Forensic analytics focuses on examining financial data to detect fraud, errors, and irregularities through detailed investigation techniques. Risk assessment identifies and evaluates potential financial threats to prevent losses and ensure compliance with regulatory standards. Explore how integrating forensic analytics with risk assessment enhances financial oversight and decision-making.

Why it is important

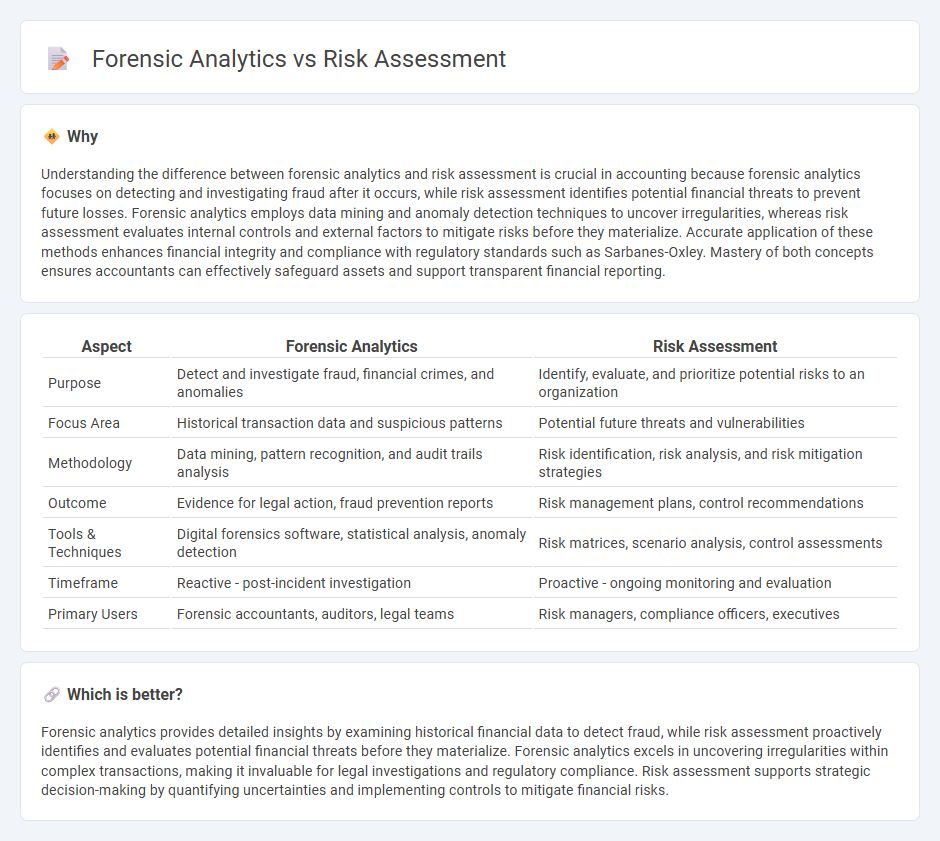

Understanding the difference between forensic analytics and risk assessment is crucial in accounting because forensic analytics focuses on detecting and investigating fraud after it occurs, while risk assessment identifies potential financial threats to prevent future losses. Forensic analytics employs data mining and anomaly detection techniques to uncover irregularities, whereas risk assessment evaluates internal controls and external factors to mitigate risks before they materialize. Accurate application of these methods enhances financial integrity and compliance with regulatory standards such as Sarbanes-Oxley. Mastery of both concepts ensures accountants can effectively safeguard assets and support transparent financial reporting.

Comparison Table

| Aspect | Forensic Analytics | Risk Assessment |

|---|---|---|

| Purpose | Detect and investigate fraud, financial crimes, and anomalies | Identify, evaluate, and prioritize potential risks to an organization |

| Focus Area | Historical transaction data and suspicious patterns | Potential future threats and vulnerabilities |

| Methodology | Data mining, pattern recognition, and audit trails analysis | Risk identification, risk analysis, and risk mitigation strategies |

| Outcome | Evidence for legal action, fraud prevention reports | Risk management plans, control recommendations |

| Tools & Techniques | Digital forensics software, statistical analysis, anomaly detection | Risk matrices, scenario analysis, control assessments |

| Timeframe | Reactive - post-incident investigation | Proactive - ongoing monitoring and evaluation |

| Primary Users | Forensic accountants, auditors, legal teams | Risk managers, compliance officers, executives |

Which is better?

Forensic analytics provides detailed insights by examining historical financial data to detect fraud, while risk assessment proactively identifies and evaluates potential financial threats before they materialize. Forensic analytics excels in uncovering irregularities within complex transactions, making it invaluable for legal investigations and regulatory compliance. Risk assessment supports strategic decision-making by quantifying uncertainties and implementing controls to mitigate financial risks.

Connection

Forensic analytics and risk assessment are interconnected through their focus on identifying and mitigating financial fraud and errors within accounting processes. Forensic analytics employs advanced data analysis techniques to detect anomalies and suspicious transactions that indicate potential fraud, while risk assessment evaluates these vulnerabilities to prioritize areas requiring stronger internal controls. Together, they enhance the accuracy of financial reporting and strengthen organizational safeguards against financial misconduct.

Key Terms

Inherent Risk

Inherent risk refers to the exposure to potential loss in the absence of any controls or mitigation efforts within both risk assessment and forensic analytics. While risk assessment evaluates inherent risk to prioritize areas needing control implementation, forensic analytics investigates suspicious activities by analyzing data patterns associated with such risks. Explore detailed differences and applications of inherent risk in these fields to enhance your risk management strategies.

Data Mining

Risk assessment uses data mining techniques to identify potential vulnerabilities and predict future risks by analyzing historical data patterns and trends. Forensic analytics applies data mining to detect anomalies and fraud within transactional data, ensuring detailed investigation and evidence collection. Explore how advanced data mining enhances both disciplines for comprehensive risk management and fraud detection.

Fraud Detection

Risk assessment utilizes predictive models and historical data to identify potential fraud vulnerabilities, emphasizing preventative measures. Forensic analytics investigates past transactions and anomalies to uncover confirmed fraudulent activities and support legal actions. Explore deeper insights into how these approaches complement each other in robust fraud detection strategies.

Source and External Links

Risk assessment - Risk assessment is a systematic process for identifying hazards, evaluating their likelihood and potential impact, and determining actions to mitigate negative effects on individuals, assets, or the environment.

Risk Assessment: Process, Tools, & Techniques - A risk assessment involves identifying potential hazards, analyzing the consequences if they occur, and deciding on measures to eliminate or control risks, especially to protect health and safety in the workplace.

Risk assessment: An overview - Risk assessment is the process of identifying, analyzing, and evaluating risks to understand potential threats and develop strategies to mitigate them, supporting both organizational decision-making and public safety.

dowidth.com

dowidth.com