Microtransaction accounting focuses on recording and managing individual, often low-value, financial transactions to ensure precise tracking and reporting. Microbilling systems automate these processes, enabling businesses to efficiently handle numerous small charges by streamlining invoicing and payment collection. Explore how integrating microtransaction accounting with advanced microbilling systems optimizes financial accuracy and operational efficiency.

Why it is important

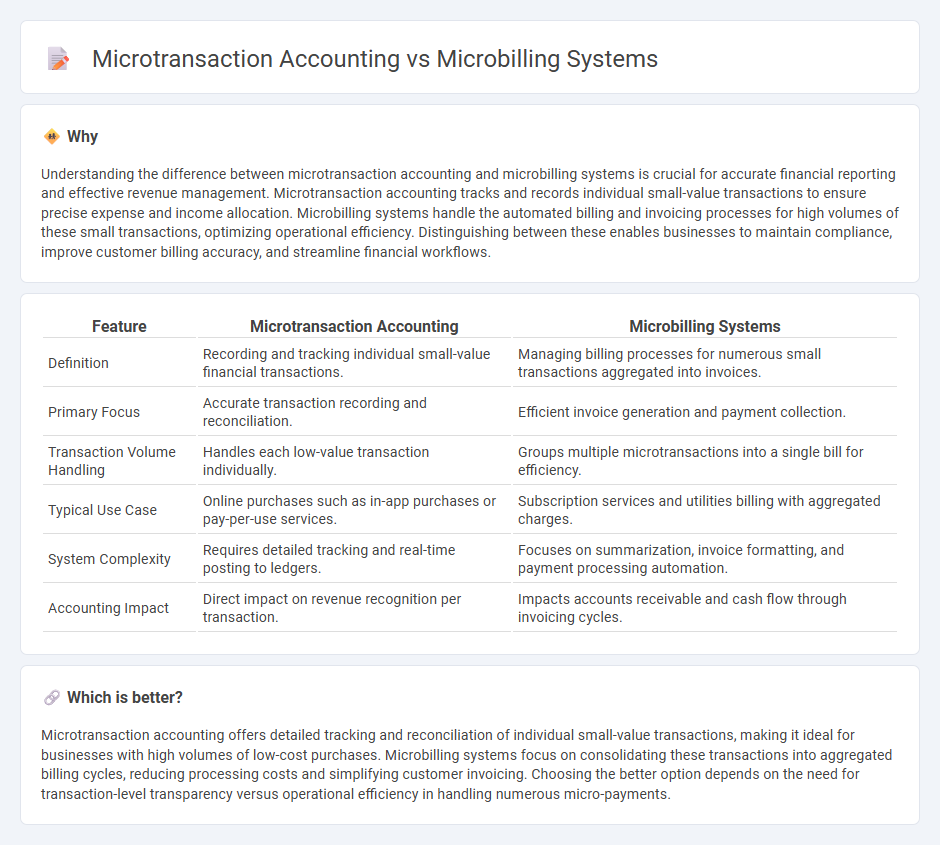

Understanding the difference between microtransaction accounting and microbilling systems is crucial for accurate financial reporting and effective revenue management. Microtransaction accounting tracks and records individual small-value transactions to ensure precise expense and income allocation. Microbilling systems handle the automated billing and invoicing processes for high volumes of these small transactions, optimizing operational efficiency. Distinguishing between these enables businesses to maintain compliance, improve customer billing accuracy, and streamline financial workflows.

Comparison Table

| Feature | Microtransaction Accounting | Microbilling Systems |

|---|---|---|

| Definition | Recording and tracking individual small-value financial transactions. | Managing billing processes for numerous small transactions aggregated into invoices. |

| Primary Focus | Accurate transaction recording and reconciliation. | Efficient invoice generation and payment collection. |

| Transaction Volume Handling | Handles each low-value transaction individually. | Groups multiple microtransactions into a single bill for efficiency. |

| Typical Use Case | Online purchases such as in-app purchases or pay-per-use services. | Subscription services and utilities billing with aggregated charges. |

| System Complexity | Requires detailed tracking and real-time posting to ledgers. | Focuses on summarization, invoice formatting, and payment processing automation. |

| Accounting Impact | Direct impact on revenue recognition per transaction. | Impacts accounts receivable and cash flow through invoicing cycles. |

Which is better?

Microtransaction accounting offers detailed tracking and reconciliation of individual small-value transactions, making it ideal for businesses with high volumes of low-cost purchases. Microbilling systems focus on consolidating these transactions into aggregated billing cycles, reducing processing costs and simplifying customer invoicing. Choosing the better option depends on the need for transaction-level transparency versus operational efficiency in handling numerous micro-payments.

Connection

Microtransaction accounting involves tracking and recording numerous small-value financial transactions, requiring precise data management and reconciliations to maintain accurate financial records. Microbilling systems automate the invoicing and payment processes for these minor transactions, enabling efficient handling of high transaction volumes with minimal administrative overhead. The integration of microtransaction accounting and microbilling systems ensures seamless financial tracking, reduces errors, and improves real-time revenue recognition in businesses dealing with micropayments.

Key Terms

Transaction Aggregation

Transaction aggregation in microbilling systems consolidates multiple small payments into a single charge, reducing processing fees and improving user experience. Microtransaction accounting emphasizes detailed tracking of individual transactions to ensure accurate revenue recognition and compliance. Explore the advantages and implementation strategies of transaction aggregation in optimizing microbilling efficiency.

Revenue Recognition

Microbilling systems efficiently manage numerous small-value transactions, ensuring accurate tracking and aggregation for revenue recognition purposes. Microtransaction accounting involves detailed recording and recognition of these minimal financial exchanges, aligning with regulatory standards to reflect true earnings. Explore comprehensive insights to optimize your revenue recognition strategies in microtransaction environments.

Cost Allocation

Microbilling systems streamline cost allocation by breaking down expenses into smaller, manageable units to enhance financial transparency and control. Microtransaction accounting captures each individual transaction's cost impact, enabling precise tracking and allocation of funds across departments or projects. Discover how integrating these methods can optimize your organization's financial accuracy and resource management.

Source and External Links

Micro Bill Systems - Wikipedia - Micro Bill Systems (MicroBillSys, MBS) is an online collection service considered malware that aggressively bills users for subscription services through disruptive pop-up windows, often linked to online gambling and adult sites, with a three-day free trial period that leads to automatic charges if not canceled.

Micropayments 101: A guide to get businesses started - Stripe - Micropayments allow for very small online financial transactions (often less than a dollar), using platforms where users preload accounts and then pay for tiny digital items or services, reducing transaction fees by aggregating payments.

What Are Micropayments? How Do They Work? [2023 Info] - Micropayments work via three main models--pay-as-you-go, prepay, and postpay--with aggregation methods used to reduce processing costs, enabling profitable payment for very small-value goods and services online.

dowidth.com

dowidth.com