Forensic accounting involves the investigation of financial records to detect fraud, embezzlement, and other financial crimes, often supporting legal proceedings. Management accounting focuses on providing internal financial analysis, budgeting, and decision-making support to improve business performance and strategy. Discover the key differences and applications of forensic accounting and management accounting to enhance your financial expertise.

Why it is important

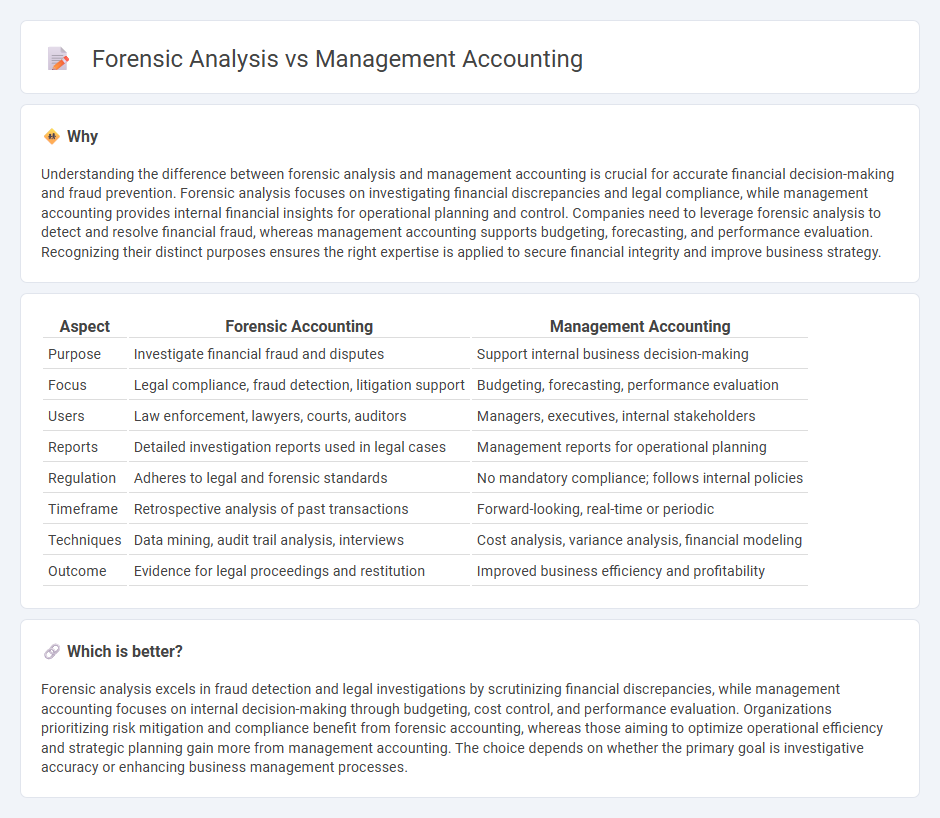

Understanding the difference between forensic analysis and management accounting is crucial for accurate financial decision-making and fraud prevention. Forensic analysis focuses on investigating financial discrepancies and legal compliance, while management accounting provides internal financial insights for operational planning and control. Companies need to leverage forensic analysis to detect and resolve financial fraud, whereas management accounting supports budgeting, forecasting, and performance evaluation. Recognizing their distinct purposes ensures the right expertise is applied to secure financial integrity and improve business strategy.

Comparison Table

| Aspect | Forensic Accounting | Management Accounting |

|---|---|---|

| Purpose | Investigate financial fraud and disputes | Support internal business decision-making |

| Focus | Legal compliance, fraud detection, litigation support | Budgeting, forecasting, performance evaluation |

| Users | Law enforcement, lawyers, courts, auditors | Managers, executives, internal stakeholders |

| Reports | Detailed investigation reports used in legal cases | Management reports for operational planning |

| Regulation | Adheres to legal and forensic standards | No mandatory compliance; follows internal policies |

| Timeframe | Retrospective analysis of past transactions | Forward-looking, real-time or periodic |

| Techniques | Data mining, audit trail analysis, interviews | Cost analysis, variance analysis, financial modeling |

| Outcome | Evidence for legal proceedings and restitution | Improved business efficiency and profitability |

Which is better?

Forensic analysis excels in fraud detection and legal investigations by scrutinizing financial discrepancies, while management accounting focuses on internal decision-making through budgeting, cost control, and performance evaluation. Organizations prioritizing risk mitigation and compliance benefit from forensic accounting, whereas those aiming to optimize operational efficiency and strategic planning gain more from management accounting. The choice depends on whether the primary goal is investigative accuracy or enhancing business management processes.

Connection

Forensic analysis in accounting involves investigating financial records to detect fraud, discrepancies, and legal compliance issues within an organization. Management accounting focuses on internal financial planning, budgeting, and performance evaluation to aid decision-making and strategic control. Integrating forensic analysis enhances management accounting by providing accurate, fraud-free data essential for reliable financial insights and risk management.

Key Terms

**Management Accounting:**

Management accounting centers on analyzing financial data to aid internal decision-making, budgeting, and performance evaluation within organizations. It emphasizes cost control, financial planning, and resource management to enhance operational efficiency and strategic goals. Explore further to understand how management accounting drives business success through detailed financial insights.

Budgeting

Management accounting centers on budgeting to plan, control, and evaluate financial resources within an organization, ensuring optimal allocation and cost efficiency. Forensic analysis, in contrast, investigates financial discrepancies and fraud by scrutinizing budgets and financial records for irregularities. Explore how both fields utilize budgeting techniques to enhance financial accuracy and accountability.

Cost Analysis

Management accounting centers on cost analysis to optimize budgeting, reduce expenses, and enhance financial decision-making within an organization. Forensic analysis, by contrast, investigates cost discrepancies and potential fraud by examining financial records and transactions for irregularities. Explore more about how these distinct approaches impact cost management and organizational integrity.

Source and External Links

What Is Management Accounting? - Management accounting is the process of preparing reports about business operations to help managers make short-term and long-term decisions.

Managerial Accounting - Managerial accounting generates reports to help management make better decisions related to business performance, primarily for internal use.

What Is Management Accounting? - Management accounting involves analyzing financial data to aid managers in planning, decision-making, and optimizing business operations.

dowidth.com

dowidth.com