| Key Benefits | Cost-effective expert advice, personalized service. | Real-time data access, proactive financial management. |

Which is better?

Fractional CFO services provide an experienced financial executive on a part-time basis, offering strategic financial planning and leadership tailored to a company's growth stage. Virtual CFO services deliver comprehensive financial management remotely, leveraging cloud-based tools for real-time data access and cost efficiency. Choosing between them depends on business size, complexity, and the need for hands-on CFO involvement versus flexible, technology-driven support.

Connection

Fractional CFO services and Virtual CFO roles both provide businesses with expert financial leadership without the commitment of a full-time executive, offering cost-effective solutions tailored to company size and needs. They deliver strategic financial planning, budget management, and forecasting remotely or on a part-time basis, enhancing cash flow management and financial reporting accuracy. Leveraging cutting-edge financial software, these services ensure businesses maintain agile decision-making and scalable financial oversight.

Key Terms

Scope of Responsibility

Virtual CFO services typically encompass strategic financial planning, budgeting, forecasting, and high-level financial analysis to support long-term business growth. Fractional CFO services often include a broader scope, involving hands-on management of daily financial operations, cash flow oversight, and direct team leadership tailored to specific organizational needs. Discover more about how each service can align with your business goals and operational requirements.

Time Commitment

Virtual CFO services typically offer flexible time commitment, where engagement hours can vary from part-time to as-needed support, ideal for startups and small businesses with fluctuating financial oversight needs. Fractional CFO services involve a more structured, consistent time commitment, often allocating a specific portion of the CFO's time, such as several days per week, tailored for growing companies requiring regular strategic financial leadership. Explore the distinctions to determine which CFO model best aligns with your company's financial management demands.

Cost Structure

Virtual CFO services typically offer a flexible cost structure with monthly retainer fees based on the scope of work, making them suitable for startups and small businesses needing part-time expertise. Fractional CFO services often involve a fixed hourly or project-based fee tailored to specific financial strategies, providing scalability for mid-sized companies requiring deeper financial insights. Explore detailed comparisons to determine which CFO service best aligns with your business's financial goals.

Source and External Links

Virtual CFO - A virtual CFO is an outsourced service provider offering high-skill financial assistance to organizations, similar to a traditional CFO but on a part-time basis.

The Rise of the Virtual CFO - This article discusses the role of virtual CFOs in providing financial leadership tasks, including financial strategy, cash flow management, and risk management.

What is a Virtual CFO - A virtual CFO performs the same functions as a full-time CFO but at a fraction of the cost, offering services like financial strategy, forecasting, and cash flow management.

dowidth.com

dowidth.com