Sustainability assurance focuses on verifying environmental, social, and governance (ESG) data within corporate sustainability reports, ensuring accuracy and transparency in non-financial disclosures. Financial audit concentrates on examining financial statements to confirm compliance with accounting standards and the reliability of monetary information. Explore the distinctions between these assurance services to understand their roles in corporate accountability.

Why it is important

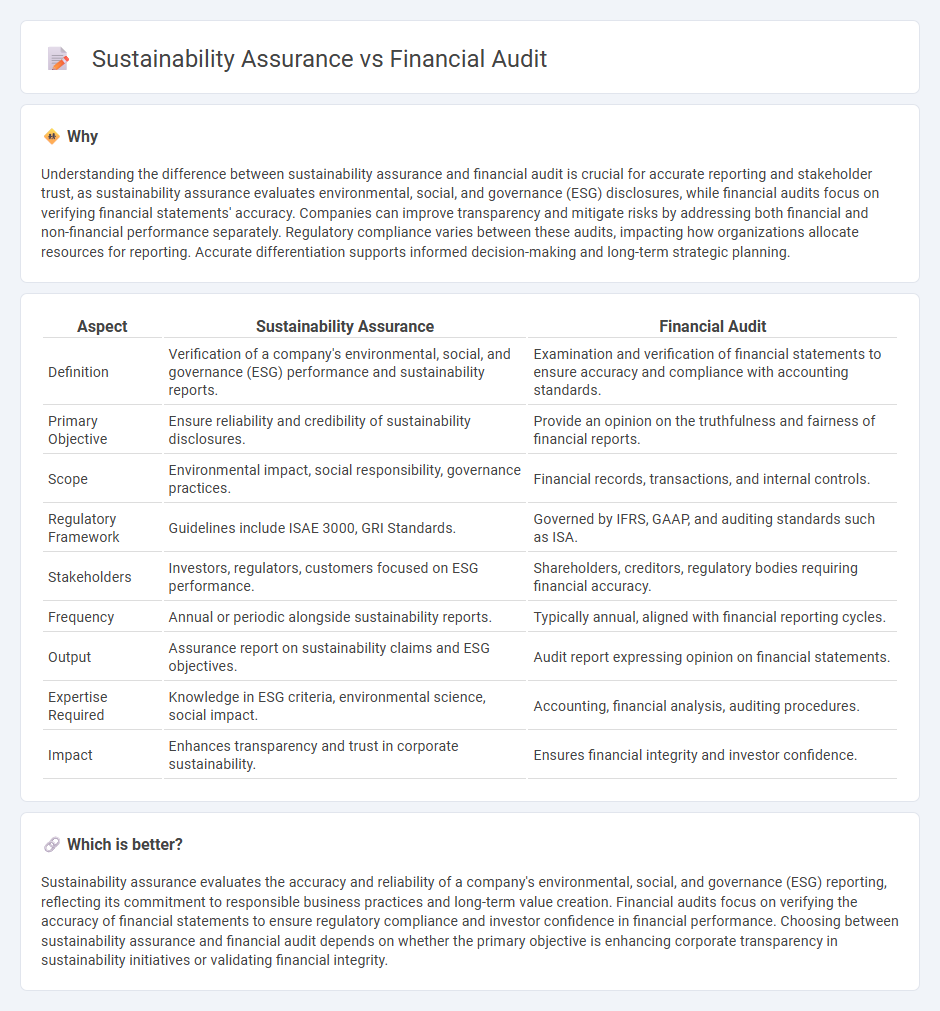

Understanding the difference between sustainability assurance and financial audit is crucial for accurate reporting and stakeholder trust, as sustainability assurance evaluates environmental, social, and governance (ESG) disclosures, while financial audits focus on verifying financial statements' accuracy. Companies can improve transparency and mitigate risks by addressing both financial and non-financial performance separately. Regulatory compliance varies between these audits, impacting how organizations allocate resources for reporting. Accurate differentiation supports informed decision-making and long-term strategic planning.

Comparison Table

| Aspect | Sustainability Assurance | Financial Audit |

|---|---|---|

| Definition | Verification of a company's environmental, social, and governance (ESG) performance and sustainability reports. | Examination and verification of financial statements to ensure accuracy and compliance with accounting standards. |

| Primary Objective | Ensure reliability and credibility of sustainability disclosures. | Provide an opinion on the truthfulness and fairness of financial reports. |

| Scope | Environmental impact, social responsibility, governance practices. | Financial records, transactions, and internal controls. |

| Regulatory Framework | Guidelines include ISAE 3000, GRI Standards. | Governed by IFRS, GAAP, and auditing standards such as ISA. |

| Stakeholders | Investors, regulators, customers focused on ESG performance. | Shareholders, creditors, regulatory bodies requiring financial accuracy. |

| Frequency | Annual or periodic alongside sustainability reports. | Typically annual, aligned with financial reporting cycles. |

| Output | Assurance report on sustainability claims and ESG objectives. | Audit report expressing opinion on financial statements. |

| Expertise Required | Knowledge in ESG criteria, environmental science, social impact. | Accounting, financial analysis, auditing procedures. |

| Impact | Enhances transparency and trust in corporate sustainability. | Ensures financial integrity and investor confidence. |

Which is better?

Sustainability assurance evaluates the accuracy and reliability of a company's environmental, social, and governance (ESG) reporting, reflecting its commitment to responsible business practices and long-term value creation. Financial audits focus on verifying the accuracy of financial statements to ensure regulatory compliance and investor confidence in financial performance. Choosing between sustainability assurance and financial audit depends on whether the primary objective is enhancing corporate transparency in sustainability initiatives or validating financial integrity.

Connection

Sustainability assurance and financial audit are connected through their shared objective of enhancing the reliability and transparency of corporate reporting. Both processes involve independent verification of non-financial and financial information, ensuring stakeholders receive accurate data regarding a company's environmental, social, governance (ESG) performance and financial health. Integrating sustainability assurance with financial audit supports comprehensive risk assessment and strengthens overall corporate accountability.

Key Terms

**Financial Audit:**

Financial audit primarily evaluates the accuracy and fairness of an organization's financial statements, ensuring compliance with accounting standards and regulatory requirements. It involves detailed examination of financial records, internal controls, and transaction verifications to provide stakeholders with confidence in the reported financial position. Discover more about how financial audits safeguard fiscal integrity and drive transparency in corporate reporting.

Materiality

Financial audit emphasizes materiality based on quantitative thresholds related to financial misstatements affecting stakeholders' economic decisions. Sustainability assurance prioritizes materiality through a broader lens, integrating environmental, social, and governance (ESG) factors that influence long-term value creation and stakeholder trust. Explore the nuanced differences in materiality approaches to enhance your understanding of audit and assurance practices.

Internal Controls

Financial audit emphasizes verifying the accuracy and completeness of financial statements through rigorous testing of internal controls related to financial reporting. Sustainability assurance, on the other hand, focuses on assessing the effectiveness of internal controls that manage environmental, social, and governance (ESG) data to ensure reliable sustainability disclosures. Explore our detailed comparison to understand how these distinct assurance processes enhance organizational accountability.

Source and External Links

Financial Audit: Overview, and Best Practices - AuditBoard - A financial audit is a detailed examination of a company's financial statements (balance sheet, income statement, cash flows, equity changes) to ensure accuracy and fairness, involving key steps like preparation, team designation, execution, audit opinion formation, and action planning.

Financial audit - Wikipedia - A financial audit provides an opinion on the fairness of financial statements through analytical procedures and tests of balances, relying heavily on auditor judgment before issuing an audit report.

Caleb Hammer - Financial audit also refers to personal financial health reviews helping individuals take control of their finances, budgeting, and debt through education and coaching.

dowidth.com

dowidth.com