Invoice factoring platforms provide businesses immediate cash by selling outstanding invoices to third parties at a discount, improving liquidity and reducing collection efforts. Accounts receivable financing involves using invoice balances as collateral for a loan, enabling companies to maintain control over collections while accessing funds. Explore the differences to determine which financing solution best supports your cash flow management.

Why it is important

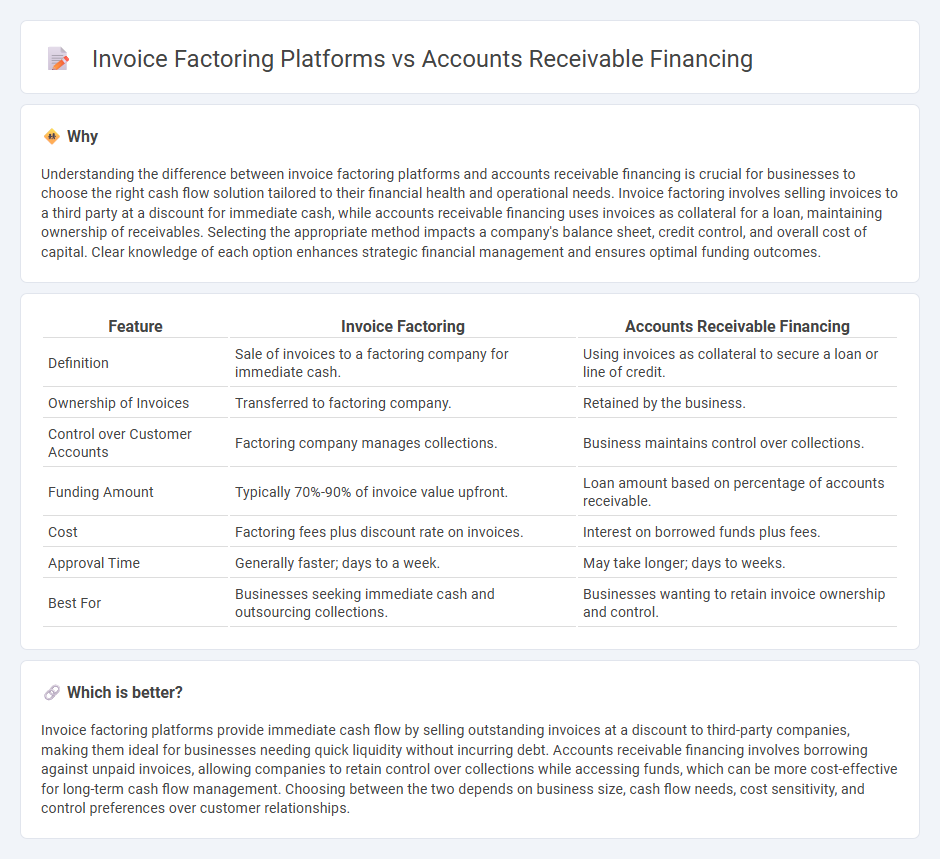

Understanding the difference between invoice factoring platforms and accounts receivable financing is crucial for businesses to choose the right cash flow solution tailored to their financial health and operational needs. Invoice factoring involves selling invoices to a third party at a discount for immediate cash, while accounts receivable financing uses invoices as collateral for a loan, maintaining ownership of receivables. Selecting the appropriate method impacts a company's balance sheet, credit control, and overall cost of capital. Clear knowledge of each option enhances strategic financial management and ensures optimal funding outcomes.

Comparison Table

| Feature | Invoice Factoring | Accounts Receivable Financing |

|---|---|---|

| Definition | Sale of invoices to a factoring company for immediate cash. | Using invoices as collateral to secure a loan or line of credit. |

| Ownership of Invoices | Transferred to factoring company. | Retained by the business. |

| Control over Customer Accounts | Factoring company manages collections. | Business maintains control over collections. |

| Funding Amount | Typically 70%-90% of invoice value upfront. | Loan amount based on percentage of accounts receivable. |

| Cost | Factoring fees plus discount rate on invoices. | Interest on borrowed funds plus fees. |

| Approval Time | Generally faster; days to a week. | May take longer; days to weeks. |

| Best For | Businesses seeking immediate cash and outsourcing collections. | Businesses wanting to retain invoice ownership and control. |

Which is better?

Invoice factoring platforms provide immediate cash flow by selling outstanding invoices at a discount to third-party companies, making them ideal for businesses needing quick liquidity without incurring debt. Accounts receivable financing involves borrowing against unpaid invoices, allowing companies to retain control over collections while accessing funds, which can be more cost-effective for long-term cash flow management. Choosing between the two depends on business size, cash flow needs, cost sensitivity, and control preferences over customer relationships.

Connection

Invoice factoring platforms and accounts receivable financing both provide businesses with immediate cash flow solutions by leveraging outstanding invoices as collateral. These platforms enable companies to sell their receivables to third-party financiers at a discount, accelerating access to working capital without waiting for payment terms. By streamlining the conversion of accounts receivable into liquid funds, they improve cash management and support operational stability.

Key Terms

Collateral

Accounts receivable financing uses outstanding invoices as collateral, enabling businesses to borrow funds while maintaining control over collections. Invoice factoring platforms sell invoices to third parties who assume credit risk and handle payment collections directly, reducing the seller's operational burden. Explore the differences between these collateral approaches to choose the best financing solution.

Advance Rate

Accounts receivable financing platforms typically offer higher advance rates, often ranging from 80% to 90% of the invoice value, allowing businesses to retain control over collections and customer relationships. Invoice factoring platforms usually provide advance rates between 70% and 85%, as they purchase the invoices outright and manage the collection process, which can impact customer interactions. Explore detailed comparisons of advance rate structures to determine the best solution for your cash flow needs.

Credit Risk

Accounts receivable financing platforms retain the credit risk with the business, requiring strong credit management and timely payments to maintain liquidity. Invoice factoring platforms transfer credit risk to the factoring company, which assumes responsibility for customer payment defaults, offering businesses immediate cash flow but often at a higher cost. Explore how credit risk impacts your funding options to select the best platform for your company's financial health.

Source and External Links

The Ins and Outs of Accounts Receivable Financing - Accounts receivable financing lets companies access funds by borrowing against unpaid invoices, either through factoring or asset-based lending, providing working capital without lengthy loan applications.

What is Accounts Receivable Financing? - This financing involves a company receiving early payment on invoices by committing them to a funder, with main types including asset-based lending, traditional factoring, and selective receivables finance.

What Is accounts receivable (AR) financing? - AR financing is a loan or line of credit secured by outstanding invoices, allowing businesses to access capital tied up in unpaid customer balances.

dowidth.com

dowidth.com