Cryptotax focuses on the accurate reporting and tax compliance of cryptocurrency transactions, ensuring adherence to evolving tax regulations and minimizing liability risks. In contrast, auditing involves a comprehensive examination of financial records, including crypto assets, to verify their accuracy and compliance with accounting standards. Explore the differences between cryptotax and audit to optimize your financial management strategies.

Why it is important

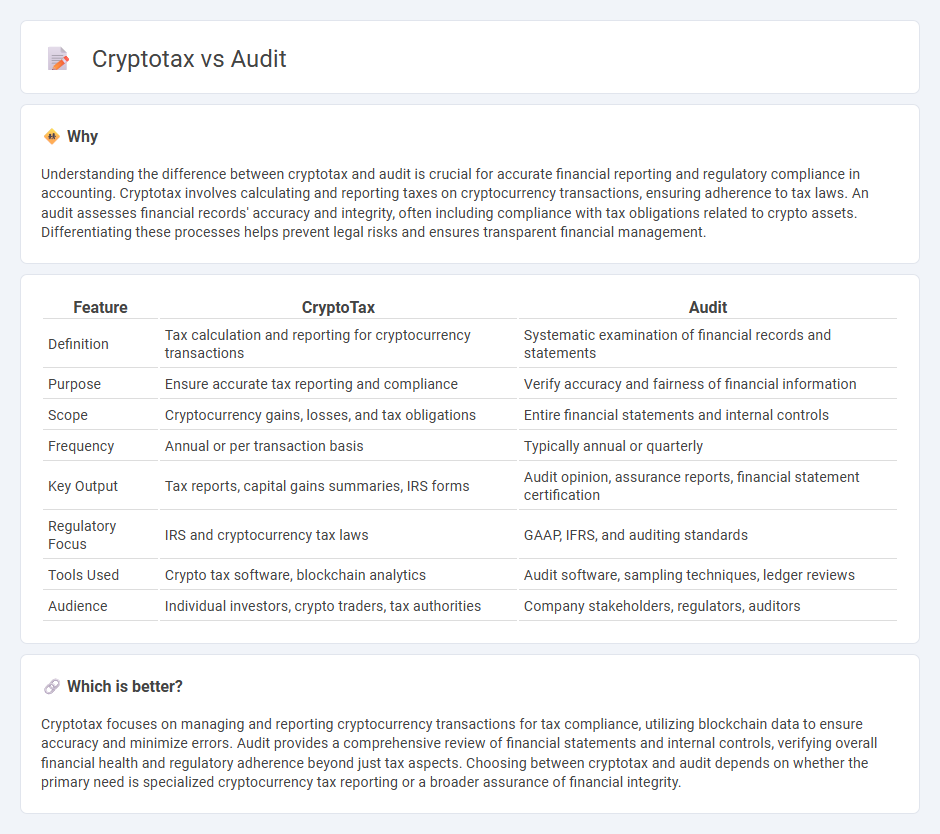

Understanding the difference between cryptotax and audit is crucial for accurate financial reporting and regulatory compliance in accounting. Cryptotax involves calculating and reporting taxes on cryptocurrency transactions, ensuring adherence to tax laws. An audit assesses financial records' accuracy and integrity, often including compliance with tax obligations related to crypto assets. Differentiating these processes helps prevent legal risks and ensures transparent financial management.

Comparison Table

| Feature | CryptoTax | Audit |

|---|---|---|

| Definition | Tax calculation and reporting for cryptocurrency transactions | Systematic examination of financial records and statements |

| Purpose | Ensure accurate tax reporting and compliance | Verify accuracy and fairness of financial information |

| Scope | Cryptocurrency gains, losses, and tax obligations | Entire financial statements and internal controls |

| Frequency | Annual or per transaction basis | Typically annual or quarterly |

| Key Output | Tax reports, capital gains summaries, IRS forms | Audit opinion, assurance reports, financial statement certification |

| Regulatory Focus | IRS and cryptocurrency tax laws | GAAP, IFRS, and auditing standards |

| Tools Used | Crypto tax software, blockchain analytics | Audit software, sampling techniques, ledger reviews |

| Audience | Individual investors, crypto traders, tax authorities | Company stakeholders, regulators, auditors |

Which is better?

Cryptotax focuses on managing and reporting cryptocurrency transactions for tax compliance, utilizing blockchain data to ensure accuracy and minimize errors. Audit provides a comprehensive review of financial statements and internal controls, verifying overall financial health and regulatory adherence beyond just tax aspects. Choosing between cryptotax and audit depends on whether the primary need is specialized cryptocurrency tax reporting or a broader assurance of financial integrity.

Connection

Crypto tax and audit are interconnected through the accurate reporting and verification of cryptocurrency transactions to ensure compliance with tax regulations. Audits assess the integrity of crypto tax filings by examining transaction records, wallet balances, and blockchain activity for discrepancies or potential fraud. Effective crypto tax management relies on audit processes to validate the legitimacy of reported income, gains, and losses within decentralized financial ecosystems.

Key Terms

Compliance

Audit processes in cryptocurrency primarily target the verification of transaction accuracy and adherence to financial reporting standards, ensuring transparent and reliable records for regulatory bodies. Cryptotax compliance emphasizes the accurate calculation and timely reporting of taxable events such as capital gains, income, and staking rewards within complex digital asset ecosystems. Explore detailed strategies to enhance compliance and mitigate risks in your crypto audit and tax processes.

Verification

Audit in the context of finance involves a comprehensive examination of financial statements and records to ensure accuracy and compliance with regulations. Crypto tax verification specifically targets the validation of cryptocurrency transactions and reported gains for tax purposes, often using blockchain analytics and transaction histories. Explore more on how audit processes differ from cryptotax verification to ensure regulatory adherence in digital assets.

Transparency

Audit processes enhance transparency in financial reporting by systematically verifying and validating records, which reduces errors and fraud risks in cryptocurrency transactions. Crypto tax compliance requires clear documentation of all digital asset activities, ensuring accurate tax calculations and legal adherence. Discover how maintaining transparency through audits and crypto tax solutions protects your investments and ensures regulatory compliance.

Source and External Links

What is an audit? - PwC Middle East - An audit is the independent examination of an organisation's financial report, including balance sheets and income statements, to determine if it fairly reflects the financial position at a given date, following auditing standards and resulting in an audit report with an opinion.

Audit - Wikipedia - An audit is an independent examination of financial information of any entity to express an opinion on its fairness, ensuring accounts are properly maintained and providing third-party assurance on the absence of material misstatement.

What is an Audit? - Types of Audits & Auditing Certification - ASQ - Auditing is an on-site verification activity of a process or quality system to ensure compliance with requirements, including first-party (internal), second-party (by customers), and third-party (independent) audits with various administrative purposes.

dowidth.com

dowidth.com