Forensic data analytics scrutinizes financial records to detect fraud, irregularities, and potential criminal activities, using advanced algorithms and data mining techniques. Compliance monitoring ensures adherence to regulatory standards and internal policies, systematically reviewing transactions and controls to prevent violations. Explore the distinctions and applications of these critical accounting practices to enhance organizational integrity and risk management.

Why it is important

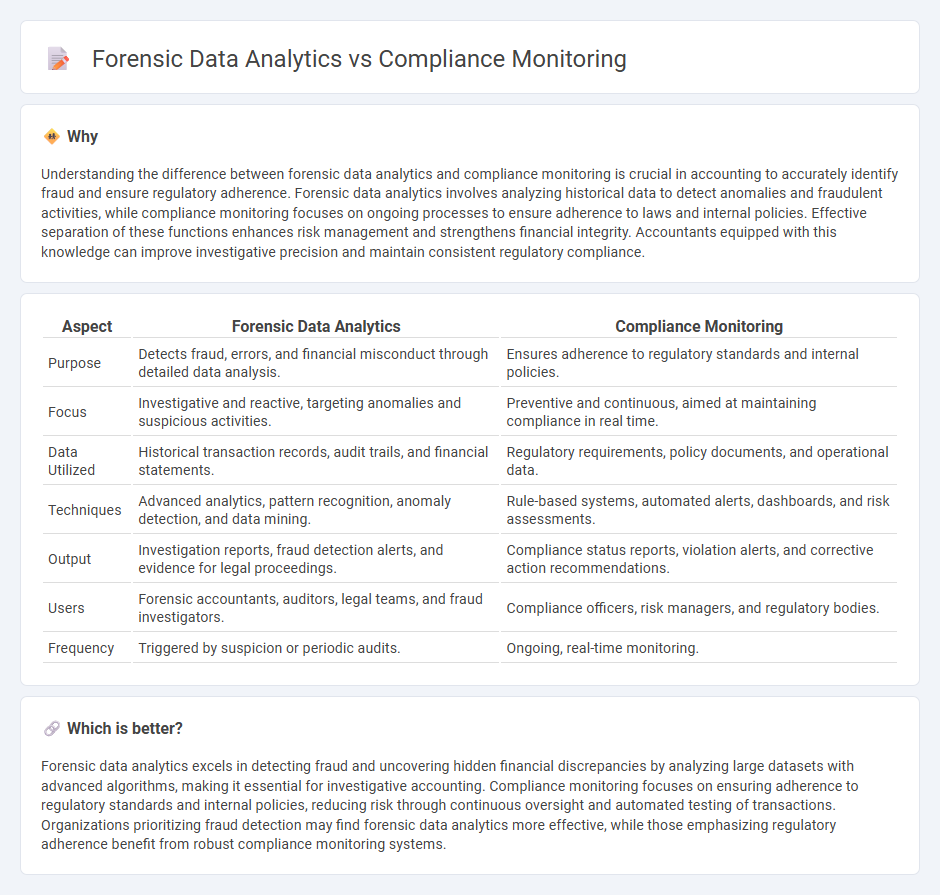

Understanding the difference between forensic data analytics and compliance monitoring is crucial in accounting to accurately identify fraud and ensure regulatory adherence. Forensic data analytics involves analyzing historical data to detect anomalies and fraudulent activities, while compliance monitoring focuses on ongoing processes to ensure adherence to laws and internal policies. Effective separation of these functions enhances risk management and strengthens financial integrity. Accountants equipped with this knowledge can improve investigative precision and maintain consistent regulatory compliance.

Comparison Table

| Aspect | Forensic Data Analytics | Compliance Monitoring |

|---|---|---|

| Purpose | Detects fraud, errors, and financial misconduct through detailed data analysis. | Ensures adherence to regulatory standards and internal policies. |

| Focus | Investigative and reactive, targeting anomalies and suspicious activities. | Preventive and continuous, aimed at maintaining compliance in real time. |

| Data Utilized | Historical transaction records, audit trails, and financial statements. | Regulatory requirements, policy documents, and operational data. |

| Techniques | Advanced analytics, pattern recognition, anomaly detection, and data mining. | Rule-based systems, automated alerts, dashboards, and risk assessments. |

| Output | Investigation reports, fraud detection alerts, and evidence for legal proceedings. | Compliance status reports, violation alerts, and corrective action recommendations. |

| Users | Forensic accountants, auditors, legal teams, and fraud investigators. | Compliance officers, risk managers, and regulatory bodies. |

| Frequency | Triggered by suspicion or periodic audits. | Ongoing, real-time monitoring. |

Which is better?

Forensic data analytics excels in detecting fraud and uncovering hidden financial discrepancies by analyzing large datasets with advanced algorithms, making it essential for investigative accounting. Compliance monitoring focuses on ensuring adherence to regulatory standards and internal policies, reducing risk through continuous oversight and automated testing of transactions. Organizations prioritizing fraud detection may find forensic data analytics more effective, while those emphasizing regulatory adherence benefit from robust compliance monitoring systems.

Connection

Forensic data analytics and compliance monitoring are interconnected through their shared goal of detecting and preventing fraudulent activities within financial records. Forensic data analytics employs advanced techniques such as data mining and pattern recognition to uncover anomalies and suspicious transactions, supporting compliance efforts by ensuring adherence to regulatory standards. Effective compliance monitoring integrates forensic analytics to continuously audit financial processes, enhancing risk management and organizational accountability.

Key Terms

Compliance monitoring:

Compliance monitoring involves the systematic review of processes, transactions, and behavior within an organization to ensure adherence to regulatory standards, internal policies, and industry guidelines. It uses automated tools and real-time analytics to detect deviations and prevent compliance breaches proactively. Explore our detailed insights to enhance your compliance monitoring strategies effectively.

Regulatory requirements

Compliance monitoring involves continuous oversight to ensure adherence to regulatory requirements, employing automated systems to detect deviations and maintain risk management standards. Forensic data analytics focuses on investigating past data to identify fraudulent activities, uncover compliance breaches, and support legal or regulatory actions. Explore deeper insights into how these approaches safeguard organizations against regulatory risks and enhance governance.

Internal controls

Compliance monitoring systematically evaluates internal controls to ensure adherence to regulatory requirements and company policies. Forensic data analytics dives deeper into anomalies and irregularities within internal controls to detect fraud or misconduct through detailed data examination. Explore how integrating both approaches strengthens organizational governance and fraud prevention.

Source and External Links

What is Compliance Monitoring? - Compliance monitoring is a continuous process ensuring alignment with internal and external regulations through a structured plan and system.

What is Compliance Monitoring? - Compliance monitoring involves assessing an organization's adherence to regulatory requirements and industry standards to maintain compliance and cybersecurity.

Compliance Monitoring - A Definitive Guide for Beginners - This guide outlines essential steps for creating a compliance monitoring program, focusing on legal analysis, risk assessment, and building a culture of accountability.

dowidth.com

dowidth.com