Data lake reconciliation involves aligning data from large, diverse data repositories to ensure accuracy and consistency across financial records, while book-to-bank reconciliation focuses on matching internal accounting books with external bank statements to identify discrepancies. Both processes are critical for maintaining financial integrity, yet data lake reconciliation addresses broader data integration challenges, essential for complex financial environments. Explore the differences and applications of these reconciliation methods to enhance your accounting accuracy and efficiency.

Why it is important

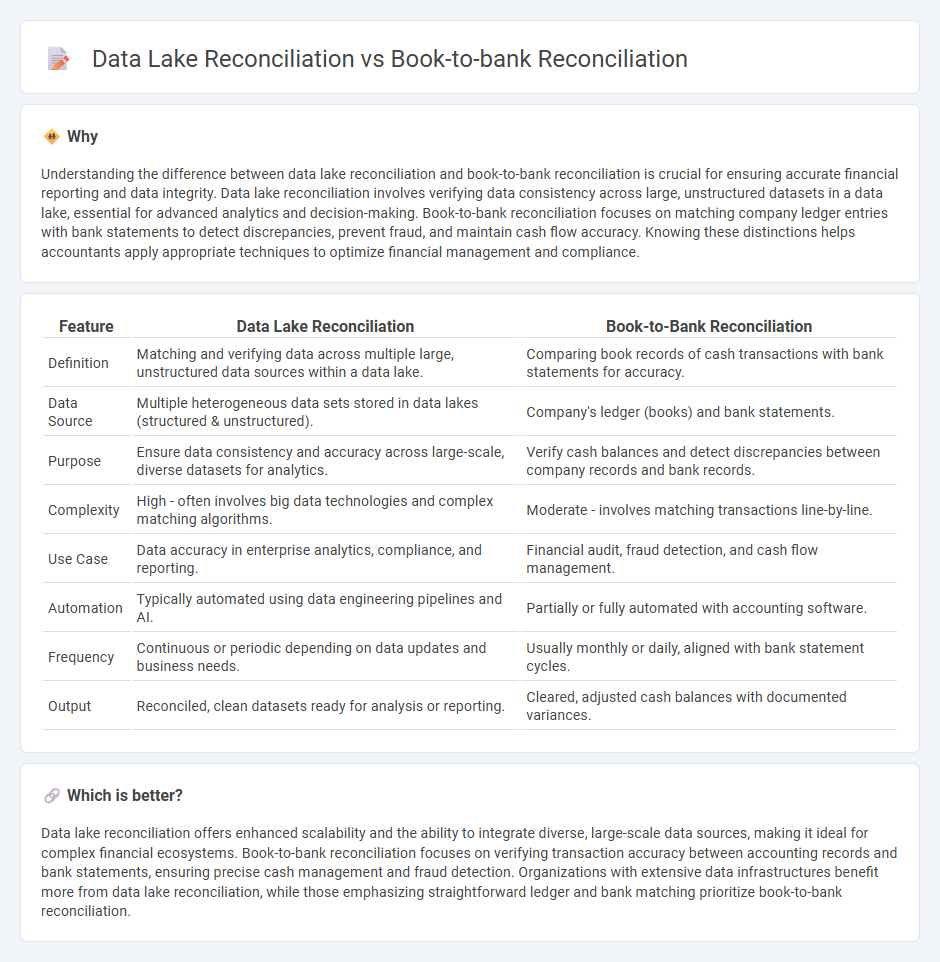

Understanding the difference between data lake reconciliation and book-to-bank reconciliation is crucial for ensuring accurate financial reporting and data integrity. Data lake reconciliation involves verifying data consistency across large, unstructured datasets in a data lake, essential for advanced analytics and decision-making. Book-to-bank reconciliation focuses on matching company ledger entries with bank statements to detect discrepancies, prevent fraud, and maintain cash flow accuracy. Knowing these distinctions helps accountants apply appropriate techniques to optimize financial management and compliance.

Comparison Table

| Feature | Data Lake Reconciliation | Book-to-Bank Reconciliation |

|---|---|---|

| Definition | Matching and verifying data across multiple large, unstructured data sources within a data lake. | Comparing book records of cash transactions with bank statements for accuracy. |

| Data Source | Multiple heterogeneous data sets stored in data lakes (structured & unstructured). | Company's ledger (books) and bank statements. |

| Purpose | Ensure data consistency and accuracy across large-scale, diverse datasets for analytics. | Verify cash balances and detect discrepancies between company records and bank records. |

| Complexity | High - often involves big data technologies and complex matching algorithms. | Moderate - involves matching transactions line-by-line. |

| Use Case | Data accuracy in enterprise analytics, compliance, and reporting. | Financial audit, fraud detection, and cash flow management. |

| Automation | Typically automated using data engineering pipelines and AI. | Partially or fully automated with accounting software. |

| Frequency | Continuous or periodic depending on data updates and business needs. | Usually monthly or daily, aligned with bank statement cycles. |

| Output | Reconciled, clean datasets ready for analysis or reporting. | Cleared, adjusted cash balances with documented variances. |

Which is better?

Data lake reconciliation offers enhanced scalability and the ability to integrate diverse, large-scale data sources, making it ideal for complex financial ecosystems. Book-to-bank reconciliation focuses on verifying transaction accuracy between accounting records and bank statements, ensuring precise cash management and fraud detection. Organizations with extensive data infrastructures benefit more from data lake reconciliation, while those emphasizing straightforward ledger and bank matching prioritize book-to-bank reconciliation.

Connection

Data lake reconciliation streamlines the process of matching large volumes of unstructured financial data by consolidating multiple sources into a centralized repository, enhancing the accuracy of book-to-bank reconciliation. Book-to-bank reconciliation verifies ledger entries against bank statements to ensure accurate cash flow tracking and financial reporting; data lakes provide the raw, harmonized data necessary for efficient validation. Integrating data lake reconciliation with book-to-bank reconciliation reduces discrepancies, accelerates error detection, and supports regulatory compliance in accounting operations.

Key Terms

Outstanding Items

Book-to-bank reconciliation focuses on matching bank statement records with a company's cash book to identify discrepancies such as outstanding checks or deposits in transit. Data lake reconciliation involves comparing large volumes of diverse data sources to identify inconsistencies or missing entries, often highlighting outstanding items in financial or operational datasets across systems. Explore how advanced reconciliation techniques can improve accuracy and efficiency in managing outstanding items across various platforms.

Data Integration

Book-to-bank reconciliation ensures financial records align with bank statements by integrating transaction data from accounting systems and banks, emphasizing accuracy and fraud detection. Data lake reconciliation focuses on integrating diverse, large-scale datasets from multiple sources, ensuring data consistency and completeness within centralized data repositories. Explore deeper insights into how data integration techniques optimize both reconciliation processes and enhance organizational reliability.

Matching Algorithms

Book-to-bank reconciliation employs rule-based matching algorithms that compare transaction amounts, dates, and references to identify discrepancies between company records and bank statements. Data lake reconciliation utilizes advanced machine learning models and fuzzy matching techniques to handle vast, diverse datasets and detect patterns across multiple data sources. Explore the complexities and innovations in matching algorithms to optimize reconciliation processes.

Source and External Links

Understanding Book to Bank Reconciliation - Book-to-bank reconciliation compares the bank statement balances against the system's general ledger bank balance for a fiscal period, adjusting for timing differences and first notice items, and is confirmed before continuing with the general ledger closing process.

How to Do a Bank Reconciliation? Step-By-Step Process - The book-to-bank method starts with the company's ledger balance and reconciles it against the bank statement by identifying outstanding checks, deposits in transit, and making necessary adjustments.

Performing Book-to-Bank Reconciliation - The process involves making appropriate adjustments to align the ledger and bank balances and confirming the statement as reconciled before proceeding with the general ledger close.

dowidth.com

dowidth.com