Real-time expense recognition records costs as they occur, providing immediate and accurate financial insights, whereas estimation methods rely on predictive models and historical data to approximate expenses. This distinction impacts cash flow analysis, budgeting accuracy, and compliance with accounting standards such as GAAP or IFRS. Explore more to understand how each method influences financial decision-making and reporting precision.

Why it is important

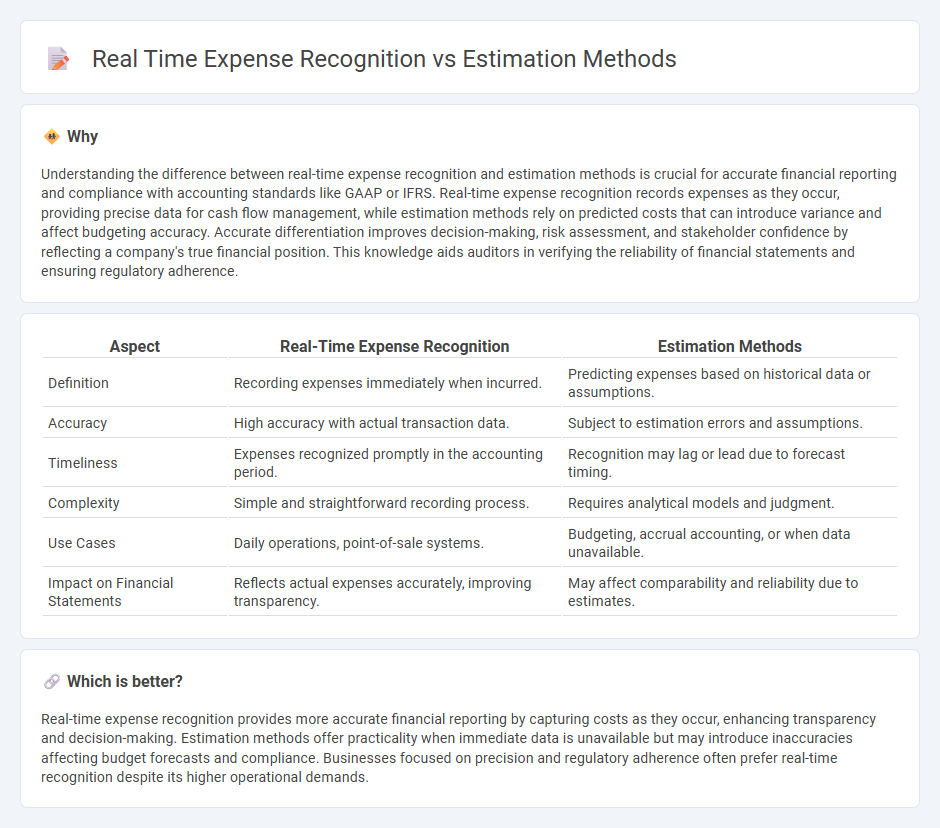

Understanding the difference between real-time expense recognition and estimation methods is crucial for accurate financial reporting and compliance with accounting standards like GAAP or IFRS. Real-time expense recognition records expenses as they occur, providing precise data for cash flow management, while estimation methods rely on predicted costs that can introduce variance and affect budgeting accuracy. Accurate differentiation improves decision-making, risk assessment, and stakeholder confidence by reflecting a company's true financial position. This knowledge aids auditors in verifying the reliability of financial statements and ensuring regulatory adherence.

Comparison Table

| Aspect | Real-Time Expense Recognition | Estimation Methods |

|---|---|---|

| Definition | Recording expenses immediately when incurred. | Predicting expenses based on historical data or assumptions. |

| Accuracy | High accuracy with actual transaction data. | Subject to estimation errors and assumptions. |

| Timeliness | Expenses recognized promptly in the accounting period. | Recognition may lag or lead due to forecast timing. |

| Complexity | Simple and straightforward recording process. | Requires analytical models and judgment. |

| Use Cases | Daily operations, point-of-sale systems. | Budgeting, accrual accounting, or when data unavailable. |

| Impact on Financial Statements | Reflects actual expenses accurately, improving transparency. | May affect comparability and reliability due to estimates. |

Which is better?

Real-time expense recognition provides more accurate financial reporting by capturing costs as they occur, enhancing transparency and decision-making. Estimation methods offer practicality when immediate data is unavailable but may introduce inaccuracies affecting budget forecasts and compliance. Businesses focused on precision and regulatory adherence often prefer real-time recognition despite its higher operational demands.

Connection

Real-time expense recognition relies on continuous data capture to accurately record financial transactions as they occur, enhancing financial transparency and decision-making. Estimation methods complement this by providing predictive insights where immediate data is unavailable, allowing for timely recognition of anticipated costs. Together, these approaches ensure comprehensive expense tracking, improve financial accuracy, and support dynamic budgeting processes in accounting systems.

Key Terms

Accrual Basis

Accrual basis accounting records expenses when they are incurred rather than when cash is paid, ensuring accurate matching of expenses to revenues within the same period. Estimation methods under accrual accounting involve predicting costs such as unbilled expenses to provide timely financial information, while real-time expense recognition captures costs as they occur, enhancing precision and reducing reliance on approximations. Explore more about the advantages of accrual-based expense recognition for improved financial reporting.

Matching Principle

Estimation methods allocate expenses to periods based on anticipated costs, ensuring alignment with revenues under the Matching Principle, while real-time expense recognition records costs as they occur, providing precise financial data. Estimation supports smoother financial reporting by matching expenses to the associated revenue period despite uncertain timing, whereas real-time recognition enhances accuracy but may lead to fluctuations. Explore detailed insights on how these approaches impact financial statements and compliance with accrual accounting standards.

Historical Cost

Historical cost accounting relies on estimation methods to record expenses based on actual transaction values rather than current market prices, ensuring consistency and verifiability in financial reporting. Real-time expense recognition captures costs as they occur, providing timely financial information but often requiring complex adjustments for accuracy. Explore the advantages and limitations of both approaches in historical cost accounting to enhance your understanding of expense recognition methodologies.

Source and External Links

6 Successful Project Estimation Techniques in 2025 - Simplilearn.com - Describes key estimation methods including Top-Down, Bottom-Up, Analogous, Parametric, Three-point Estimating (PERT), and What-If Analysis, with detailed steps like breaking down scope into work packages and assessing resources and risks for accurate project estimates.

6 Project Estimation Techniques: Pros + Cons - Explains major estimation methods such as Expert Judgment, Analogous, Parametric, and Top-down Estimating, highlighting their suitability, benefits, and limitations depending on project type and phase.

Project Estimation [Methods & Best Practices] | The Workstream - Covers Parametric, Bottom-up, and Top-down estimation methods focusing on their approach, accuracy, and best use cases, emphasizing the balance between detail and efficiency in project planning.

dowidth.com

dowidth.com