Deferred revenue recognition records income when cash is received before the goods or services are delivered, aligning with the revenue recognition principle. Accrual basis accounting recognizes revenues and expenses when they are incurred, regardless of cash flow, providing a more accurate financial picture. Explore the key differences and their impact on financial statements to deepen your understanding.

Why it is important

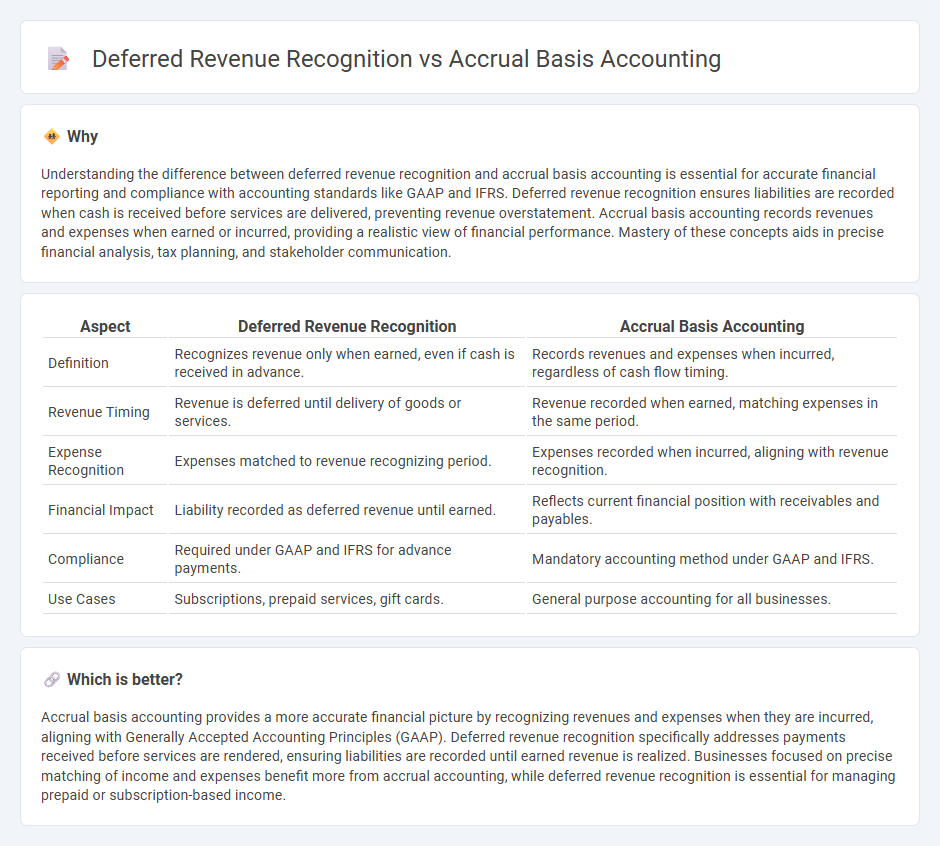

Understanding the difference between deferred revenue recognition and accrual basis accounting is essential for accurate financial reporting and compliance with accounting standards like GAAP and IFRS. Deferred revenue recognition ensures liabilities are recorded when cash is received before services are delivered, preventing revenue overstatement. Accrual basis accounting records revenues and expenses when earned or incurred, providing a realistic view of financial performance. Mastery of these concepts aids in precise financial analysis, tax planning, and stakeholder communication.

Comparison Table

| Aspect | Deferred Revenue Recognition | Accrual Basis Accounting |

|---|---|---|

| Definition | Recognizes revenue only when earned, even if cash is received in advance. | Records revenues and expenses when incurred, regardless of cash flow timing. |

| Revenue Timing | Revenue is deferred until delivery of goods or services. | Revenue recorded when earned, matching expenses in the same period. |

| Expense Recognition | Expenses matched to revenue recognizing period. | Expenses recorded when incurred, aligning with revenue recognition. |

| Financial Impact | Liability recorded as deferred revenue until earned. | Reflects current financial position with receivables and payables. |

| Compliance | Required under GAAP and IFRS for advance payments. | Mandatory accounting method under GAAP and IFRS. |

| Use Cases | Subscriptions, prepaid services, gift cards. | General purpose accounting for all businesses. |

Which is better?

Accrual basis accounting provides a more accurate financial picture by recognizing revenues and expenses when they are incurred, aligning with Generally Accepted Accounting Principles (GAAP). Deferred revenue recognition specifically addresses payments received before services are rendered, ensuring liabilities are recorded until earned revenue is realized. Businesses focused on precise matching of income and expenses benefit more from accrual accounting, while deferred revenue recognition is essential for managing prepaid or subscription-based income.

Connection

Deferred revenue recognition and accrual basis accounting are interconnected through the matching principle, ensuring revenues are recorded when earned rather than when cash is received. Accrual accounting requires recognizing deferred revenue as a liability until the goods or services are delivered, aligning revenue with corresponding expenses in the same accounting period. This connection provides a more accurate financial position and performance measurement for businesses by adhering to Generally Accepted Accounting Principles (GAAP).

Key Terms

Revenue Recognition

Accrual basis accounting records revenue when earned, regardless of cash receipt, ensuring financial statements reflect the true economic activity. Deferred revenue recognition, a key component, arises when payment is received before the service or product delivery, and is recorded as a liability until earned. Explore more to understand how these practices impact financial accuracy and compliance.

Matching Principle

Accrual basis accounting records revenues and expenses when they are earned or incurred, aligning with the Matching Principle by ensuring expenses are recognized in the same period as the related revenues. Deferred revenue recognition involves recording cash received before delivering goods or services as a liability, which is then recognized as revenue when the performance obligation is satisfied. Explore deeper insights into how these accounting methods impact financial reporting and compliance with regulatory standards.

Unearned Revenue

Accrual basis accounting records revenues when earned, not necessarily when cash is received, contrasting with deferred revenue recognition where cash is received before services or goods are delivered, leading to unearned revenue, a liability on the balance sheet. Unearned revenue represents obligations that must be fulfilled before revenue can be recognized, ensuring accurate matching of income with related expenses per GAAP standards. Explore the nuances of unearned revenue and its impact on financial statements for deeper accounting insights.

Source and External Links

Accrual-Based Accounting Explained - Accrual basis accounting recognizes revenues when earned and expenses when incurred, providing an accurate financial picture by matching revenues with expenses.

Accrual Basis of Accounting Definition - The accrual basis of accounting records revenues when earned and expenses as incurred, aligning with GAAP and IFRS standards for financial reporting.

Accrual Accounting Guide - Accrual accounting involves recording revenues and expenses when they are earned or incurred, regardless of when cash is exchanged, matching revenues with expenses for financial clarity.

dowidth.com

dowidth.com