Payroll automation streamlines salary calculations, tax withholdings, and compliance reporting, significantly reducing errors and saving time compared to manual payroll processing. Manual payroll methods often involve repetitive data entry, increasing the chance of mistakes and delaying payment cycles. Discover how adopting payroll automation can enhance accuracy and efficiency in your accounting processes.

Why it is important

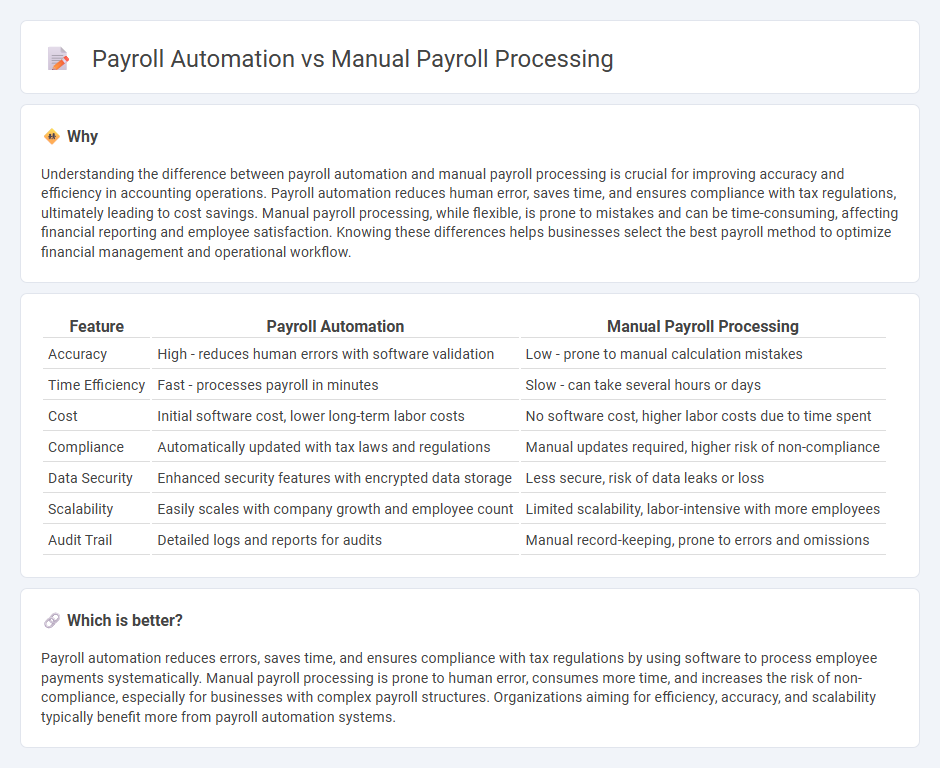

Understanding the difference between payroll automation and manual payroll processing is crucial for improving accuracy and efficiency in accounting operations. Payroll automation reduces human error, saves time, and ensures compliance with tax regulations, ultimately leading to cost savings. Manual payroll processing, while flexible, is prone to mistakes and can be time-consuming, affecting financial reporting and employee satisfaction. Knowing these differences helps businesses select the best payroll method to optimize financial management and operational workflow.

Comparison Table

| Feature | Payroll Automation | Manual Payroll Processing |

|---|---|---|

| Accuracy | High - reduces human errors with software validation | Low - prone to manual calculation mistakes |

| Time Efficiency | Fast - processes payroll in minutes | Slow - can take several hours or days |

| Cost | Initial software cost, lower long-term labor costs | No software cost, higher labor costs due to time spent |

| Compliance | Automatically updated with tax laws and regulations | Manual updates required, higher risk of non-compliance |

| Data Security | Enhanced security features with encrypted data storage | Less secure, risk of data leaks or loss |

| Scalability | Easily scales with company growth and employee count | Limited scalability, labor-intensive with more employees |

| Audit Trail | Detailed logs and reports for audits | Manual record-keeping, prone to errors and omissions |

Which is better?

Payroll automation reduces errors, saves time, and ensures compliance with tax regulations by using software to process employee payments systematically. Manual payroll processing is prone to human error, consumes more time, and increases the risk of non-compliance, especially for businesses with complex payroll structures. Organizations aiming for efficiency, accuracy, and scalability typically benefit more from payroll automation systems.

Connection

Payroll automation streamlines payroll processing by reducing manual data entry errors, saving time, and ensuring compliance with tax regulations. Manual payroll processing often serves as a fallback for auditing or resolving discrepancies that automation cannot address directly. Combining both methods ensures payroll accuracy, enhances security, and maintains comprehensive financial records within accounting systems.

Key Terms

Manual Payroll Processing:

Manual payroll processing involves calculating employee wages, taxes, and deductions by hand, relying heavily on spreadsheets and physical records. This traditional method is prone to human errors, time-consuming, and can lead to delays in payment and compliance risks. Explore how manual payroll processing impacts accuracy and efficiency in your business by learning more today.

Timesheets

Manual payroll processing relies heavily on physical timesheets prone to errors and delays, increasing administrative workload and risking compliance issues. Payroll automation integrates digital timesheets that automatically capture and calculate work hours, ensuring accuracy and real-time updates. Explore how transitioning from manual timesheets to automated solutions can enhance payroll efficiency and accuracy.

Payroll Registers

Manual payroll processing requires maintaining payroll registers by hand, increasing the risk of errors and time consumption during data entry and calculations. Payroll automation generates accurate payroll registers in real-time, improving compliance and reducing administrative workload. Explore how automated payroll registers can transform your payroll management for enhanced efficiency.

Source and External Links

How to run payroll without software - ADP - Manual payroll processing involves collecting employee data, calculating gross pay, deducting taxes and other withholdings, determining net pay, and maintaining accurate records--all done by hand, which is practical for small businesses but requires meticulous attention to detail and compliance with tax laws.

How to Do Payroll Yourself | Manual Calculations or Software - Running payroll manually means tracking employee hours, calculating wages and deductions, distributing pay, and filing taxes yourself, offering full control but increasing the risk of errors and consuming significant time each pay period.

Manual Payroll v. Automated - TCP Software - Manual payroll requires writing checks or processing direct deposits, documenting all payroll details for compliance, and preparing and filing tax reports manually, with the process becoming increasingly burdensome and risky as a business grows.

dowidth.com

dowidth.com