Continuous close streamlines financial reporting by updating accounting records in real-time, reducing delays and improving accuracy. Monthly close consolidates financial statements at the end of each period, ensuring comprehensive review and reconciliation of accounts. Explore the benefits and implementation strategies of continuous close compared to monthly close for efficient accounting processes.

Why it is important

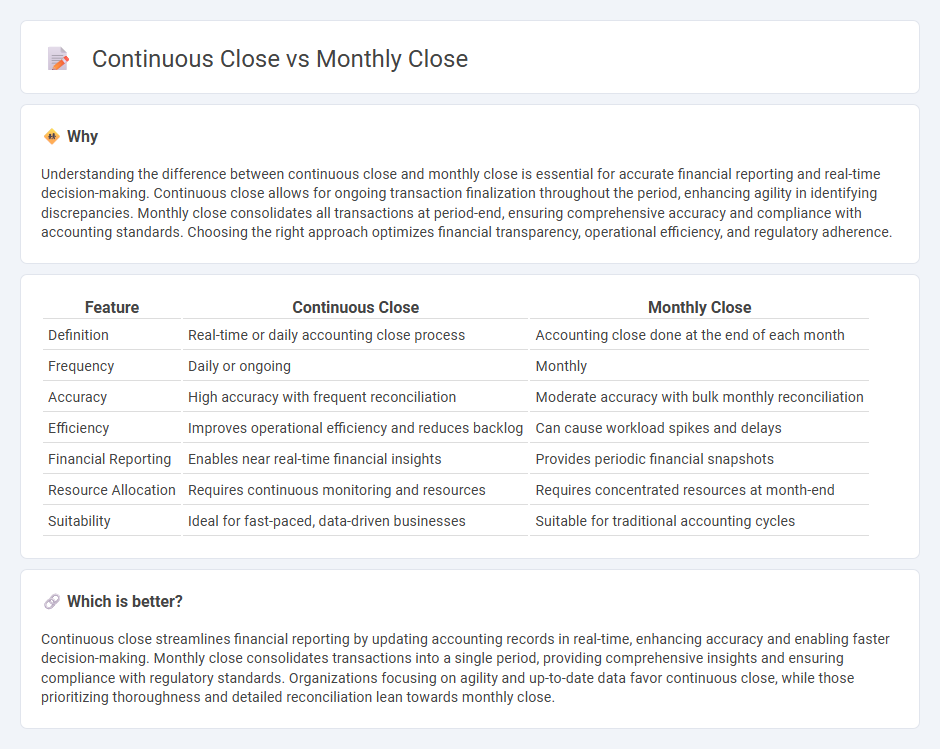

Understanding the difference between continuous close and monthly close is essential for accurate financial reporting and real-time decision-making. Continuous close allows for ongoing transaction finalization throughout the period, enhancing agility in identifying discrepancies. Monthly close consolidates all transactions at period-end, ensuring comprehensive accuracy and compliance with accounting standards. Choosing the right approach optimizes financial transparency, operational efficiency, and regulatory adherence.

Comparison Table

| Feature | Continuous Close | Monthly Close |

|---|---|---|

| Definition | Real-time or daily accounting close process | Accounting close done at the end of each month |

| Frequency | Daily or ongoing | Monthly |

| Accuracy | High accuracy with frequent reconciliation | Moderate accuracy with bulk monthly reconciliation |

| Efficiency | Improves operational efficiency and reduces backlog | Can cause workload spikes and delays |

| Financial Reporting | Enables near real-time financial insights | Provides periodic financial snapshots |

| Resource Allocation | Requires continuous monitoring and resources | Requires concentrated resources at month-end |

| Suitability | Ideal for fast-paced, data-driven businesses | Suitable for traditional accounting cycles |

Which is better?

Continuous close streamlines financial reporting by updating accounting records in real-time, enhancing accuracy and enabling faster decision-making. Monthly close consolidates transactions into a single period, providing comprehensive insights and ensuring compliance with regulatory standards. Organizations focusing on agility and up-to-date data favor continuous close, while those prioritizing thoroughness and detailed reconciliation lean towards monthly close.

Connection

Continuous close and monthly close are interconnected accounting processes that enhance financial reporting accuracy and timeliness. Continuous close involves ongoing reconciliation and validation of transactions throughout the month, which streamlines the monthly close by reducing errors and last-minute adjustments. This integration ensures that financial statements are prepared more efficiently, supporting timely decision-making and regulatory compliance.

Key Terms

Accruals

Monthly close involves finalizing financial records at the end of each month, ensuring accruals are accurately recorded to match revenues and expenses in the proper period. Continuous close automates and streamlines this process by updating accruals in near real-time, enhancing financial accuracy and timely reporting. Explore how advanced accrual management in continuous close can optimize your financial closing cycle.

Automation

Monthly close processes often involve extensive manual tasks, increasing the risk of errors and delays, whereas continuous close leverages automation to streamline financial reporting in near real-time. Automation tools integrate data from various sources, reducing reconciliation time and enhancing accuracy by providing ongoing insights rather than waiting for period-end. Discover how automating continuous close can transform your financial operations for improved efficiency and compliance.

Real-time reporting

Monthly close consolidates financial data at the end of each month, often delaying insights, while continuous close enables real-time reporting by updating records and financial statements throughout the period. Real-time reporting enhances decision-making speed by providing up-to-date information and reducing the risk of errors common in traditional monthly close processes. Explore how continuous close can transform your financial operations and improve business agility with real-time reporting.

Source and External Links

What is the monthly close? | AccountingCoach - The monthly close is a series of steps to ensure a company's financial statements comply with the accrual method of accounting by properly recording transactions.

What is the Month-End Close? | F&A Glossary - BlackLine - The month-end close is an accounting procedure that finalizes and closes out all financial activity for a business for the preceding month to ensure accurate financial data.

What is the Month-End Close Process? | FloQast - The month-end close process involves verifying and adjusting account balances to produce accurate financial reports that help companies manage their financial performance.

dowidth.com

dowidth.com