Real-time expense management provides instantaneous tracking and categorization of financial transactions, enhancing accuracy and enabling proactive budget control. Periodic expense reporting aggregates expenses over set intervals, such as monthly or quarterly, offering comprehensive summaries for financial analysis and compliance. Discover how these accounting methods can optimize your business's financial oversight.

Why it is important

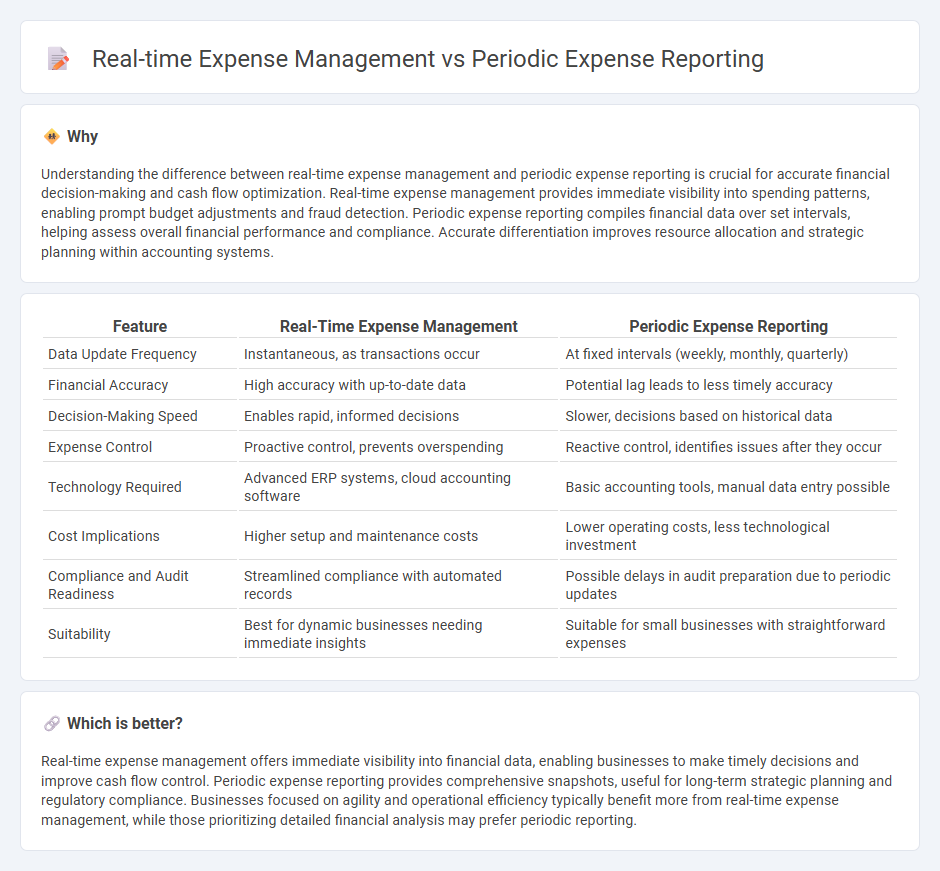

Understanding the difference between real-time expense management and periodic expense reporting is crucial for accurate financial decision-making and cash flow optimization. Real-time expense management provides immediate visibility into spending patterns, enabling prompt budget adjustments and fraud detection. Periodic expense reporting compiles financial data over set intervals, helping assess overall financial performance and compliance. Accurate differentiation improves resource allocation and strategic planning within accounting systems.

Comparison Table

| Feature | Real-Time Expense Management | Periodic Expense Reporting |

|---|---|---|

| Data Update Frequency | Instantaneous, as transactions occur | At fixed intervals (weekly, monthly, quarterly) |

| Financial Accuracy | High accuracy with up-to-date data | Potential lag leads to less timely accuracy |

| Decision-Making Speed | Enables rapid, informed decisions | Slower, decisions based on historical data |

| Expense Control | Proactive control, prevents overspending | Reactive control, identifies issues after they occur |

| Technology Required | Advanced ERP systems, cloud accounting software | Basic accounting tools, manual data entry possible |

| Cost Implications | Higher setup and maintenance costs | Lower operating costs, less technological investment |

| Compliance and Audit Readiness | Streamlined compliance with automated records | Possible delays in audit preparation due to periodic updates |

| Suitability | Best for dynamic businesses needing immediate insights | Suitable for small businesses with straightforward expenses |

Which is better?

Real-time expense management offers immediate visibility into financial data, enabling businesses to make timely decisions and improve cash flow control. Periodic expense reporting provides comprehensive snapshots, useful for long-term strategic planning and regulatory compliance. Businesses focused on agility and operational efficiency typically benefit more from real-time expense management, while those prioritizing detailed financial analysis may prefer periodic reporting.

Connection

Real-time expense management provides continuous tracking and immediate categorization of financial transactions, which enhances the accuracy and completeness of data used in periodic expense reporting. Periodic expense reporting relies on this up-to-date, detailed information to generate comprehensive financial statements and budgets for specific accounting periods. This connection improves financial decision-making by ensuring expense insights are both timely and aligned with reporting cycles, optimizing cash flow control and compliance.

Key Terms

Accrual Basis

Accrual basis accounting records expenses when incurred, making real-time expense management more aligned with accurate financial tracking compared to periodic expense reporting. Real-time systems update expenses instantly, improving cash flow forecasting and financial decision-making, while periodic reporting can cause delays and discrepancies. Explore how adopting real-time expense management enhances accrual accounting accuracy and operational efficiency.

Expense Recognition

Periodic expense reporting provides retrospective financial insights by summarizing costs at regular intervals, often leading to delayed recognition and potential cash flow challenges. Real-time expense management enables immediate tracking and recognition of expenses, improving accuracy and enhancing decision-making for timely budget adjustments. Explore how real-time expense recognition can transform your financial control and operational efficiency.

Cash Flow Timing

Periodic expense reporting provides retrospective insights into cash outflows, often resulting in delayed adjustments to cash flow timing and potential cash shortages. Real-time expense management enables immediate tracking and control over expenditures, optimizing cash flow timing by aligning payments with actual business needs. Discover how integrating real-time expense management can enhance your organization's financial fluidity and decision-making accuracy.

dowidth.com

dowidth.com