Fractional CFOs provide part-time financial leadership tailored for small to mid-sized businesses seeking strategic guidance without full-time commitment. Contract CFOs offer project-based financial expertise focused on specific objectives like audits, mergers, or financial restructuring. Discover how choosing between a fractional or contract CFO can optimize your company's financial management.

Why it is important

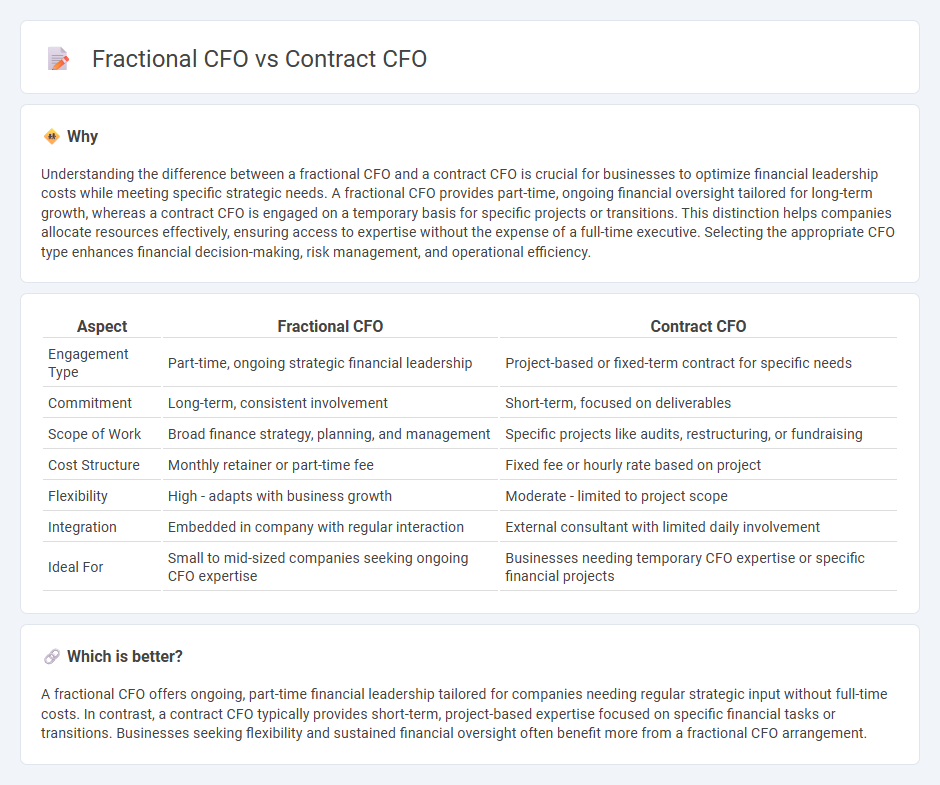

Understanding the difference between a fractional CFO and a contract CFO is crucial for businesses to optimize financial leadership costs while meeting specific strategic needs. A fractional CFO provides part-time, ongoing financial oversight tailored for long-term growth, whereas a contract CFO is engaged on a temporary basis for specific projects or transitions. This distinction helps companies allocate resources effectively, ensuring access to expertise without the expense of a full-time executive. Selecting the appropriate CFO type enhances financial decision-making, risk management, and operational efficiency.

Comparison Table

| Aspect | Fractional CFO | Contract CFO |

|---|---|---|

| Engagement Type | Part-time, ongoing strategic financial leadership | Project-based or fixed-term contract for specific needs |

| Commitment | Long-term, consistent involvement | Short-term, focused on deliverables |

| Scope of Work | Broad finance strategy, planning, and management | Specific projects like audits, restructuring, or fundraising |

| Cost Structure | Monthly retainer or part-time fee | Fixed fee or hourly rate based on project |

| Flexibility | High - adapts with business growth | Moderate - limited to project scope |

| Integration | Embedded in company with regular interaction | External consultant with limited daily involvement |

| Ideal For | Small to mid-sized companies seeking ongoing CFO expertise | Businesses needing temporary CFO expertise or specific financial projects |

Which is better?

A fractional CFO offers ongoing, part-time financial leadership tailored for companies needing regular strategic input without full-time costs. In contrast, a contract CFO typically provides short-term, project-based expertise focused on specific financial tasks or transitions. Businesses seeking flexibility and sustained financial oversight often benefit more from a fractional CFO arrangement.

Connection

Fractional CFOs and contract CFOs both provide flexible, part-time financial leadership tailored to business needs, sharing expertise in financial strategy, budgeting, and reporting without the commitment of a full-time role. These professionals help companies optimize cash flow, improve financial controls, and support growth initiatives by delivering high-level CFO services on a scalable basis. Businesses leverage fractional or contract CFOs to access executive financial insights while managing costs efficiently during transitional phases or fluctuating workloads.

Key Terms

Engagement Structure

Contract CFOs typically work on a project basis with fixed terms and specific deliverables, often providing expertise during critical financial events like mergers or fundraising. Fractional CFOs offer part-time, ongoing financial leadership tailored to the company's evolving needs, integrating closely with the management team for strategic planning and daily operations. Explore the key differences in engagement structure to determine which CFO model best aligns with your business goals.

Scope of Services

Contract CFOs typically engage in short-term projects or specific financial tasks like fundraising, audits, or financial reporting, offering targeted expertise without ongoing involvement. Fractional CFOs provide continuous, part-time leadership, overseeing comprehensive financial strategies, budgeting, cash flow management, and long-term planning tailored to business growth. Explore more to determine which CFO model aligns best with your company's financial needs and goals.

Compensation Model

Contract CFOs typically receive a fixed fee or hourly rate based on the scope and duration of their engagement, offering predictable budgeting for companies needing short-term expertise. Fractional CFOs often follow a retainer or part-time salary model aligned with ongoing strategic involvement, providing flexible financial leadership at a reduced cost compared to full-time executives. Explore detailed comparisons to determine which compensation model best fits your organization's financial leadership needs.

Source and External Links

Contract CFO - Bennett, Bennett & Trice, PLLC - A contract CFO provides expert financial oversight for businesses experiencing growth or needing financial guidance without affording a full-time CFO, helping identify strengths, weaknesses, risks, and opportunities to align finances with long-term goals while saving costs.

When Does It Make Sense to Hire a Contract CFO? - Hiring a contract CFO is ideal for small to mid-sized businesses needing flexible, broad financial expertise without full-time commitment, but is less suitable when frequent onsite presence or constant management consultation is required.

Is It Time? Signs You Need a Contract CFO - Key signs to hire a contract CFO include rapid business growth, financial uncertainty, or preparing for investment or sale, offering strategic financial planning, risk management, and due diligence preparation without permanent hire obligations.

dowidth.com

dowidth.com